New technologies are rewiring liquidity, payments, and economic stability

More than 15 years after the global financial crisis, the banking and financial system looks safer. But it’s also evolving in ways that are reshaping who provides liquidity, how money moves, and risks to economic and financial stability. As a result, the next shock may begin not in a bank, but in the new infrastructure underpinning the system.

After 2008, regulators moved swiftly to raise capital standards and introduce new supervisory tools such as stress testing. Banks rebuilt their balance sheets and retreated from risky lending and arbitrage businesses. Asset managers were blamed for the financial turmoil at the onset of the pandemic, but not banks.

Yet even as regulators fortified banks, postcrisis innovations reshaped the financial landscape. Asset managers provided more liquidity as banks stepped back, nonbank start-ups built new risk assessment tools for institutional lenders, developers introduced a wider array of crypto assets, and central banks and governments established real-time payment systems.

These developments cut costs, broadened access, and accelerated transactions. Yet they also caused significant shifts in the structure of financial intermediation. Liquidity, credit, and payments—the core of the banking system—gravitated toward asset managers, tech platforms, and decentralized networks.

This reshaping of finance itself now raises big questions. What happens when critical finance functions lie outside the regulatory framework? How should we ensure stability in a faster, flatter, and more fragmented financial system?

From banks to asset managers

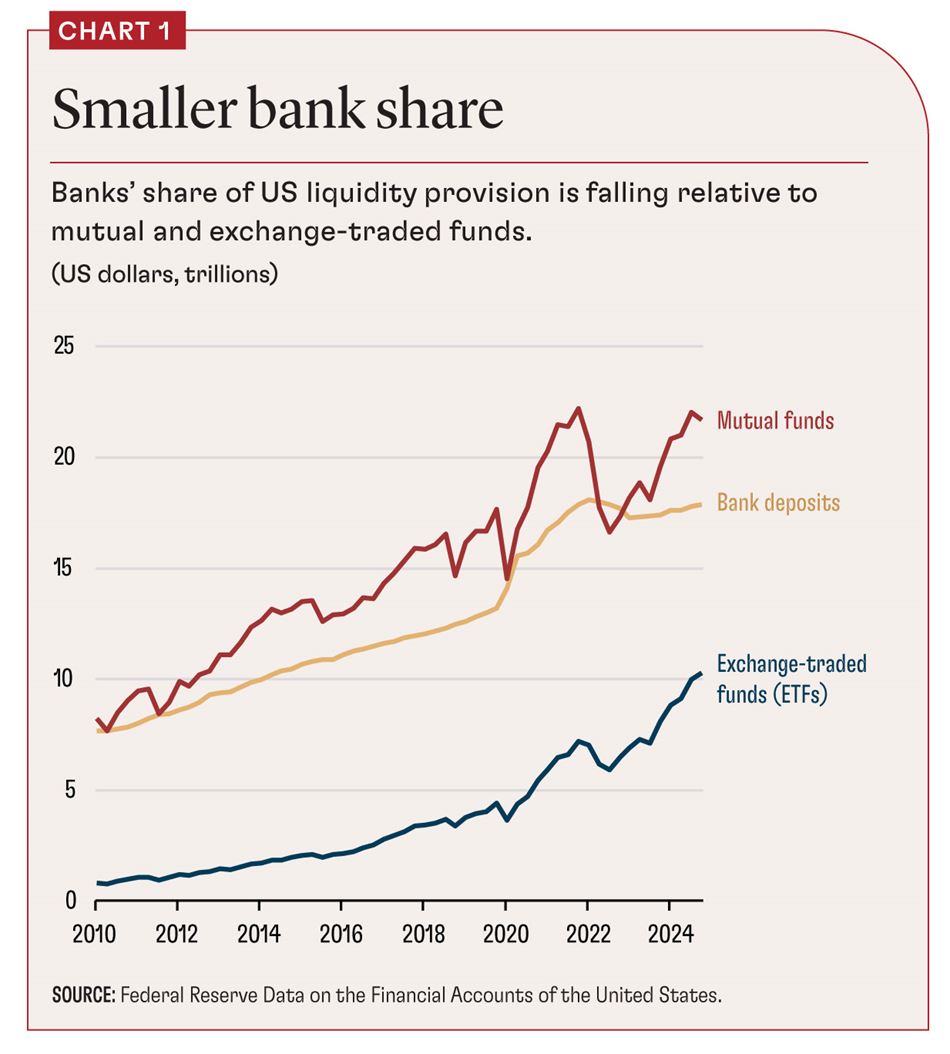

Banks were once the protagonists of liquidity creation for financial markets. Yet today, it is nonbank asset management funds, not banks, that contribute a growing share of the system’s day-to-day liquidity to households and investors (Chart 1). Open-end mutual funds and exchange-traded funds (ETFs) let investors redeem money on demand, even though these funds hold assets such as corporate bonds that are anything but liquid. They promise daily liquidity but hold underlying assets that can’t always be sold—just as banks do, but without deposit insurance, capital buffers, or access to the central bank.

This isn’t theory. It’s happening. My research with Columbia University’s Yiming Ma and Kairong Xiao shows that bond mutual funds alone now supply sizable liquidity compared with the entire banking system, and this share is rising. Yet when markets turn volatile, mutual funds can be shock amplifiers rather than absorbers. They may be forced to sell illiquid assets in a falling market, deepening the stress.

ETFs add complexity. On paper, most ETFs are passive vehicles. More than 95 percent track an index, such as the S&P 500 or Bloomberg US Aggregate Bond Index. But in practice, many are surprisingly active. There are now more ETFs than underlying assets. For many asset classes, investors can choose among plain-vanilla trackers, sector-specific funds, smart beta strategies, and even thematic products like AI-, robotics-, and green-focused ETFs.

Behind the scenes, ETF sponsors must actively manage portfolios to meet investor flows and keep prices in line with the value of the underlying assets. Bond ETF managers frequently deviate from their stated benchmarks, as my work with Naz Koont of Stanford University, Lubos Pastor of the University of Chicago’s Booth School of Business, and Columbia’s Ma shows. Bond ETFs, especially, trade like liquid stocks but hold underlying illiquid bonds. They rely on a network of specialized intermediaries, called authorized participants, to arbitrage price discrepancies between ETFs and underlying assets.

These participants are also bond dealers and use the same balance sheets both in their role of managing ETFs and to serve their trading clients. When dealer balance sheets get tight, or when bond markets seize up, ETF arbitrage can break down. Prices drift, and liquidity thins. And investors who expected stock-like flexibility may be left holding something closer to a closed-end fund.

The new ecosystem of liquidity provision is more market based, broader, and potentially cheaper than the old one. After all, bankers face greater constraints in providing daily liquidity, and asset managers step in to fill the gap. But the new ecosystem plays by a different rule book, with different risks when markets freeze.

AI and big data

Lending, once the province of bankers and loan officers, increasingly relies on AI and big data. Nonbank fintech platforms use payment records and machine learning to cut search costs, bypass collateral requirements, speed loan approvals, and reach borrowers that traditional banks often overlook. Data, in turn, flows more freely between borrowers and lenders, training increasingly precise and adaptive machines. My research with the Indian Institute of Management’s Pulak Ghosh and Harvard’s Boris Vallee shows how this plays out in India. Small merchants who rely more on cashless payments with detailed and traceable paper trails get better access to working-capital loans. They pay lower interest rates and are less likely to default. In effect, digital footprints are the new credit scores.

This credit-data feedback loop has boosted the power of Big Tech. Platforms such as Alibaba’s Ant Group, Amazon, and Latin America’s Mercado Libre now bundle payments, e-commerce, and credit. The size of their consumer and small-business loan books now exceeds that of many banks. Scale delivers convenience, but also concentration: The platform that controls the checkout button can steer borrowers and merchants away from rival bank lenders, raising difficult questions about competition.

Size is not the only concern. Because Big Tech sits outside traditional safety nets, traditional capital, liquidity, and resolution rules do not yet apply. In 2024, Amazon abruptly discontinued its $140 billion in-house lending program to small businesses, illustrating how platform credit can vanish just when firms need it most. As AI- and data-driven lending pushes ever more credit through a few digital gateways, more questions crop up alongside the emergence of too-big-to-fail tech monopolies.

Crypto and instant payments

Also at the core of this changing banking landscape is the evolution of payment intermediation. Bitcoin was released in 2008 during the financial crisis as an alternative form of money for payments. Built on blockchain technology, Bitcoin aimed to bypass commercial banks and central banks, offering a decentralized way to move money without relying on trust in institutions. For good or ill, Bitcoin never fulfilled that promise. It’s slow to settle, costly to use, and highly volatile. For most crypto believers, it is less digital dollar and more digital gold: a speculative asset, not functional money.

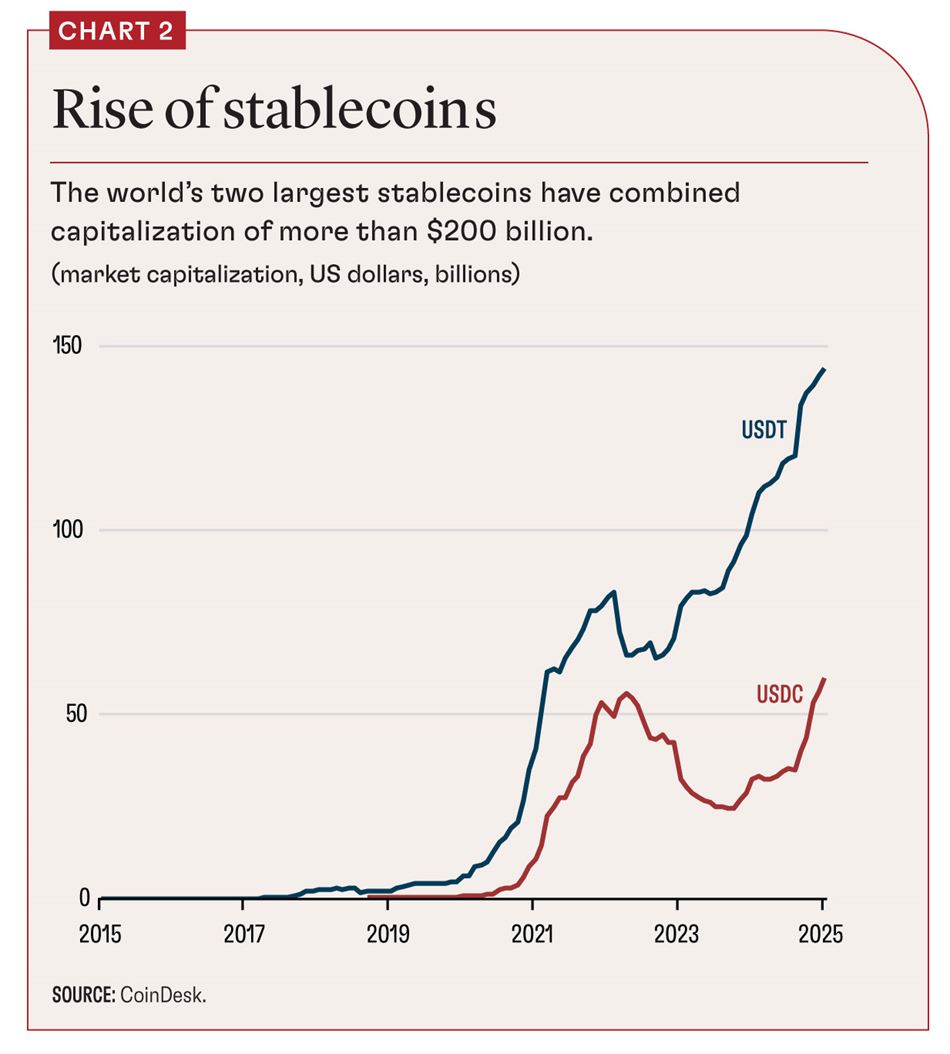

Stablecoins, a close cousin of Bitcoin, emerged to fix this (Chart 2). Like Bitcoin, stablecoins are blockchain assets designed to provide payment services. New US legislation, including the GENIUS and STABLE acts, may further boost their growth. An important difference from Bitcoin is that stablecoins are pegged to real-world currencies, usually the US dollar. Issuers like Circle (USDC) and Tether (USDT) hold reserves in bank deposits, Treasury securities, and corporate bonds to maintain that peg. Avoiding the huge volatility of Bitcoin, stablecoins have shown promise as a cheap and borderless payment alternative. Stablecoins have become lifelines in Argentina, Türkiye, and Venezuela, where inflation is high; ordinary people in these economies now use stablecoins for saving, sending remittances, and settling transactions. They are steadily moving into mainstream payment flows as big banks and giant merchants contemplate issuing their own stablecoins.

But just like mutual funds and ETFs, stablecoins lack traditional safeguards such as deposit insurance and direct access to central bank support. In March 2023, when Silicon Valley Bank failed, Circle’s USDC temporarily lost its peg after losing access to reserves. The previous year, the collapse of Terra’s algorithmic stablecoin triggered widespread losses. My research with Columbia’s Ma and Chicago Booth’s Anthony Lee Zhang highlights a core dilemma facing stablecoins: The more effectively they maintain stable prices, the more they resemble banks—yet without deposit insurance or a lender of last resort, making them more vulnerable to runs. These observations make one thing clear: Stablecoins may function well in good times, but they can falter under stress.

Alongside the rise of private crypto payment alternatives, government-sponsored fast payment systems offer a different path. After all, people value speed and efficiency in payments, yet crypto assets are neither as fast nor as cheap as they claim. Brazil’s central bank introduced Pix, a fast, free payment system built on traditional bank payment rails and always available. It processes more daily transactions than cash, credit, and debit cards combined. More than 90 percent of Brazilian households and businesses have adopted it. India’s Unified Payments Interface followed a similar trajectory (see “India’s Frictionless Payments” in this issue of F&D).

These systems deliver what crypto promised—faster, more inclusive payments—but in a far less disruptive way. They have attracted growing international attention, including praise from the Bank for International Settlements, for promoting financial inclusion while preserving monetary stability.

Despite the merits, however, fast payment systems come with trade-offs. My new research with the Massachusetts Institute of Technology’s Ding Ding, the Central Bank of Brazil’s Rodrigo Gonzalez, and Columbia’s Ma shows that payment systems like Pix force banks to hold more liquid assets to meet unpredictable outflows, reduce bank lending, and—perhaps surprisingly—increase credit risk. This is because the convenience of fast payments to consumers comes at the expense of banks’ losses in delaying and netting payment flows. Fast payments increase banks’ need to hold liquid assets such as cash and government bonds over extending illiquid loans. When banks hold more liquid low-yielding assets, in turn, it exacerbates their yield-seeking incentives in extending riskier loans. In a sense, the payment system becomes faster, yet fast payments may inadvertently make the banking model narrower and potentially riskier.

Macro-financial implications

Banks are safer thanks to stronger capital requirements, tighter supervision, and regular stress tests. But we have not necessarily protected the macroeconomic environment.

First, the financial system is more fragmented. Key functions, payments, credit, and liquidity have shifted outside the regulatory perimeter. Mutual funds, ETFs, and stablecoins mimic deposits. Robots and platforms extend credit. But unlike banks, they operate without deposit insurance, lender-of-last-resort access, or systemic oversight. This, combined with geoeconomic rivalries, increases the possibility of a more fragmented financial system, posing challenges to global regulatory coordination, as highlighted by the European Central Bank’s Christine Lagarde and the People’s Bank of China’s Pan Gongsheng. The risks didn’t vanish. They just moved.

Second, capital flows have accelerated. Real-time trading, credit-data loops, and fast payments may all amplify shocks. What once took days now happens in minutes. Yet the tools for absorbing stress, liquidity backstops, and market interventions haven’t caught up. The plumbing is faster, but the stabilizers aren’t.

Third, the policy toolkit may have gradually become misaligned. Central banks built their frameworks for a bank-dominated system in which deposit rates influence lending and lender-of-last-resort facilities calm depositors. But when money resides with asset managers or as on-chain transactions or moves through apps, traditional barometers are less effective. It’s harder to see where risk builds, and harder to stop it when it breaks.

The global financial landscape has changed, yet the rules remain largely unchanged—and that mismatch may be the biggest risk of all.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Ding, Ding, Rodrigo Gonzalez, Yiming Ma, and Yao Zeng. 2025. “The Effect of Instant Payments on the Banking System: Liquidity Transformation and Risk-Taking.” University of Pennsylvania Working Paper, Philadelphia, PA.

Ghosh, Pulak, Boris Vallee, and Yao Zeng. Forthcoming. “FinTech Lending and Cashless Payments.” Journal of Finance.

Koont, Naz, Yiming Ma, Lubos Pastor, and Yao Zeng. Forthcoming. “Steering a Ship in Illiquid Waters: Active Management of Passive Funds.” Review of Financial Studies.

Ma, Yiming, Kairong Xiao, and Yao Zeng. Forthcoming. “Bank Debt, Mutual Fund Equity, and Swing Pricing in Liquidity Provision.” Review of Financial Studies.

Ma, Yiming, Yao Zeng, and Anthony Lee Zhang. Forthcoming. “Stablecoin Runs and the Centralization of Arbitrage.” Review of Financial Studies.