Central banks should harness crypto’s technical wizardry to enable a rich monetary ecosystem

When people or companies make a payment, they are trusting in two things: the money itself and the payment system that executes the transaction. While often taken for granted, these two elements are a crucial foundation of any economy. Every day, billions of times, households and businesses put their trust in this system and the institutions underpinning it.

Digital innovation is upending both money and payments. Cryptocurrencies and decentralized finance (DeFi) are built on the premise of decentralization, aiming to replace traditional financial intermediaries (bankers, brokers, custodians) with technological solutions. The remarkable rise of cryptocurrencies has captured the popular imagination and offers a glimpse of new technical capabilities. These include the ability to program payments (programmability), combine different operations into one transaction (composability), and generate a digital representation of money and assets (tokenization).

Yet recent developments have underscored crypto’s failure to fulfill the requirements of a monetary system that fully serves society. Its shortcomings are not just bugs but structural flaws. This is why we argue that the monetary system of the future should harness the new technical capabilities demonstrated by crypto but be grounded in the trust central banks provide (BIS 2022).

In other words, any legitimate transaction that can be carried out with crypto can be accomplished better with central bank money. Central bank digital currencies (CBDCs) and other public infrastructure can underpin a rich and diverse monetary ecosystem that supports innovation in the public interest.

Crypto’s structural flaws

Let’s start by looking at the requirements of a monetary system that can fully serve society. It must be safe and stable, with participants (public and private) who are accountable to the public. It must be efficient and inclusive. Users must have control over their data, and fraud and abuse must be prevented. The system must also adapt to changing demands. And it must be open across borders, to support international economic integration. Today’s monetary system is generally safe and stable, but there is room for improvement in many areas (see table, page 13).

Cryptocurrencies and DeFi aim to replicate money, payments, and a range of financial services. They build on permissionless distributed ledger technology such as blockchain. This technology allows for technical functions that can adapt to new demands as they arise, as well as for openness across borders. Yet crypto suffers from serious structural flaws that prevent it from serving as a sound basis for the monetary system.

First, crypto lacks a sound nominal anchor. The system relies on volatile cryptocurrencies and so-called stablecoins that seek such an anchor by maintaining a fixed value to a sovereign currency, such as the US dollar. But cryptocurrencies are not currencies, and stablecoins are not stable. This was underscored by the implosion of TerraUSD in May 2022 and persistent doubts about the actual assets that back the largest stablecoin, Tether. In other words, stablecoins seek to “borrow” credibility from real money issued by central banks. This shows that if central bank money did not exist, it would be necessary to invent it.

Second, crypto induces fragmentation. Money is a social convention, characterized by network effects—the more people use a given type of money, the more attractive it becomes to others. These network effects are anchored in a trusted institution—the central bank—that guarantees the stability of the currency as well as the safety and finality (settlement and irreversibility) of transactions.

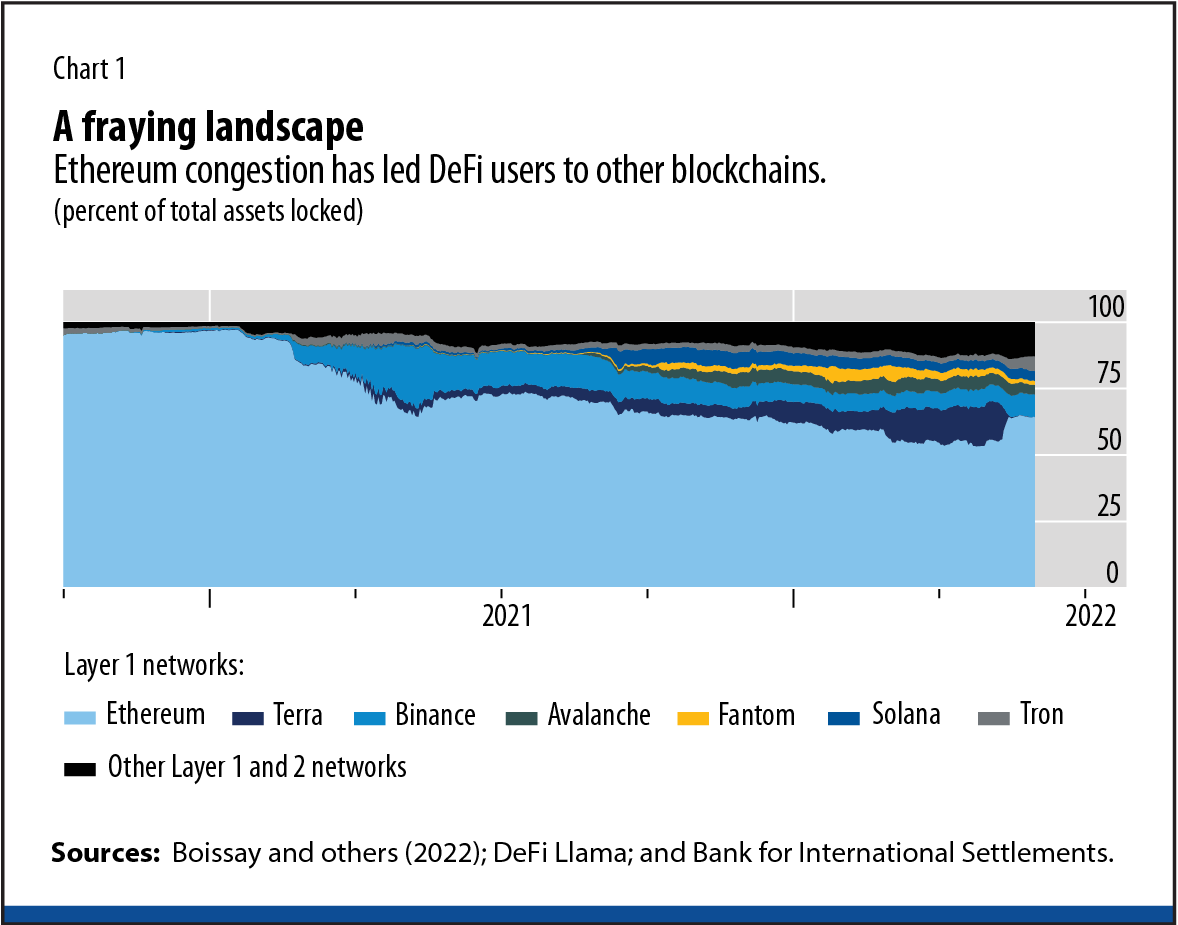

Crypto’s decentralized nature means that it relies on incentives to anonymous validators to confirm transactions, in the form of fees and rents. This causes congestion and prevents scalability. For example, when the Ethereum network (a blockchain widely used for DeFi applications) nears its transaction limit, fees rise exponentially. As a result, over the past two years, users have moved to other blockchains, resulting in growing fragmentation of the DeFi landscape (see Chart 1). This inherent feature prevents widespread use (Boissay and others 2022).

Because of these flaws, crypto is neither stable nor efficient. It is a largely unregulated sector, and its participants are not accountable to society. Frequent fraud, theft, and scams have raised serious concerns about market integrity.

Crypto has introduced us to the possibilities of innovation. Yet its most useful elements must be put on a sounder footing. By adopting new technical capabilities but building on a core of trust, central bank money can provide the foundation for a rich and diverse monetary ecosystem that is scalable and designed with the public interest in mind.

The trees and the forest

Central banks are uniquely placed to provide this core of trust, given the key roles they play in the monetary system. First is their role as the issuers of sovereign currency. Second is their duty to provide the means for the ultimate finality of payments. Central banks are also responsible for the smooth functioning of payment systems and for safeguarding their integrity through regulation and supervision of private services.

If the monetary system is a tree, the central bank is its solid trunk. The branches are banks and other private providers competing to offer services to households and businesses. Central bank public goods will support innovative services to back up the digital economy. The system is rooted in settlement on the central bank’s balance sheet.

Zooming out, we can see the global monetary system as a healthy forest (see Chart 2). In the trees’ canopies, the branches come together and allow economic integration across borders.

How can this vision be achieved? It will take new public infrastructure at the wholesale, retail, and cross-border levels.

First, wholesale CBDCs—a superior representation of central bank money for use exclusively by banks and other trusted institutions—can offer new technical capabilities. These include the programmability, composability, and tokenization previously mentioned. Wholesale CBDCs could unlock significant innovation that benefits end users. For instance, the buyer and seller of a house could agree up-front that the tokenized payment and the tokenized title transfer must be simultaneous. In the background, wholesale CBDCs would settle these transfers as a single transaction. Hands-on work by central banks is showcasing this and many other applications (see “Making Sense of Crypto” in this issue of F&D).

Second, at the retail level, CBDCs have great potential, together with their first cousins, fast payment systems. Retail CBDCs would work as digital cash available to households and businesses, with services provided by private companies. Central-bank-operated retail fast payment systems are similar to retail CBDCs in that they provide this common platform while ensuring that services are fully connected. Both promise to lower payment costs and enable financial inclusion. Brazil’s Pix system was adopted by two-thirds of Brazilian adults in only one year. Merchants pay a fee of just 0.2 percent of a transaction’s value on average, one-tenth the cost of a credit card payment. Many central banks are currently working on inclusive designs for retail CBDCs to better serve the unbanked (Carstens and Queen Máxima 2022).

In conclusion, at the global level, central banks can link their wholesale CBDCs together to allow banks and payment providers to carry out transactions directly in central bank money of multiple currencies. This is made possible with so-called permissioned distributed ledger technology—restricted to trusted parties. Work by the Bank for International Settlements Innovation Hub with 10 central banks shows that such arrangements can deliver faster, cheaper, and more transparent cross-border payments (Bech and others 2022). This can help migrants pay less for their remittances, allow greater cross-border e-commerce, and support complex global value chains.

Digital technologies promise a bright future for the monetary system. By embracing the core of trust provided by central bank money, the private sector can adopt the best new technologies to foster a rich and diverse monetary ecosystem. Above all, users’ needs must be at the forefront of private innovation, just as the public interest must be the lodestar for central banks.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Bank for International Settlements (BIS). 2022. “The Future Monetary System.” Chapter 3 in Annual Economic Report. Basel.

Bech, M., C. Boar, D. Eidan, P. Haene, H. Holden, and W. Toh. 2022. “Using CBDCs across Borders: Lessons from Practical Experiments.” BIS Innovation Hub, Bank for International Settlements, Basel.

Boissay, F., G. Cornelli, S. Doerr, and J. Frost. 2022. “Blockchain Scalability and the Fragmentation of Crypto.” BIS Bulletin 56 (June).

Carstens, A., and H. M. Queen Máxima of The Netherlands. 2022. “CBDCs for the People.” Project Syndicate, April 18.