Yields on bonds of different maturities reveal much about an economy’s prospects

For centuries, governments have turned to investors to fund their activities. They mostly do this by issuing bonds. Today the global market in government sovereign debt is worth about $100 trillion—almost as large as the world economy itself. But what are government bonds? What determines how much investors will pay for them? And what can bond “yield curves” tell us about an economy?

Consider a government whose outlays exceed its revenues by $100. To finance the deficit, it can borrow from investors by issuing a bond. The bond is a promise by the government to pay back the $100 principal to investors at a future date, plus annual interest, called a coupon payment, to compensate investors for the opportunity cost of parking their funds in the bond rather than some other investment.

This opportunity cost has two components: an inflation component (to preserve the purchasing power of investors’ money) and a real, inflation-adjusted, component (the additional return, on top of inflation, investors might forgo on alternative investments). The higher the expected rate of inflation and returns on alternative investments, the higher the return the government must generally offer investors.

Suppose the government issues a one-year $100 bond, or bill, with a coupon rate of 5 percent. This is a commitment to pay back investors $105 after one year: $100 in principal, $5 in interest. If the coupon rate equals the investors’ opportunity cost, investors will be willing to buy the bond at its face value, or at par ($100, in this example).

But if investors’ opportunity cost exceeds the 5 percent coupon, they will buy the bond only at a price below par. Say they are willing to pay only $98. This would provide a higher return on their investment, specifically 7.1 percent [(105÷98)-1]. This total return, which by definition equals investors’ opportunity cost, represents the bond’s yield (or yield to maturity).

Primary and secondary markets

A direct bond sale by the government to investors is a primary market transaction. But bonds can also change hands between investors in the secondary market. This is because bonds are tradable securities, like stocks. The key implication is that the issuance yield on a bond can differ from the prevailing market yield.

For instance, let’s assume that a major commercial bank fails immediately after the government issues the $100 bond above. This fuels fears of a financial crisis and recession. As investors come to expect smaller returns and lower inflation because of the recession, the opportunity cost of funds falls sharply, from 7.1 percent to 3 percent. In this situation, the bond issued at $98 will now trade above par in the secondary market, at $101.95, to reflect the new market yield of 3 percent.

Governments can issue bonds of different maturities, typically ranging from 1 to 30 years. Each bond has its own coupon rate and associated yield to maturity. Longer-term bonds usually carry a higher yield. This is called term premium. It reflects the additional compensation investors demand for the uncertainty associated with future inflation and economic conditions, and for forgoing other investments for longer.

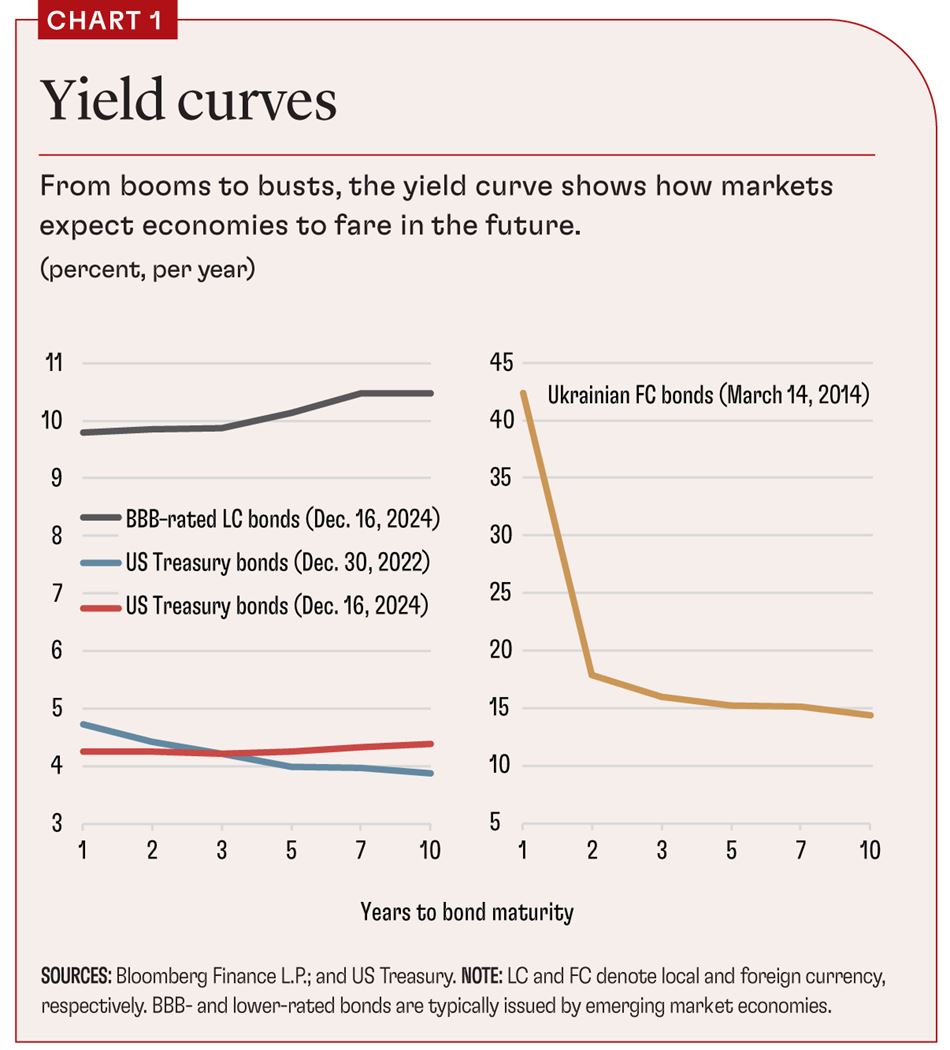

Chart 1 plots bonds’ maturities on the horizontal axis and their corresponding market yields at a given time on the vertical axis. These yield curves tell us many things—the most important is whether markets expect the economy to strengthen or weaken.

Let’s assume markets expect economic growth to accelerate. This means future inflation will likely be higher than present inflation: As the economy heats up, demand for goods and services will pick up and eventually feed into prices. The lure of alternative investments, such as commodities or property, will also rise as economic activity strengthens. Both these factors mean investors will demand a higher yield on a longer-term than on a shorter-term government bond. In other words, the yield curve will slope upward—as was the case for the US on December 16, 2024 (see red line).

Are yield curves always upward-sloping? No. When US inflation spiked following the COVID-19 pandemic, the Federal Reserve hiked interest rates. Because higher interest rates typically dampen household consumption and business investment, the hike fueled expectations of an economic slowdown, weaker inflation, and lower economic returns. Reflecting these market expectations, the government yield curve began to invert, or slope downward (see blue line). An inverted yield curve is often seen as a recession predictor, and, until recently, inversions preceded every US economic contraction for the past half century.

Country risk premium

Do yield curves of government bonds in emerging markets and low-income countries convey the same information as those of advanced economies? Yes, but with a greater focus on country risk premium. Major advanced economies are diversified, and their institutions are strong. Their sovereign bonds are generally considered safe because investors are almost certain the government will pay them back. The same cannot be said for all developing economies, which typically have weaker institutions and are more prone to shocks that can lead to large currency depreciations, rapid inflation, and loss of access to market funding.

Some developing economy governments—especially those with lots of foreign-currency debt—must sometimes restructure their debt (change their bonds’ repayment profile, yield, or both). This default risk, or country risk premium, means their bond yields are generally higher than those for advanced economies across all maturities. This difference in bond yields, or spread, is an important indicator of sovereign credit risk (see dark gray line).

When country risk reaches a point where markets see debt restructuring as imminent, the yield on bonds with short residual maturities typically spikes, producing a sharply inverted yield curve. In early 2014, for instance, nobody knew that Ukraine would restructure its sovereign bonds within a year. But the March 2014 inverted yield curve showed that investors were already pricing in a debt event. Because such operations involve a bigger extension of the residual maturity of bonds falling due sooner (in 2015, say) than those due later (2018), investors demanded a higher yield on the former than the latter (see yellow line).

Developing bond markets

Many developing economies are working to develop the market for local-currency government bonds to reduce reliance on foreign-currency borrowing, which carries exchange rate risk. Putting in place the requirements for such a market—sound debt management, robust laws, regulations and market infrastructure, and a diversified domestic investor base—can take time, but the rewards are substantial.

The IMF, together with the World Bank, provides active guidance to governments in this area. It’s encouraging that many developing economies, notably in Asia and Latin America, have made progress on this front in recent decades.

A yield curve in a well-functioning government bond market not only tells us something about the economy’s outlook, but is also a benchmark for pricing other financial assets, such as long-term bank loans, corporate bonds, and mortgages. It facilitates more efficient allocation of resources and thus supports long-term economic growth.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.