More than half of the world’s central banks are exploring or developing digital currencies

Central bank digital currencies (CBDCs) are digital versions of cash that are issued and regulated by central banks. As such, they are more secure and inherently not volatile, unlike crypto assets.

While some may assume that CBDCs are a new concept, they have in fact been around for three decades. In 1993, the Bank of Finland launched the Avant smart card, an electronic form of cash. Although the system was eventually dropped in the early 2000s, it can be considered the world’s first CBDC.

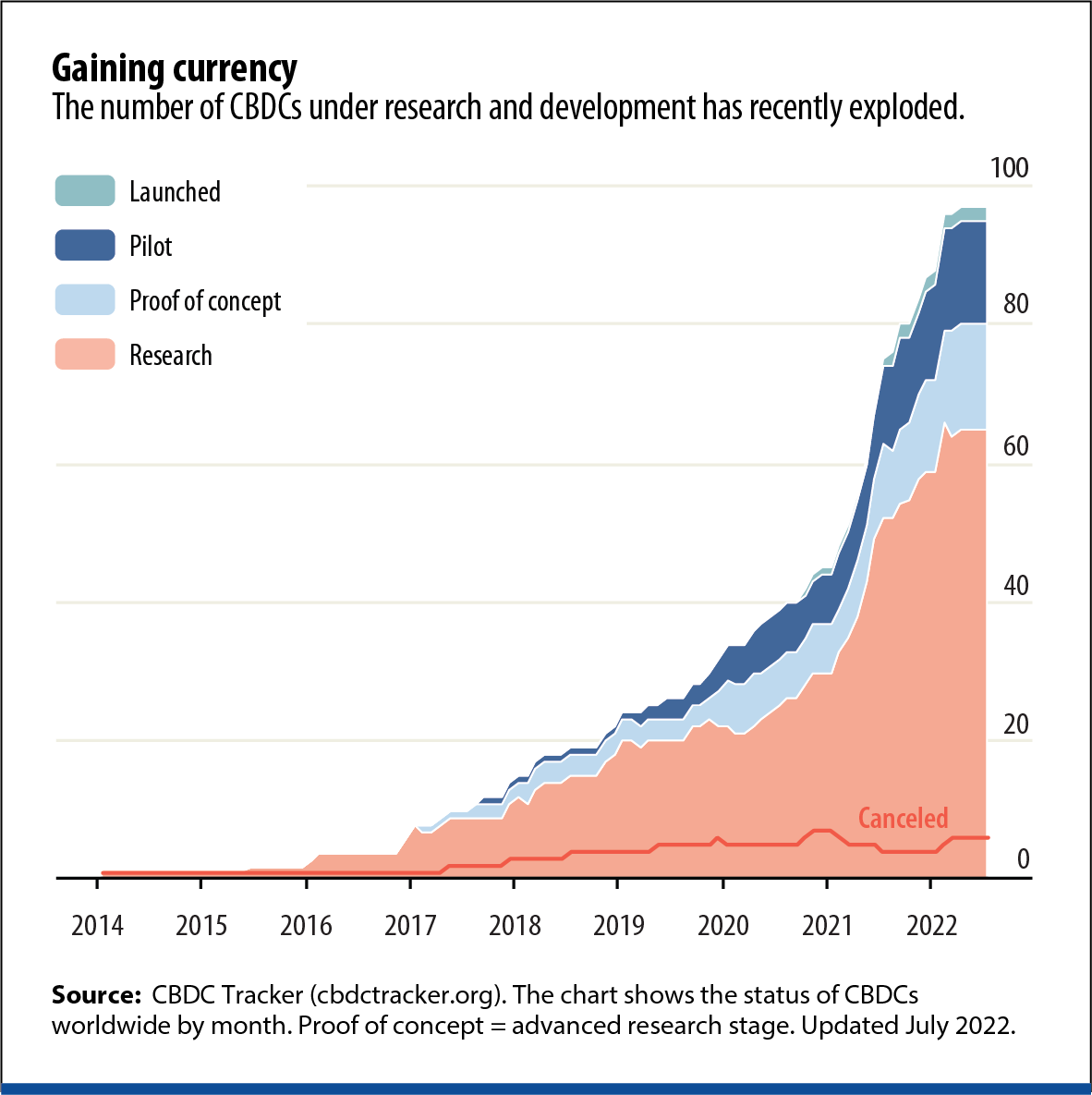

But not until recently has research into CBDCs proliferated globally, prompted by technological advances and a decline in the use of cash. Central banks all over the world are now exploring their potential benefits, including how they improve the efficiency and safety of payment systems.

As of July 2022, there were nearly 100 CBDCs in research or development stages and two fully launched: the eNaira in Nigeria, unveiled in October 2021, and the Bahamian sand dollar, which made its debut in October 2020.

Countries have different motives for exploring and issuing CBDCs, but in the case of The Bahamas, the need to serve unbanked and under-banked populations across more than 30 of its inhabited islands was a primary driving force.

Beyond promoting financial inclusion, leading experts argue that CBDCs can create greater resilience for domestic payment systems and foster more competition, which may lead to better access to money, increase efficiency in payments, and in turn lower transaction costs. CBDCs can also improve transparency in money flows and could help reduce currency substitution (when a country uses a foreign currency in addition to, or instead of, its own).

While a CBDC may have many potential benefits on paper, central banks will first need to determine if there is a compelling case to adopt them, including if there will be sufficient demand. Some have decided there is not, at least for now, and many are still grappling with this question.

Additionally, issuing CBDCs comes with risks that central banks need to consider. Users might withdraw too much money from banks all at once to purchase CBDCs, which could trigger a crisis. Central banks will also need to weigh their capacity to manage risks posed by cyberattacks, while also ensuring data privacy and financial integrity.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.