Reforms to address misallocation of resources can boost productivity enough to revive stagnating global growth

The global economy has been struggling to regain its footing since the 2008–09 global financial crisis. Forecasts for medium-term growth continue to be downgraded. Advanced economies have seen a deterioration in growth since the early 2000s, and emerging markets experienced similar challenges after the financial crisis.

Our recent study suggests that without timely policy interventions or breakthroughs in technology and its adoption, global growth could stagnate at just 2.8 percent by the end of the decade. That is a significant drop of 1 percentage point from prepandemic levels.

But this outcome is not preordained. Currently, the United States leads the world among our sample countries in allocative efficiency, a measure of how well an economy’s resources are distributed to its most productive uses.

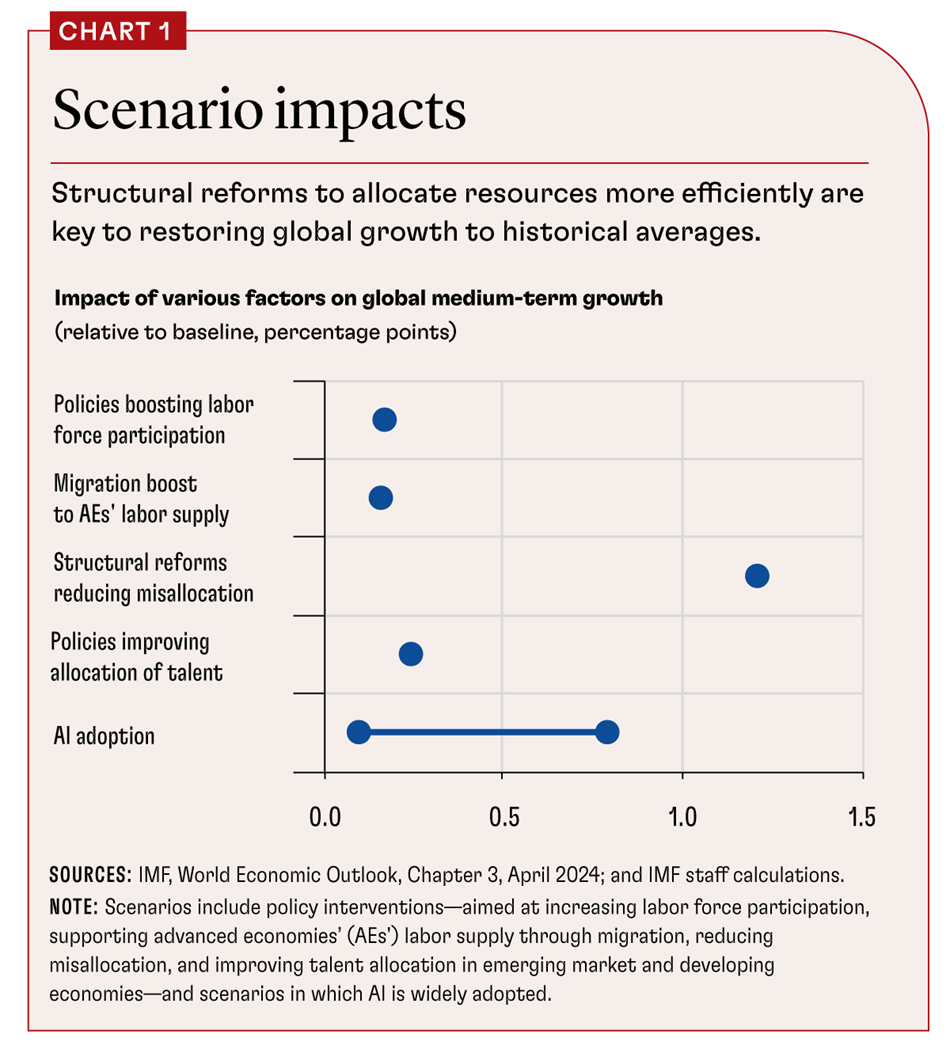

We calculate that if less efficient countries could narrow their gap with the United States by just 15 percent, it would boost productivity and stimulate investment, adding about 1.2 percentage points to annual global growth. Structural reforms addressing regulatory barriers, labor market rigidity, and access to financing are key to achieving this.

The benefits of economic growth are well known. Growth leads to improved living standards, more tax revenue for public services, and increased investment in new technologies and businesses, including needed investment to combat climate change and the transition to renewable energy. This is why higher productivity is so important.

In recent years, productivity growth—output increases that are not attributable to growth in inputs such as labor and capital—has markedly decelerated, accounting for more than half of the decline in global growth. In advanced economies, annual productivity growth plunged from 1.4 percent during 1995–2000 to just 0.4 percent after the pandemic. Emerging market economies saw a drop from 2.5 percent during 2001–07 to 0.8 percent. The situation is even grimmer for low-income countries, where productivity growth nose-dived from 2 percent during 2001–07 to nearly zero after the pandemic.

What drives productivity

Higher productivity means more output from the same amount of input. Two main factors drive productivity growth: within-firm improvements and economy-wide allocative efficiency.

Within-firm productivity gains are achieved through better technology, improved management practices, and innovative processes. Companies that adopt state-of-the-art technologies and attract top talent can significantly enhance their productivity. For example, a tech company that invests in cutting-edge research and development can create new products or improve existing ones, thereby expanding its market share and increasing its competitiveness.

The problem is, returns on investment in R&D are diminishing. For instance, in the semiconductor industry, more researchers are needed to double the density of chips. This trend also spans various sectors, including information and communications technology, where rapid gains have notably plateaued since the early 2000s. Therefore, it is imperative to look to other sources of enhanced productivity to sustain economic growth.

That brings us to the second major factor driving productivity growth, allocative efficiency. Economy-wide allocative efficiency is about how well an economy’s resources are distributed across businesses for their most productive uses. Imagine an economy as a large farm. If the best land is used for growing the highest-value crops, the farm will be more productive overall. In the same way, if an economy’s resources flow to the most innovative and efficient companies, those enterprises can grow and drive economic progress. This process ensures that the best businesses thrive, while less efficient ones exit the market.

Addressing misallocation

Unfortunately, misallocation of capital and labor across companies within sectors has increased. This misallocation of resources has been dragging down productivity growth by an average of 0.6 percentage point annually. Without this increase in misallocation, productivity growth could have been 50 percent higher.

The rise in misallocation stems primarily from uneven productivity growth among companies, hampered in many countries by economic frictions that prevent efficient reallocation of resources. Structural frictions, such as regulatory barriers, rigid labor markets, financing constraints, and lack of trade openness tend to be associated with higher misallocation.

Our study finds that two-thirds of the observed misallocation is attributable to persistent structural issues. This suggests that targeted policy interventions, addressing these inefficiencies, could substantially boost productivity and foster growth (see Chart 1).

One policy that supports this goal is the reduction of barriers to market entry and increasing competition. For example, India in 1991 embarked on wide-ranging economic reforms that included deregulating significant sectors of the economy. The removal of compulsory industrial licensing, also known as the “License Raj,” allowed for greater private sector participation and competition. This reform reduced entry barriers and capacity constraints, enabling more efficient allocation of resources.

Another effective approach is liberalization of financial markets, which enables businesses to access the funding they need to grow and innovate. This allows firms with high productivity potential to obtain the necessary capital to expand, rather than being constrained by financial limitations.

Equally important is reducing labor market rigidities to foster a dynamic and adaptable workforce. For example, in Brazil, stringent labor market regulations in the past have driven up costs for formal sector employers, resulting in a significant share of employment in the less productive informal sector. By making it easier for workers to move to where they are most needed, countries can better match labor supply with demand, thereby enhancing overall productivity.

Addressing other institutional barriers that hinder efficient resource allocation is crucial for long-term growth. Issues such as corruption and weak property rights must be tackled through effective governance and institutional reforms. Improving the regulatory framework and ensuring transparent and fair market practices can create a more dynamic and productive economic landscape.

Emerging technologies, such as artificial intelligence, supercomputer chips, biotechnology, and green technologies, have the potential to lift productivity and boost economic growth. For example, AI can optimize supply chains, reduce operational costs, and improve customer service, all of which contribute to higher productivity. In health care, AI-driven diagnostics and personalized medicine are revolutionizing patient care, making it more efficient and effective. Similarly, in manufacturing, AI-powered automation is increasing production speeds and reducing errors, leading to significant cost savings and productivity gains.

Governments should foster an innovation and adoption ecosystem that supports creativity and minimizes frictions in reallocation of research resources. Technological advances are pivotal in enhancing productivity because they allow firms to operate more efficiently and compete effectively in the global market.

A thought experiment

Here is a straightforward yet illuminating thought experiment: What if every country could close its policy gaps with the best-performing economy in terms of labor market flexibility, financial market liberalization, trade liberalization, and the regulation of certain product markets?

If other countries were to narrow their policy gaps with the United States by just 15 percent—an ambitious yet achievable target given historical reform measures—the drag on annual productivity growth from allocative inefficiency could be eliminated, reversing the decline in productivity and boosting growth.

The global economy stands at a pivotal moment. The path forward requires decisive action to enhance productivity through better resource allocation and technological adoption. Historical lessons and many analyses converge on the same point: effective policy interventions can halt and reverse the trend of declining growth. By creating environments where the most productive businesses can thrive and by leveraging the potential of emerging technologies, countries can set the stage for a new era of economic prosperity.

A Multifacted Challenge

Brazil

A leading emerging market economy, Brazil is progressing to the world’s technological frontier as it becomes more integrated with global markets and implements reforms. Worker productivity has increased since a 2017 labor reform, which led to a decline in litigation cases and the costs associated with them. Implementation of a 2023 value-added tax reform is expected to improve resource allocation, particularly in manufacturing, boost investment, and increase formal-sector activities, raising economic growth by 0.3-0.5 percentage points per year. Greater hydrocarbon output is expected to lift medium-term growth. This will improve Brazil’s prospects of raising its income closer to that of advanced economies. Investment in green growth opportunities could lift economic potential further.

China

Rapid transformation and integration into global markets drove decades of unparalleled economic performance. But growth has slowed in recent years and is projected to decelerate further amid an aging population and declining productivity growth. The allocation of capital and labor across companies has become less efficient in the service sector, which accounts for more than half of value added. Less productive services companies corner too large a share of the market, while more productive businesses remain too small because they struggle to attract new capital and labor to grow. China should prioritize reforms to improve allocative efficiency. Reforming state-owned enterprises, removing protectionist barriers, and further opening up to international trade in services could boost growth potential.

Euro Area

Europe’s productivity growth has lagged the United States since the 1990s, and its companies have failed to match the innovative success of their competitor across the Atlantic. Without a truly integrated market for goods, services, labor, and capital, businesses cannot explore economies of scale or grow as much as their US peers. This is especially true of disruptive start-ups. Inefficient insolvency frameworks slow the exit of unproductive companies, hinder resource allocation, and reduce competitive pressure, including for the adoption of new technologies. An aging population, skills mismatches, and other labor challenges discourage the job churn needed to support productivity growth. A stronger single market would improve competition and allocative efficiency.

Japan

Japan’s total factor productivity growth recovered from a decades-long slowdown in the 2010s as companies tried to overcome the constraints imposed by an aging population and tight labor markets by investing in software and digitalization. However, the recovery didn’t last, and productivity growth soon slowed again. Despite being one of the world’s top spenders on research and development as a share of GDP, Japan has not made sufficient technological breakthroughs to restore productivity to historical levels. In addition, a widening gap between high- and low-productivity companies holds back allocative efficiency: poor-performing companies continue operating for years before they finally close and exit markets. This imposes a drag on economy-wide productivity growth.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.