Measures of uncertainty don’t quite measure up

Amid this year’s geopolitical rifts, one signal of uncertainty is flashing red; another, green; and a third, amber. Ordinarily, they tend to track one another.

This is no parlor game. High levels of uncertainty can freeze investment and consumption, tank markets, and help spark a recession.

What are we to make of this in assessing the direction of the global economy?

Let’s start with a review of how economists, investors, and policymakers gauge uncertainty.

How high is uncertainty?

Measuring uncertainty is not easy. The questions are uncertainty about whom, over what, and for what time period. There is no single dominant metric for uncertainty.

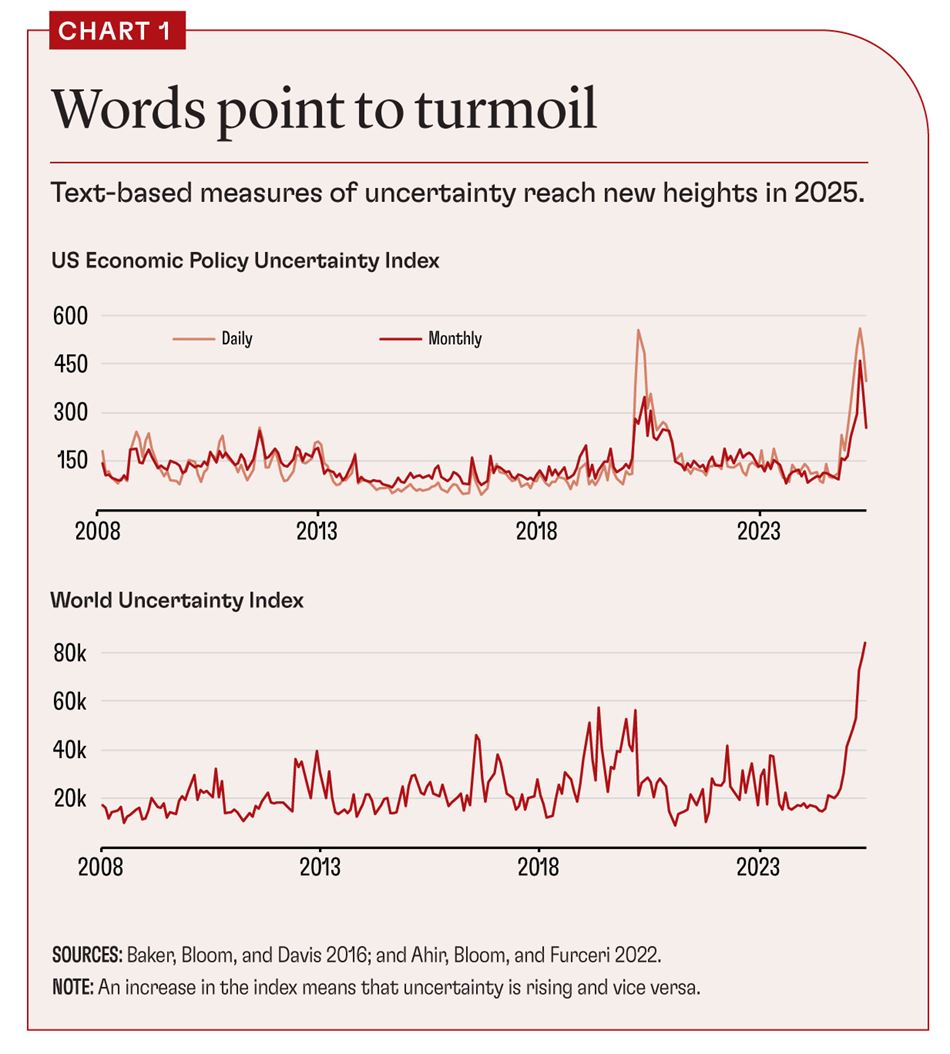

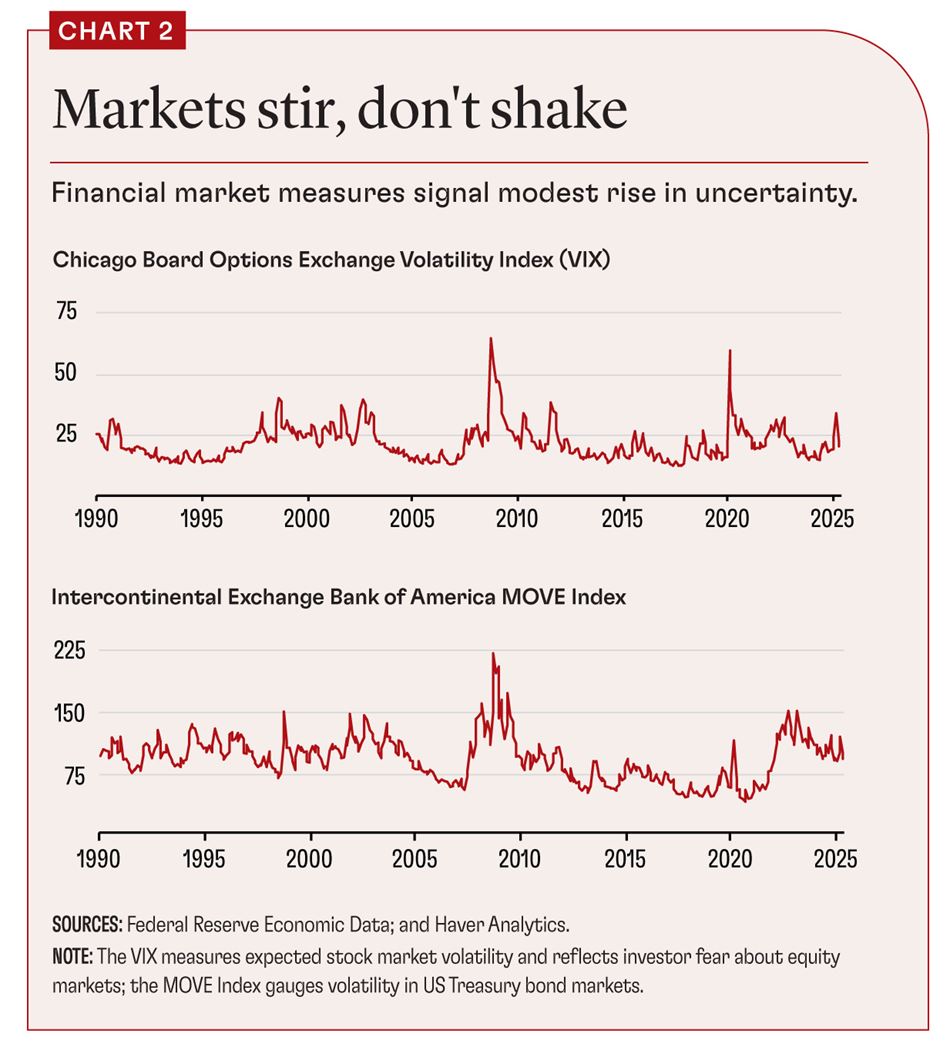

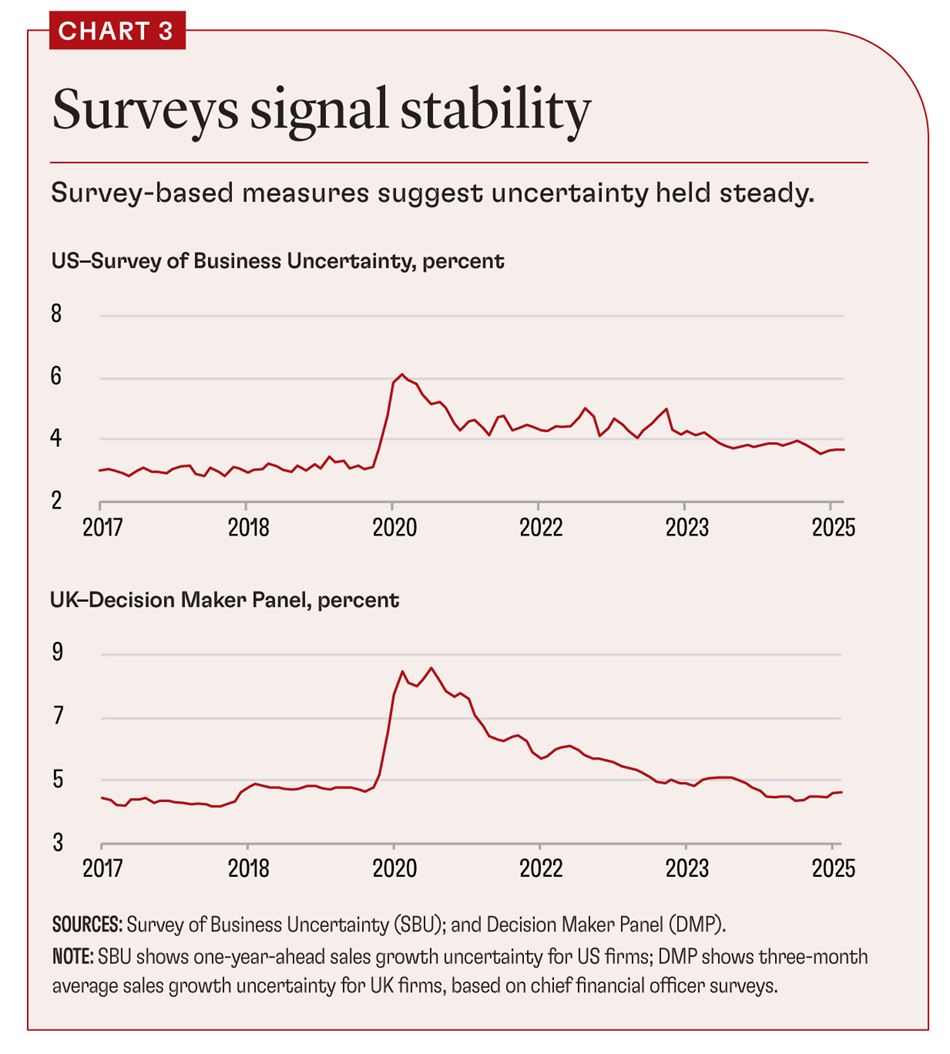

The three main measures rely on textual analysis, financial markets, and business surveys. Text-based measures now show exceptionally high levels of uncertainty. Everything you read, from newspapers to country reports to official publications, seems to discuss uncertainty. Financial-market-based measures, meanwhile, show only moderate levels of uncertainty. And survey-based measures, which spiked during the pandemic, have largely flatlined.

Perhaps the best-known text-based metric is the Economic Policy Uncertainty (EPU) Index developed by Baker, Bloom, and Davis (2016). The index analyzes articles in hundreds of newspapers for mentions of terms related to economics, policy, and uncertainty. This century, the EPU for the United States has typically surged during crises, spiking after events like the 2008 financial crisis and the 2020 COVID pandemic (Chart 1). In 2025, the EPU reached a record high, indicating extensive discussions of uncertainty in national and local newspapers.

One concern with the EPU is that it may reflect media bias. We developed a second set of indicators based on the Economist Intelligence Unit’s country reports (Ahir, Bloom, and Furceri 2022). These reports appear monthly and provide a detailed discussion of political and economic conditions in 71 countries. By calculating the frequency of the appearance of the term “uncertain,” we created the World Uncertainty Index (WUI). It shows a similar trajectory as the EPU, suggesting that perceptions of elevated uncertainty—across countries—are not solely media-driven.

Concerns about using textual data to measure uncertainty include the evolution of language, potential bias in sources, and inaccuracies in word counts as measures of intensity. An alternative approach is to examine financial market volatility. The 32-year-old Chicago Board Options Exchange Volatility Index, known as the VIX, embodies this concept. It calculates the one-month-ahead implied volatility of the S&P 500 Index of US stocks, based on a basket of put and call options.

Significant spikes in the VIX over the past three decades occurred around economic and political shocks, such as the Asian and Russian financial crises in 1997 and 1998, the 2008 financial crisis, the 2011 debt ceiling crisis, and the 2020 pandemic (Chart 2). In 2025, the VIX has been elevated—reaching 32 in April—but that was not a large spike compared with previous jumps.

Other market-based measures—such as the Intercontinental Exchange Bank of America MOVE Index of implied volatility on bond yields—present a similar picture of increased but not extreme uncertainty.

In many ways, the most informative measure of uncertainty is how managers perceive future business conditions. Ultimately, it is uncertainty in the minds of executives that influences decisions about hiring and investment, which drive economic growth.

The US Survey of Business Uncertainty (SBU), administered by the Atlanta Federal Reserve Bank, queries almost 1,000 US businesses each month, collecting information about sales forecasts. As Altig and others (2020) show, these forecasts accurately predict business actions, including current and future hiring, investment, and sales.

This metric showed a significant surge in uncertainty during the pandemic, roughly doubling between January and May 2020, before slowly easing (Chart 3). Through June 2025, there was no uncertainty surge. One explanation is that businesses may not be following the economic or political news. However, the SBU panel did notably raise predictions for sales growth after the November 2024 election of Donald Trump. The forecasts declined in spring 2025 after the beginning of tariff wars.

The UK’s Decision Maker Panel collects similar measures of company-level sales growth uncertainty. It polls about 2,500 businesses a month across the UK. As Chart 3 also shows, the UK sales uncertainty index followed a pattern similar to that of the US measure, with a surge during the pandemic but no recent increase.

It’s a little puzzling that the survey-based metrics don’t show a rise through June 2025, whereas the market-based measures increased moderately and the text-based indicators surged. These indices tracked each other remarkably closely over previous episodes, such as the pandemic and the financial crisis. One explanation is that text measures are excessively high because of the intense media focus on the Trump administration. Another is that because our financial and business measures are shorter term and US-focused, they may miss the rise in longer-term global uncertainty. Our sense is that the truth is somewhere in between—global uncertainty has risen, but not as much as text-based measures would suggest.

Uncertainty and growth

Economists have been developing theories for decades about the economic impact of uncertainty. One body of research focuses on “real options,” or the idea that companies look at their investment choices as a series of options. For example, a supermarket chain that owns a plot of land has the option to build a new store there. If the supermarket becomes uncertain about the future because it is unsure whether a local housing development will proceed, it may opt to wait. In such a case, the option value of delay is high when uncertainty is high. Uncertainty makes businesses cautious about investment and hiring.

However, real-options effects are not universal. They arise only when decisions cannot be easily reversed. Even when uncertainty is high, businesses may be happy to hire part-time employees or rent rather than buy equipment. If conditions deteriorate, they can easily cut the workers and return the rented gear. High uncertainty tends to both reduce overall activity and shift it into more reversible choices.

Uncertainty can also push individuals to postpone consumption. People can easily delay decisions on buying durables like housing, cars, and furniture. Someone thinking about moving to another house could either do so this year or wait until next year. The option value of waiting will be much higher when income uncertainty is greater.

Finally, uncertainty can increase the cost of finance (Fernandez-Villaverde and others 2011). Investors want to be compensated for higher risk, and because greater uncertainty leads to higher risk premiums, it raises the cost of borrowing. Uncertainty also increases the probability of default.

There is a growing body of research estimating the impact of uncertainty on businesses, consumers, and the overall economy. Findings generally show that greater uncertainty has a strong impact on reducing investment and a weaker effect on lowering employment and consumption—while overall helping to drive business cycles. These effects seem to be magnified when financial conditions are tight: Uncertainty and financial frictions can have a multiplicative impact on each other.

Clearly, a surge in uncertainty of the size implied by this year’s text-based measures could be extremely damaging for growth, potentially leading to a global recession. But a rise in uncertainty of the size signaled by financial markets might only slow growth without generating a recession. And, if the business surveys are correct, uncertainty has changed little over the past year.

Our best guess is that uncertainty is not as high as indicated by the text measures, which may be distorted by the turmoil in US politics. But uncertainty is not as low as suggested by business surveys focusing on year-ahead sales. Many drivers of uncertainty are longer term or will not manifest in sales.

We see uncertainty as having risen above its long-term levels without reaching the peaks of the global financial crisis or the pandemic. As such, we think the 2025 surge in uncertainty will slow growth by reducing investment, hiring, and consumer spending on durable goods. This is likely to happen through 2025 and 2026 as the impact of uncertainty typically takes 6 to 18 months to slow growth (Caldara and Iacoviello 2022). But the rise in uncertainty is not large enough to induce a global recession.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Ahir, Hites, Nicholas Bloom, and Davide Furceri. 2022. “The World Uncertainty Index.” NBER Working Paper 29763, National Bureau of Economic Research, Cambridge, MA.

Altig, David, Jose Barrero, Nicholas Bloom, Steven J. Davis, Brent Meyer, and Nicholas Parker. 2020. “Surveying Business Uncertainty.” Journal of Econometrics 221 (2): 486–502.

Baker, Scott R., Nicholas Bloom, and Steven J. Davis. 2016. “Measuring Economic Policy Uncertainty.” Quarterly Journal of Economics 131 (4): 1593–636.

Caldara, Dario, and Matteo Iacoviello. 2022. “Measuring Geopolitical Risk.” American Economic Review 112: 1194–225.

Fernandez-Villaverde, Jesus, Pablo Guerron-Quintana, Juan Rubio-Ramirez, and Martin Uribe. 2011. “Risk Matters: The Real Effects of Volatility Shocks.” American Economic Review 101 (6): 2530–561.