US entrepreneurial activity is migrating from traditional hubs like California to more rural Western and Southern states

In Laramie, Wyoming, start-up Airloom Energy is reimagining traditional wind turbine design. Instead of three-bladed turbines atop tall towers, the company’s system uses wing-like blades traveling along a horizontal oval track like a roller coaster. This technology is more compact and easier to transport than traditional turbines, with lower costs. The company plans to break ground this year on a pilot project.

Airloom is not alone. Wyoming, the least populous US state, has seen 50 percent growth in start-ups over the past decade. The state is one of the winners as entrepreneurial activity has dispersed geographically in recent years, spurred by the adoption of artificial intelligence technology (AI tech) and the shift to remote and hybrid work.

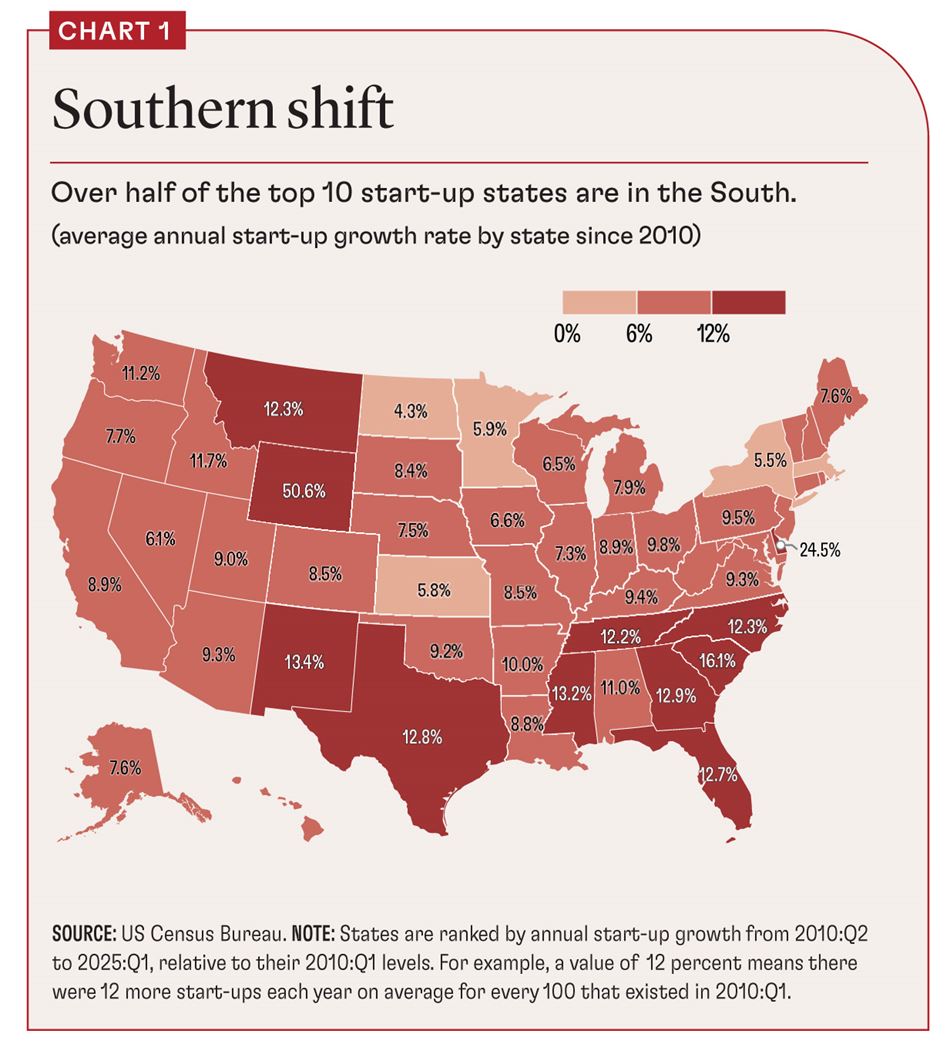

In the US, innovation hubs such as New York and California’s Silicon Valley are giving way to new geographies. Small businesses are popping up across western and southeastern states, such as Wyoming and Georgia. Seven of the top ten states in entrepreneurial activity are south of the famed Mason-Dixon Line—the historic boundary between Northern and Southern states—or the 36th parallel, a more southerly demarcation line (Chart 1).

Start-up clusters

The decentralization of innovation has enabled smaller cities and rural areas to develop start-up clusters. Some of these reflect the proliferation of data centers in regions with abundant land, electric power, and water—and, crucially, friendly local regulations. Western states may lack water, but they more than make up for it with the regulatory environment tech companies want.

JPMorgan Chase and Starwood Property Trust have committed $2 billion for a 100-acre data center development in West Jordan, Utah, near Salt Lake City. JPMorgan Chase made a loan of $2.3 billion in January 2025 for a facility in Abilene, Texas. Meta plans to build an $800 million, 715,000-square-foot data center in Cheyenne, Wyoming. Amazon is building two data centers in Madison County, Mississippi, for a total cost of $10 billion. Google is building a $2 billion center in Fort Wayne, Indiana, and a $1 billion center in Virginia.

Data centers act as a focal point for start-ups, fostering an entrepreneurial culture that applauds and even encourages risk taking. Moreover, a sociocultural mindset stemming from geographic proximity of firms along the AI tech supply chain encourages entrepreneurs to experiment and innovate rapidly. Observing peers’ success in taking risks reinforces experimentation and calculated risk taking.

Advances in AI tech have spurred the formation and growth of ancillary businesses. AI tech enables start-ups to perform tasks traditionally dominated by large corporations, such as analyzing massive datasets or automating complex processes.

Productivity increases

Innovation lies at the heart of productivity increases as new technologies encourage businesses to adopt new operational styles. For example, medical offices in Boise, Idaho, can use AI tech to read X-rays without the need for a large hospital. Manufacturing firms leverage advanced analytics to manage inventory. Workers in remote Wyoming use AI tech to streamline processes like data entry, scheduling, and email management. According to PitchBook, which maintains a database on global capital markets, AI start-ups racked up 22 percent of first-time venture capital financing in 2024.

Start-ups and new businesses have the agility to easily incorporate new technologies, unconstrained by legacy frameworks. According to Emin Dinlersoz and Nathan Goldschlag, writing for the US Census Bureau, “since the early fall of 2023, the smallest firms had a relatively high AI use rate, although the rate of increase was lower than for larger firms.” Correspondingly, an increase in start-ups often leads to higher labor productivity and potentially higher wages.

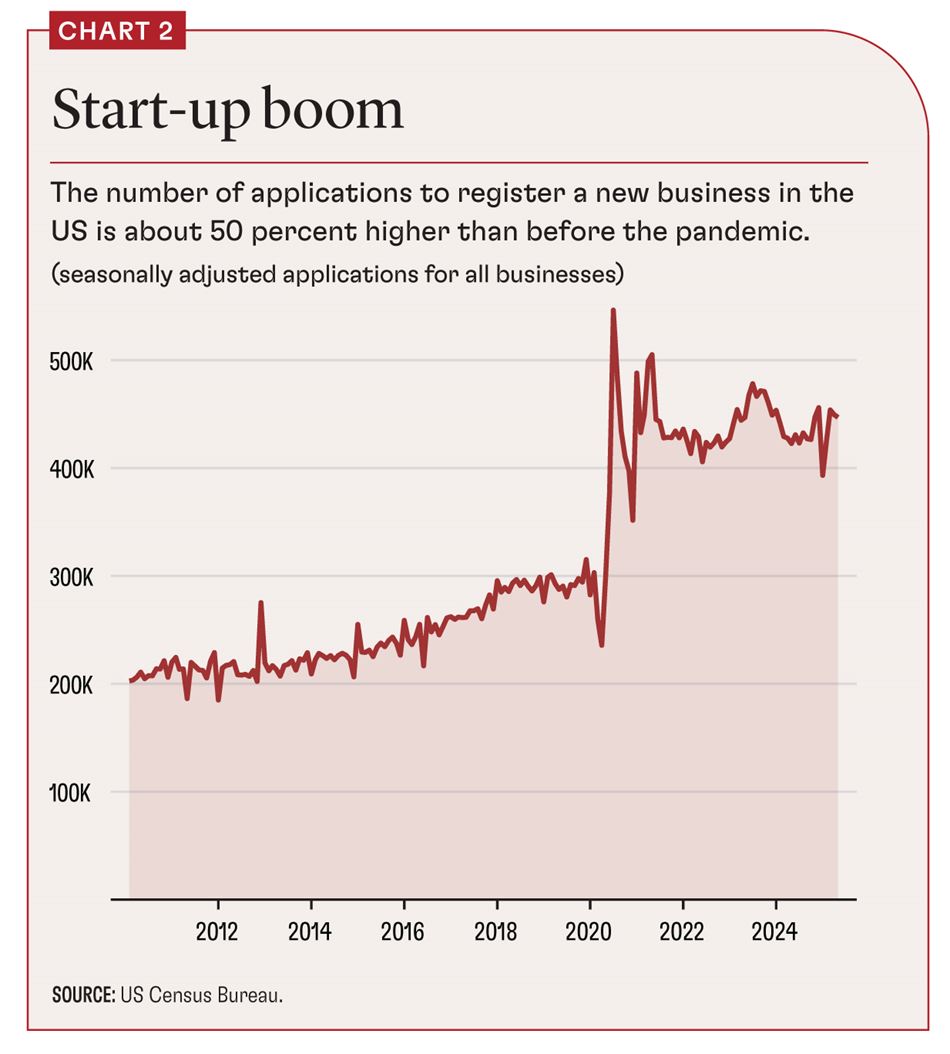

The Census Bureau’s Business Formation Statistics collect data on business applications, a good way of measuring idea generation that leads to business start-ups. As Chart 2 indicates, there has been an explosion in new business applications since the onset of the pandemic in 2020.

Another metric uses Bureau of Labor Statistics (BLS) data on planned wage payouts to measure the launch of new businesses. Whereas Census data highlight idea formation, the BLS data capture idea implementation. A key question in examining innovation is whether an idea becomes significant only when it leads to hiring or whether the birth of the idea itself qualifies as innovation.

The BLS data also show a sharp increase in entrepreneurial activity across the US during 2010–20 compared with the previous decade. Of the 15 top performing states, 10—California, Colorado, Idaho, Missouri, Montana, Nevada, South Dakota, Texas, Utah, and Washington—lie west of the Mississippi River. Conversely, the 15 weakest-performing states are located east of the Mississippi.

Economic dynamism

Before the pandemic, there was sizable entrepreneurial activity only in the Western states. That may be changing though. Census data show that 7 of the top 10 states for start-up activity in 2010–25 were in the South, as the map shows.

The question is whether all this start-up activity is contributing significantly to job growth. Recent research published by the Federal Reserve suggests that the recent wave of start-ups is less likely than previous upsurges to contribute to employment growth. Young, high-growth start-ups accounted for less than 6 percent of employment in 2024, compared with almost 10 percent in 1985, according to the Fed. AI tech–driven start-ups tend to be capital- and skill-intensive, requiring fewer workers.

Productivity and wage increases manifest in the highest-skilled workers; automation reduces the wages of those engaged in routine tasks. Economic dynamism—whereby new businesses boost economic growth—may well reflect not so much large start-ups employing large numbers of workers as an increase in the number of start-ups, each one spawning more such firms thanks to a boost in the region’s risk-taking culture.

This may help explain why population density is unrelated to entrepreneurial activity. Among the top 10 states for start-up activity, New Mexico and Wyoming have between 5 and 20 people per square mile. By contrast, Florida and Texas, also in the top 10, are among the most populous states, with 150 to 400 people per square mile.

In addition, larger firms often acquire start-up founders’ ideas, which reduces the need for independent growth. For example, Microsoft acquired all of Inflection AI, and its entire 70-person workforce, in 2024, and in 2022 acquired Nuance Communications, a leader in speech recognition and conversational AI.

Targeted investing

This shift in activity from the Western states to the South Atlantic states in the postpandemic years is remarkable. Key reasons behind this trend include venture capital reallocation, aggressive state-led incentives (tax breaks and public-private R&D partnerships), cost-of-living advantages, enhanced ecosystem building (incubators), and remote work trends. The Southeastern states’ more nuanced approach to investing—writing smaller, more directed checks to promising founders—has proved to be more resilient in the face of high exit rates for start-ups.

Manufacturing and research are important drivers. Automobile manufacturing clusters, led by Mercedes-Benz USA and Porsche North America, have headquarters in the Atlanta, Georgia, area. The 7,000-acre research cluster in Research Triangle Park in Raleigh-Durham, North Carolina, and Cummings Research Park in Huntsville, Alabama—the second-largest research park, with business incubators and Fortune 500 companies—have generated favorable spillover effects in the areas’ business climate. Most of these start-ups are integrating AI tech into their normal business functions: It is a tool in the general toolbox, as illustrated by the multibillion-dollar deals made by OpenAI with gaming company Epic Games and the fintech OneTrust in 2020, both headquartered in the Southeast.

The case of Wyoming is unique. Wyoming has no state income tax or corporate income tax, low business formation costs and filing fees, and no citizenship or residency requirements. The state has strong privacy protections as it doesn’t share business or personal records with outside agencies. In 2023, the Wyoming Banking Board approved a cryptocurrency bank. Small wonder that entrepreneurs consider Wyoming a top choice for start-ups.

Innovation and entrepreneurial activity are not inherently confined to historically established regions. Emerging areas can cultivate and adapt their entrepreneurial ecosystems to harness local potential and evolve into dynamic start-up hubs. This ability makes them a compelling model for less-developed economies seeking to stimulate economic growth through entrepreneurship. There are nevertheless challenges, such as the need to provide cheap energy and other resources to power data centers and other power-hungry facilities. Policymakers can play a critical role through targeted industrial policy—investing in infrastructure, education, and regulatory frameworks that foster innovation and lower entry barriers for new ventures in these regions.

Podcast

The US is a breeding ground for startups, and California has been the center of that universe since the dot-com boom in the late 1990s. But rising costs, tighter quarters, and increasing bureaucracy have many tech innovators seeking greener pastures, well beyond Silicon Valley. In this podcast, Princeton University's Swati Bhatt talks about these new entrepreneurs opting for a different lifestyle.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

References:

Acemoglu, Daron, and Pascual Restrepo. 2022. “Tasks, Automation, and the Rise in U.S. Wage Inequality.” Econometrica 90 (5).

Bhatt, Swati. 2022. Entrepreneurship Today: The Resurgence of Small, Technology-Driven Businesses in a Dynamic New Economy. London: Palgrave-Macmillan.

BIP Ventures. 2024. “State of Startups in the Southeast 2024.” Atlanta, GA.

Dinlersoz, Emin, Can Dogan, and Nikolas Zolas. 2024. “Starting Up AI.” Center for Economic Studies Paper 24-09, US Census Bureau, Washington, DC.

Dinlersoz, Emin, Timothy Dunne, John Haltiwanger, and Veronika Penciakova. 2023. “The Local Origins of Business Formation.” Center for Economic Studies Paper 23-24, US Census Bureau, Washington, DC.