Wider external gaps in key economies point to the need for policy adjustment at home

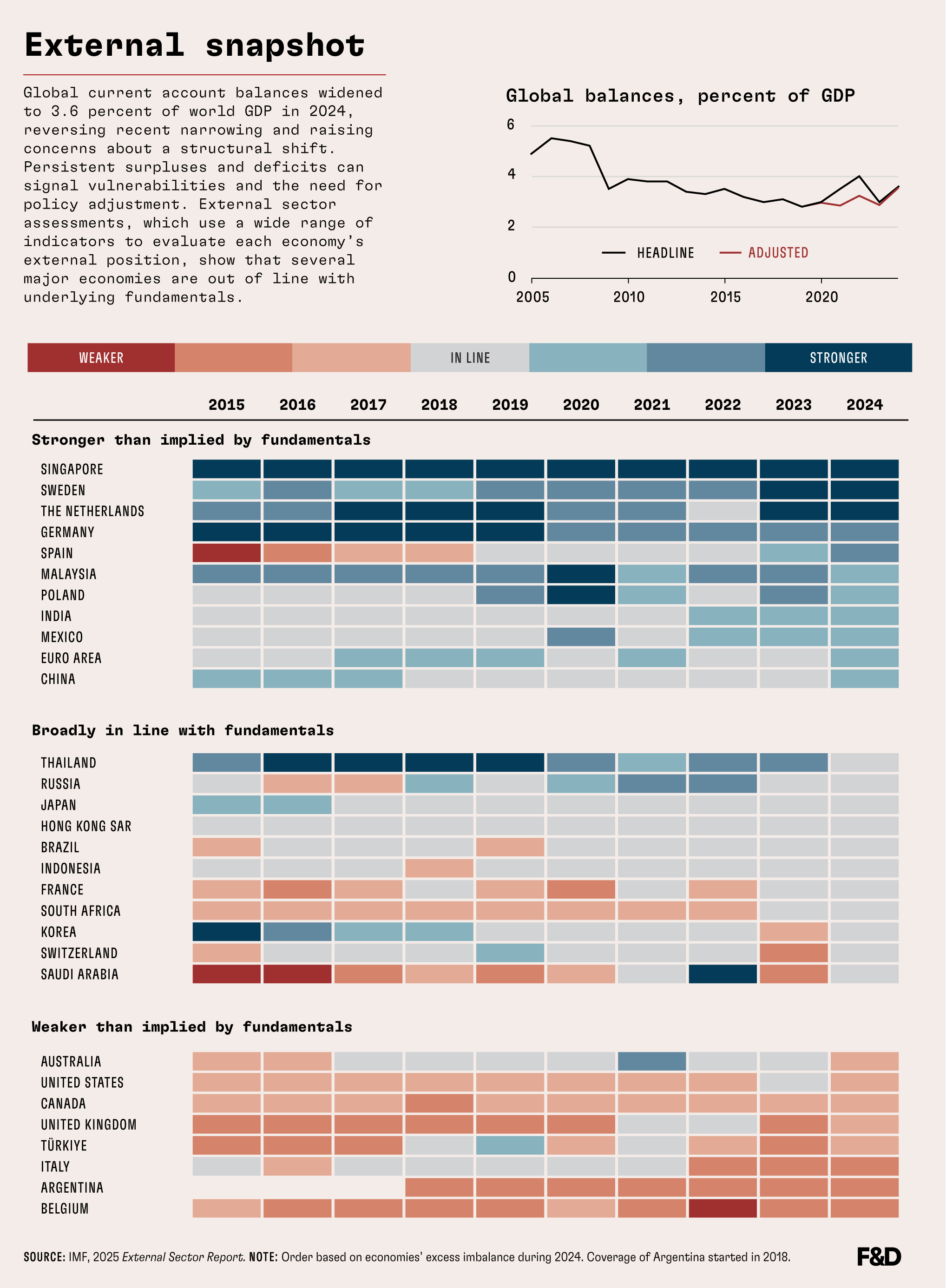

Global current account balances—the surpluses and deficits arising from cross-border trade, income flows, and current transfers—are widening again after narrowing in recent years. They fell to a postpandemic low of 3 percent of world GDP in 2023, but widened to 3.6 percent last year. Adjusting for volatility from the pandemic and Russia’s war in Ukraine reveals a notable reversal of the narrowing since the global financial crisis. This may signal a significant structural shift.

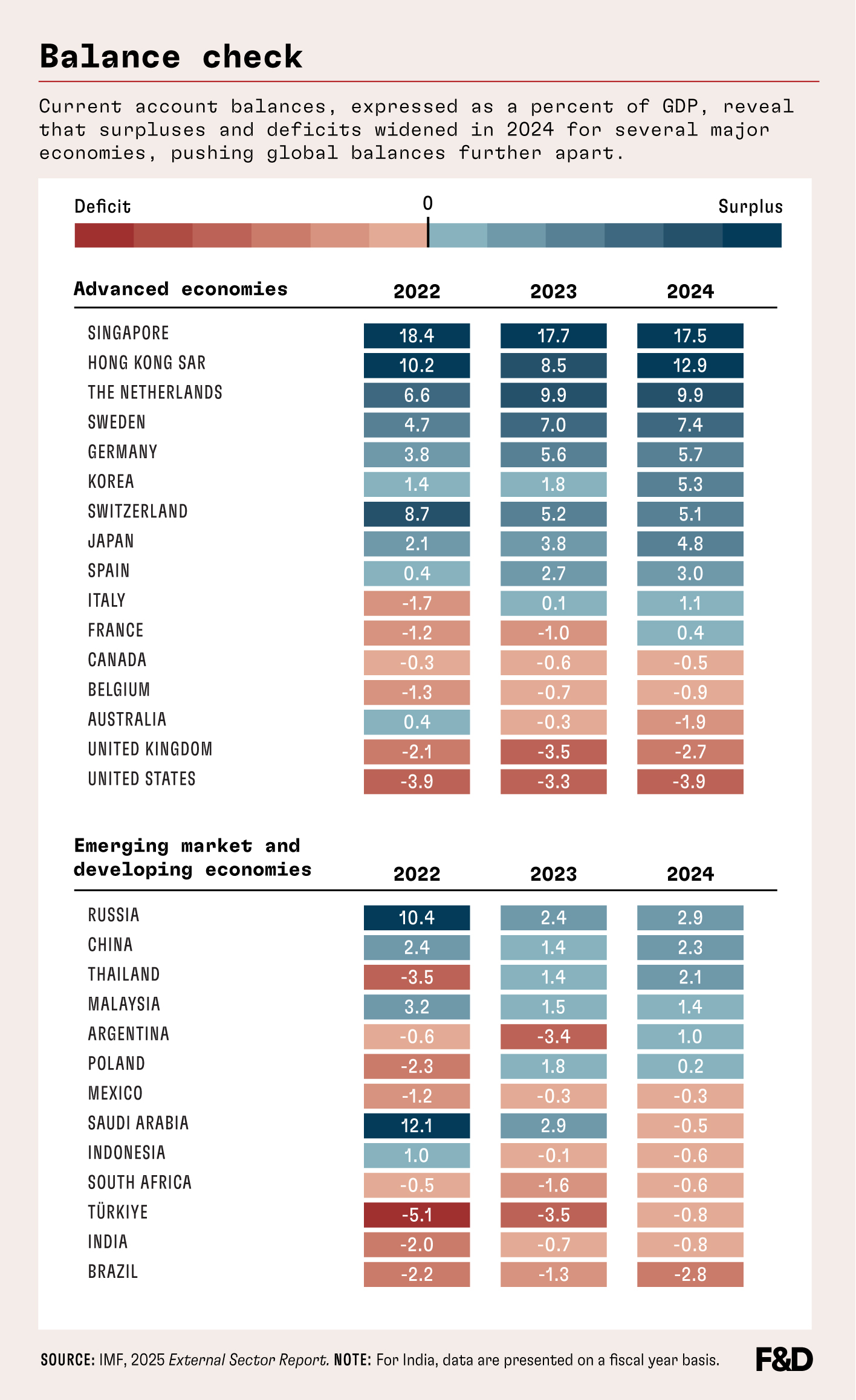

As the table below shows, several major economies have seen their surpluses or deficits expand, contributing to the growing divergence in current account balances.

Excessive deficits and surpluses can be sources of risks. Large, persistent imbalances often signal vulnerabilities. They typically reflect distortions—for example, a mismatch between a nation’s saving and investment—that leave economies more exposed to shocks.

The IMF’s external assessment shows that current account balances were out of line with fundamentals in several major economies in 2024, underscoring the need for adjustment. History demonstrates that global imbalances can unwind abruptly and painfully. To avoid such a scenario, a gradual correction is needed through concerted domestic macroeconomic policies.

Deficit countries should curb excess spending and improve competitiveness to narrow their external gaps, while surplus countries should boost domestic demand and investment to better absorb their output. Such steps would gradually shrink imbalances and foster more balanced, resilient global growth.

This article draws on the IMF’s 2025 External Sector Report.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.