The transition to net-zero greenhouse gas emissions requires unprecedented change by companies and governments, as well as additional investment of as much as $20 trillion over the next two decades. Strong fiscal policies, complemented by a broad range of regulatory and financial policies, will be necessary to facilitate the green transition.

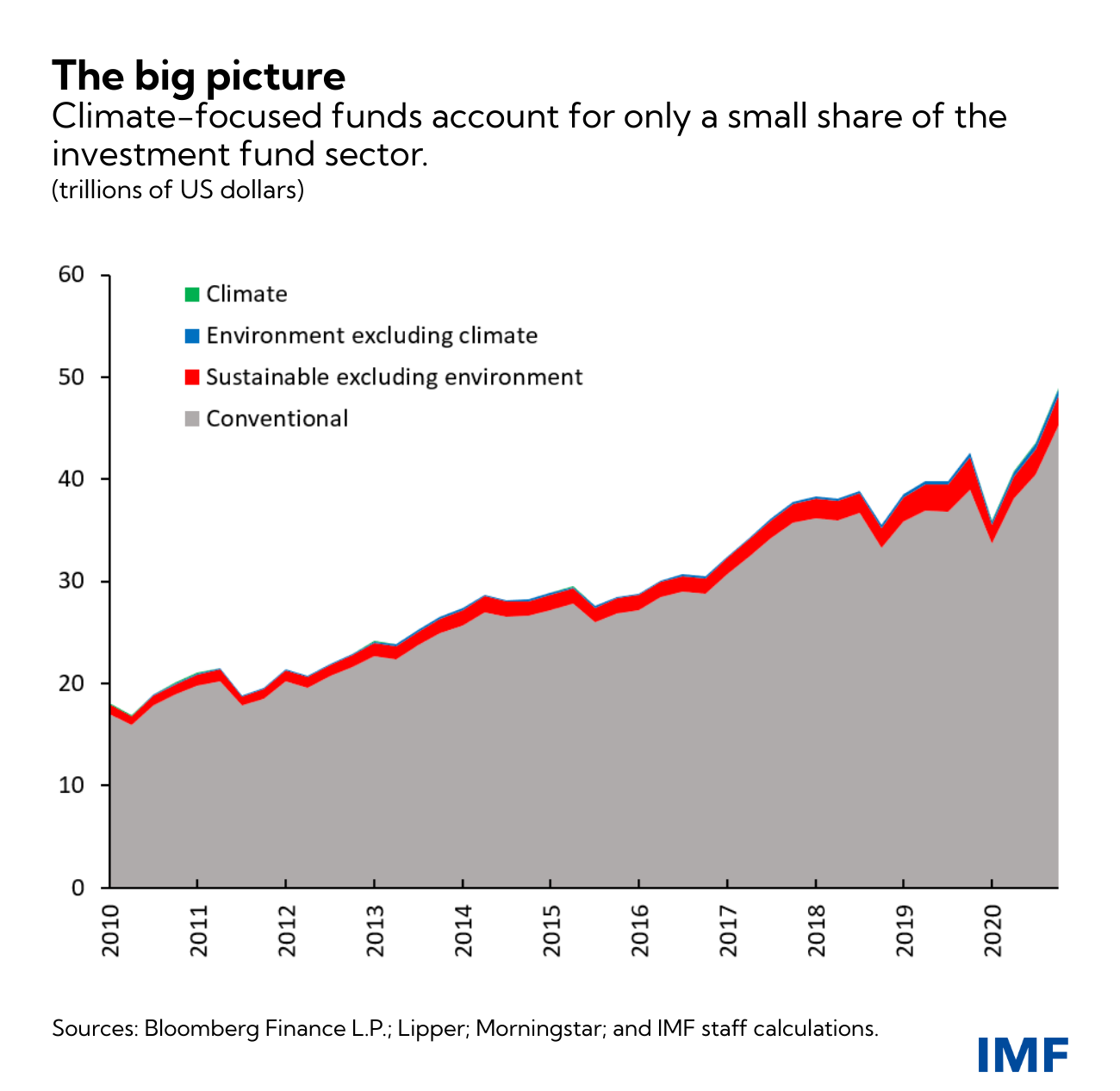

The world’s $50 trillion investment fund industry, especially funds with a sustainability focus, can play an important role financing the transition to a greener economy and helping to avoid some of the most perilous effects of climate change, according to our recent analysis as part of the IMF’s Global Financial Stability Report.

Net flows into sustainable funds increased notably in 2020.

Sustainable funds differ from conventional funds because they have a sustainability objective while also seeking financial returns. Within this broad class of funds, some funds are more narrowly focused on the environment, and a further subcategory is concerned with climate change mitigation specifically.

Climate stewardship and firm financing

The positive role of funds comes directly from their ability to influence the corporate sector. Through stewardship, which includes direct engagement with firms and proxy voting, funds can effect changes in firms’ sustainability practices. For example, earlier this year, activist investors stunned the investment and energy industries by winning seats on Exxon Mobil’s board as part of their bid to change its climate strategy.

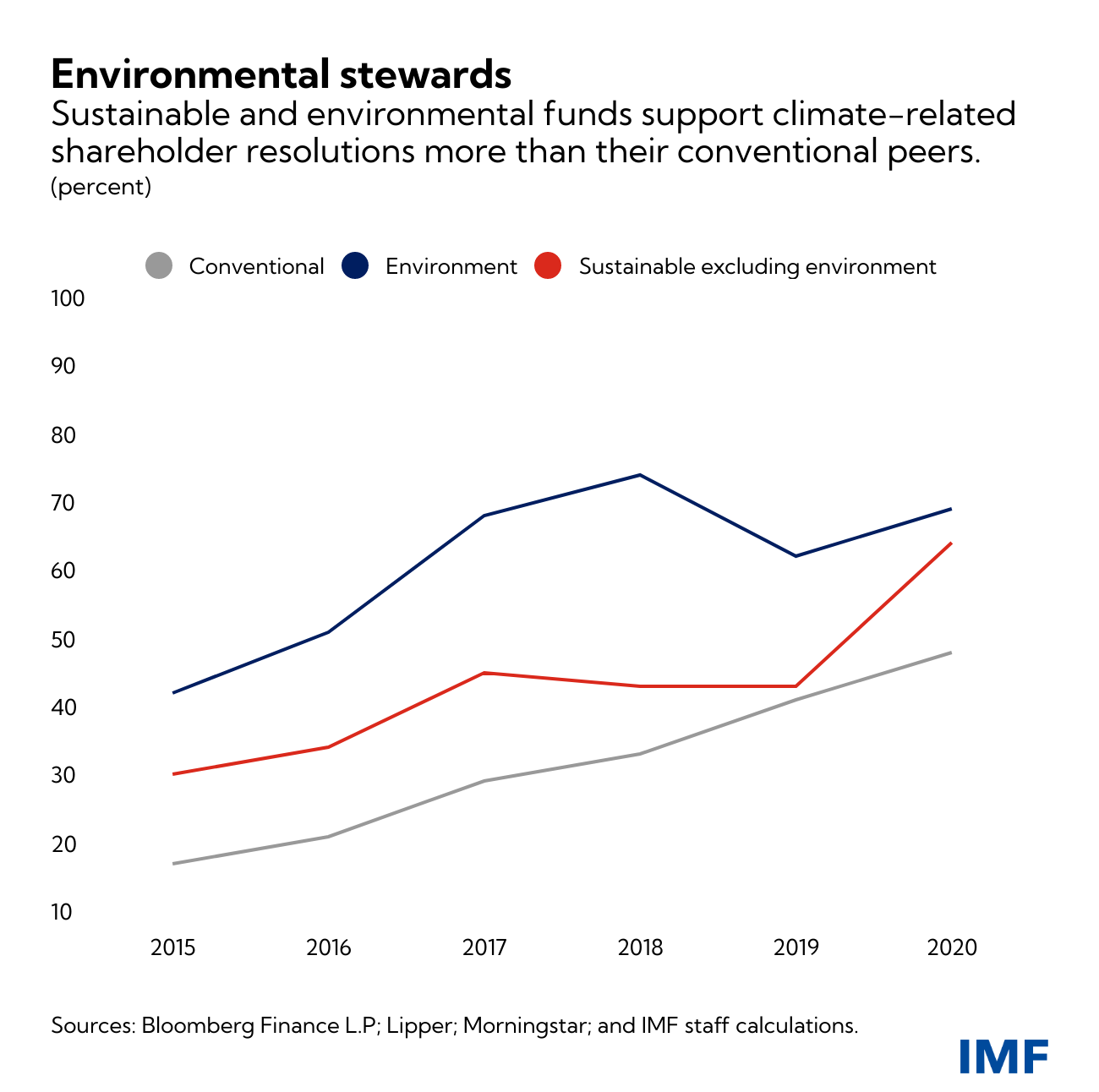

The latest Global Financial Stability Report shows how investment funds have stepped up proxy voting behavior with firms on climate-related matters. Conventional investment funds voted in favor of almost 50 percent of climate-related shareholder resolutions in 2020, up from about 20 percent in 2015. Funds with a sustainability focus had an even stronger track record, voting in favor of about 60 percent of such resolutions, and even close to 70 percent in the case of environment-themed funds.

Moreover, the growing popularity of investing in sustainable funds means more capital available to firms with a high sustainability rating, boosting firms’ bonds and shares issuance.

Still too small

However, even though sustainability is becoming mainstream in investment strategies, sustainable investment funds still represent only a small fraction of the investment fund universe. At the end of 2020, funds with a sustainability label totaled about $3.6 trillion, representing only 7 percent of the overall investment fund sector. Funds with a specific climate focus accounted for a meager $130 billion of that total.

Still, an emerging trend sees sustainable investment funds growing faster than conventional peers. Net flows into sustainable funds increased notably in 2020, and climate-themed funds grew especially fast, surging by a staggering 48 percent of assets under management.

Boosting sustainable and climate funds

So what can policymakers do to help the sustainable investment fund sector be more impactful?

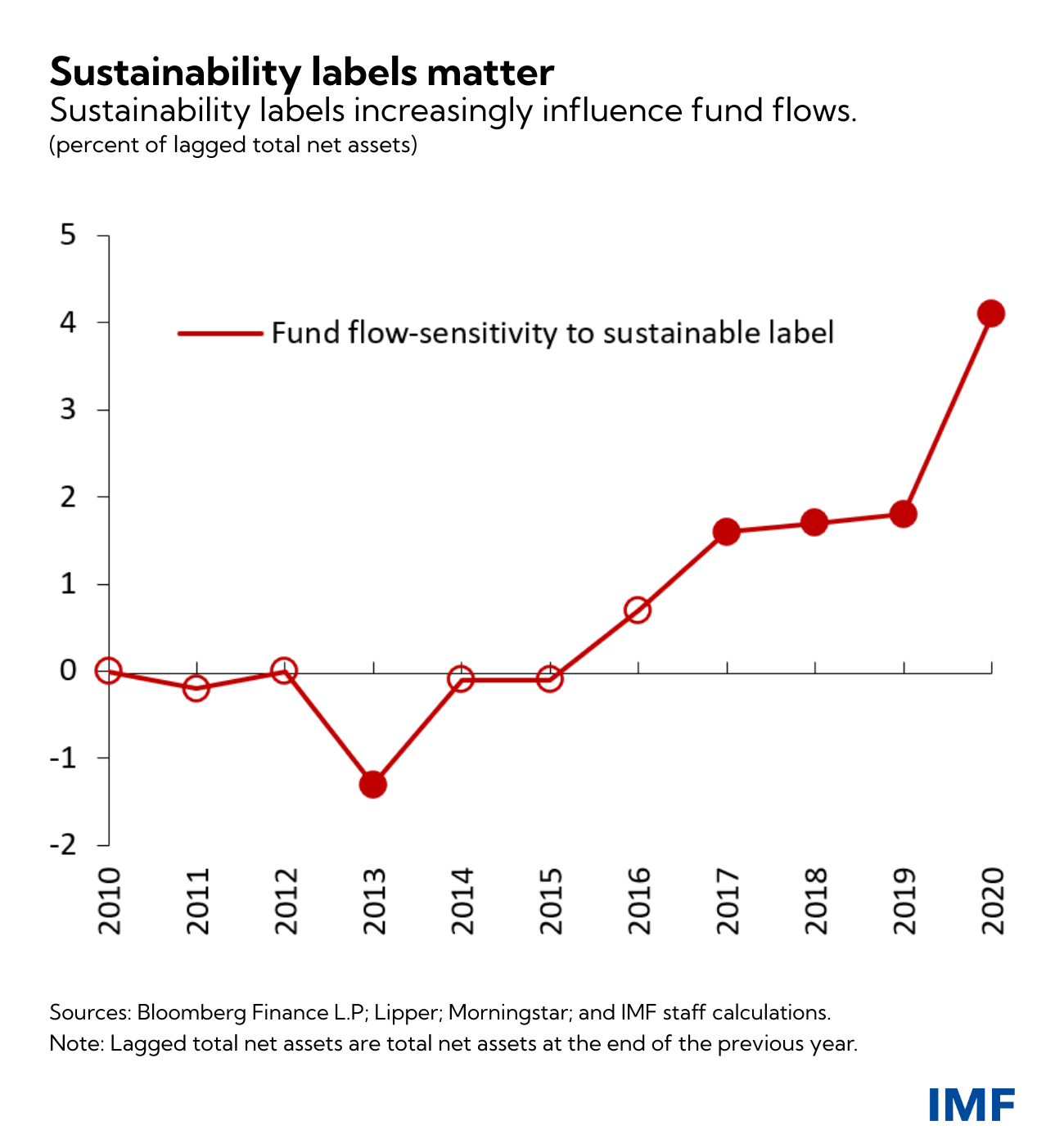

First, strengthen the global climate information architecture, which includes data, disclosures, and sustainable finance classifications, both for firms and investment funds. For example, better classification systems for funds, where fund labels and taxonomies are uniformly used and understood, helps to summarize a fund’s investment strategy and its overall approach to engagement and stewardship. In fact, our analysis shows that labels have become an increasingly important driver of fund flows—especially in the retail segment of the market.

To this end, the IMF, together with the World Bank and the OECD, aims to develop principles for such classification systems to harmonize existing approaches and support the development of sustainable finance markets.

Second, proper regulatory oversight needs to be in place to prevent “greenwashing,” that is, ensure that labels fairly represent funds’ investment objectives. This, in turn, increases market confidence and further boosts flows into sustainable funds.

Third, once those elements are in place, tools to channel savings toward funds that enhance the transition become important. For example, enhanced eligibility of climate-themed funds for favorable tax treatment in savings products (such as retirement plans or life insurance products) could help complement other climate-change-mitigation measures, such as carbon taxes.