Fintech companies will compete against, and cooperate with, traditional banks; public policy must provide direction

Digital innovation often starts with a radical idea. It can be a new way to store and process information, a new business model, or a new service. But the idea is just the start: Realizing the benefits of innovation requires hard work, sufficient investment, and user adoption.

Disruptive innovation has been the name of the game in the financial sector over the past decade. New financial technology (fintech) firms have emerged, large digital platforms (big techs) are offering payment services and credit, crypto assets and stablecoins are growing in value, and many institutions are adopting artificial intelligence. Each of these is challenging traditional financial intermediaries, like banks, insurers, and asset managers, and the services that they provide (Ben Naceur and others 2023).

Digital innovations can both complement and substitute for services in the traditional financial system. Many services seem to offer a stark alternative to existing intermediaries and services in the short term. But in the medium term, they often complement existing services, leading to even greater competition and a more diverse financial system. Still, innovations don’t always lead to the best outcomes on their own: Things can, and frequently do, go wrong. Harnessing the benefits of digital innovation often requires forward-thinking public policy.

Disruption in payments

Payments are the gateway to financial services. For individuals, a transaction account is often a prerequisite for accessing credit, buying an insurance policy, or starting to save and invest. For new entrants to the financial system, like fintechs and big techs, it is common to start by handling payments and then branch out into other areas of finance.

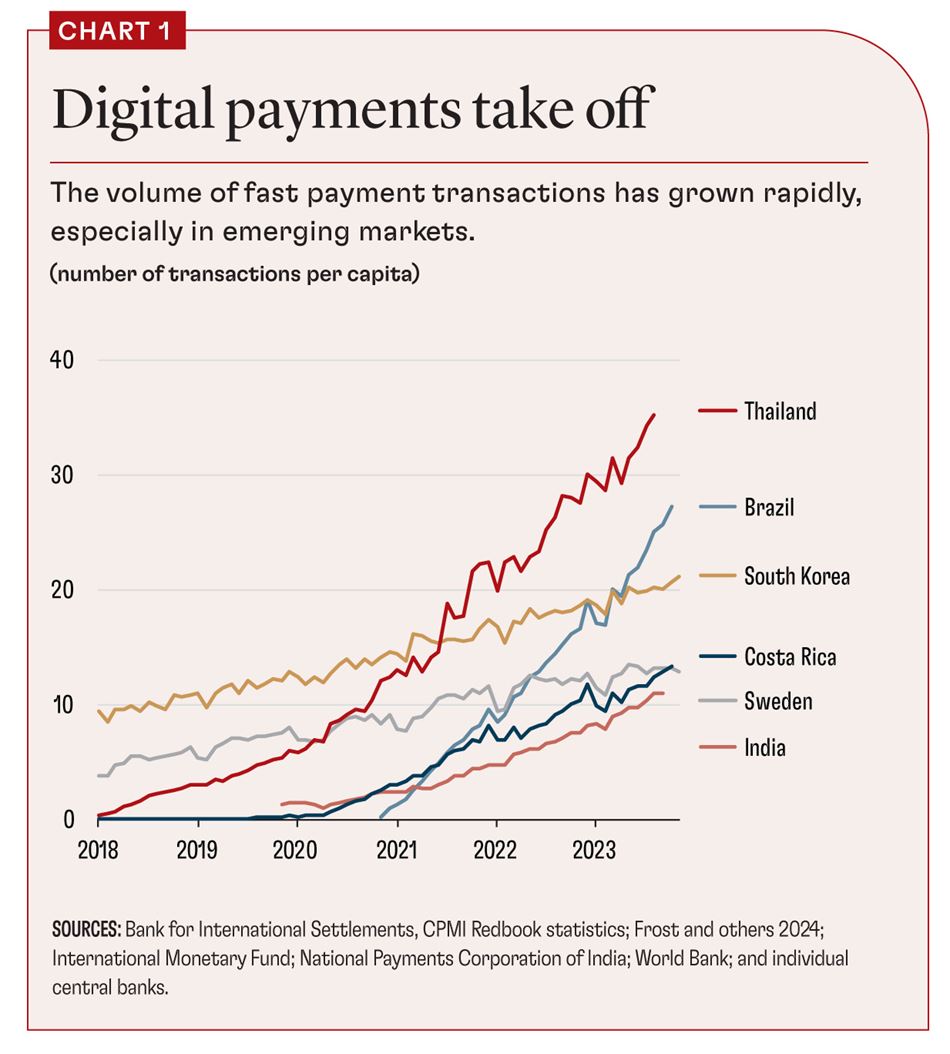

In the past decade, the way we pay has changed dramatically, with so-called fast or instant payment systems taking off in many countries, especially emerging markets (see Chart 1). They allow for real-time (or nearly real-time) transfers between end users (Frost and others 2024). Fast, 24/7 payments are provided by fintechs, big techs, and existing banks. They use smartphone apps and quick response (QR) codes, even operating on lower-tech phones. They have generally allowed disruptors to provide services that directly compete with incumbents.

The most well-known success stories come from public infrastructures, such as systems operated, or overseen, by central banks. In Brazil, for instance, the central bank introduced its fast payment system Pix in November 2020. Now, over 90 percent of Brazilian adults use the service for daily retail payments, such as food or travel, and even for recurring payments like utility bills. In India, the Unified Payments Interface (UPI)—operated by the National Payments Corporation of India and regulated by the central bank—promotes services by incumbent banks, fintechs, and big techs on one platform (see “India’s Frictionless Payments” in this issue of F&D). Similar successes include Thailand’s PromptPay, which is privately run but with a key role for the central bank, and SINPE Móvil in Costa Rica, operated by the central bank.

These successful public infrastructures stand in contrast to the situation in many economies where there are multiple private sector fast payment systems inaccessible to users of other financial institutions. For example, in the US, someone using only Venmo cannot pay someone who uses only Zelle. Similar “walled gardens” have also arisen in China, with competing wallets by Alipay and WeChat Pay, and in Peru, where the wallets Yape and Plin compete for users (Aurazo and Gasmi 2024). In the case of China and Peru, policy intervention was needed to make payment systems interoperable.

Often, what begins as a substitute (fintech and big tech challengers) can complement existing services operating in the same market. Users get cheaper, faster payments, which can also support financial resilience and higher economic growth. The disruptors—and public policy—help improve the system, serve new clients, offer new services in the same market, and push incumbents to enhance their offerings.

A digital credit metamorphosis

Beyond payments comes the need to borrow. Companies need credit to make productive investments, and people need it to buy a house or a car or to pay for education.

In the early days of the fintech revolution, it looked like new lending platforms could end up replacing many functions of banks. Crowdlending and other new credit platforms grew quickly, often using alternative data for credit scoring and connecting borrowers and lenders in streamlined, digital processes. This was soon overshadowed by new lending by big tech providers, such as merchant lending by Amazon in the US and Alibaba in China. The volume of big tech credit boomed (Cornelli and others 2023).

These new platforms have narrowed gaps in credit markets and enhanced financial inclusion. In Argentina, for example, Mercado Pago has stepped in to support small merchants spurned by banks. In China, big tech credit has been less sensitive to home prices than bank credit, potentially reducing the importance of collateral. In the US, fintech small business lenders have targeted areas with high unemployment and bankruptcies, where banks are less likely to lend. Overall, the impact of fintech and big tech varies widely from country to country.

But banks are very much still in the picture, competing now with a new set of intermediaries. They changed their business models to look more like platforms, and to use alternative data. Conversely, many challengers, such as the UK’s Revolut and Brazil’s Nubank, obtained licenses and became banks themselves.

Crypto and DeFi

While big techs challenge incumbent financial institutions at their own game, crypto assets and decentralized finance (DeFi) promise to reimagine finance, based on trust in code rather than in institutions. Global crypto adoption is on the rise again, despite its long history of volatility, mostly for speculative investment purposes, but also thanks to political support for these assets in some countries.

Crypto was intended to foster decentralization, but it hasn’t really turned out that way. Crypto exchanges, traditional banks, investment funds, and others entering the market mean that the market remains intermediated and often centralized. More important, unbacked crypto assets often have limited usability because they can be extremely volatile.

Stablecoins, which tie their value to the fiat currencies that crypto ostensibly challenged, emerged as an alternative. The largest stablecoins are issued by centralized entities that hold assets such as US Treasury bills and bank deposits to back stablecoins in circulation. But even with these new intermediaries, and with the growing presence of stablecoins, the crypto sector remains riddled with risks, including widespread fraud, scams, money laundering, and terrorism financing. In addition, stablecoins fall short of providing necessary elasticity in the monetary system. Because more than 98 percent of stablecoins by value are tied to the US dollar, they can also undermine monetary sovereignty in many jurisdictions.

Still, crypto and stablecoins provide a glimpse of functionality that may have broader applicability. For example, programmability and tokenization could improve existing functions and enable new ones within the existing monetary system, based on central banks at the core and commercial banks interacting with clients. In cross-border payments, for example, tokenization could rewire the correspondent banking system, allowing for messaging, reconciliation, and asset transfer in a single action. New functions like simultaneous (“atomic”) settlement and enhanced collateral management could dramatically improve the functioning of capital markets. These functions could lay the foundation for a future tokenized financial system.

Public policy to guide innovation

These radical innovations have significantly changed the financial system over the past decade. Stark challenges that threatened to substitute for existing services have often evolved into something new that is complementary to those services—frequently fostering competition. And by and large, this has helped lower consumer prices and made services more efficient. But innovation may not always lead to the best outcomes on its own.

Forward-looking public policies allowed for some of the biggest, most impactful breakthroughs. The adoption of fast payments, and the significant progress in access to payment accounts, has been possible thanks to an interplay of public sector infrastructures and private innovation. Proactive steps by public authorities, even in the face of initial reluctance by incumbents, helped improve payment services and financial inclusion, as most notably shown with UPI in India and Pix in Brazil. This helped bring hundreds of millions of people into the financial system worldwide.

Meanwhile, important risks are emerging from innovation that could erode financial stability. For instance, shocks from the crypto sector could spill over to the traditional financial system, potentially even posing risks to the US Treasury market (Ahmed and Aldasoro 2025).

To harness the potential of innovation and mitigate the risks, radical new ideas are necessary, but not sufficient. Also needed are public infrastructures, sound regulation, and practical experimentation in the public and private sectors to yield new insights and inform private investment and public policy. Finally, the public and private sectors need to coordinate to guide digital technologies toward applications that truly benefit people and businesses and lay a solid foundation for prosperity. A recent example of this type of coordination is Project Agorá, which brings together central banks and commercial banks to explore a unified ledger to leverage the benefits of tokenization for cross-border payments.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Ahmed, R., and I. Aldasoro. 2025. “Stablecoins and Safe Asset Prices.” BIS Working Paper 1270, Bank for International Settlements, Basel.

Aurazo, J., and F. Gasmi. 2024. “Digital Payment Systems in Emerging Economies: Lessons from Kenya, India, Brazil, and Peru.” Information Economics and Policy 69 (December).

Ben Naceur, S., B. Candelon, S. Elekdag, and D. Emrullahu. 2023. “Is FinTech Eating the Bank’s Lunch?” IMF Working Paper 239, International Monetary Fund, Washington, DC.

Cornelli, G., J. Frost., L. Gambacorta, R. Rau, R. Wardrop, and T. Ziegler. 2023. “Fintech and Big Tech Credit: Drivers of the Growth of Digital Lending Journal of Banking and Finance 148 (C).

Frost, J., P. Wilkens, A. Kosse, V. Shreeti, and C. Velásquez. 2024. “Fast Payments: Design and Adoption.” BIS Quarterly Review (March).