A study of 100 inflation shocks since the 1970s provides valuable pointers for policymakers today

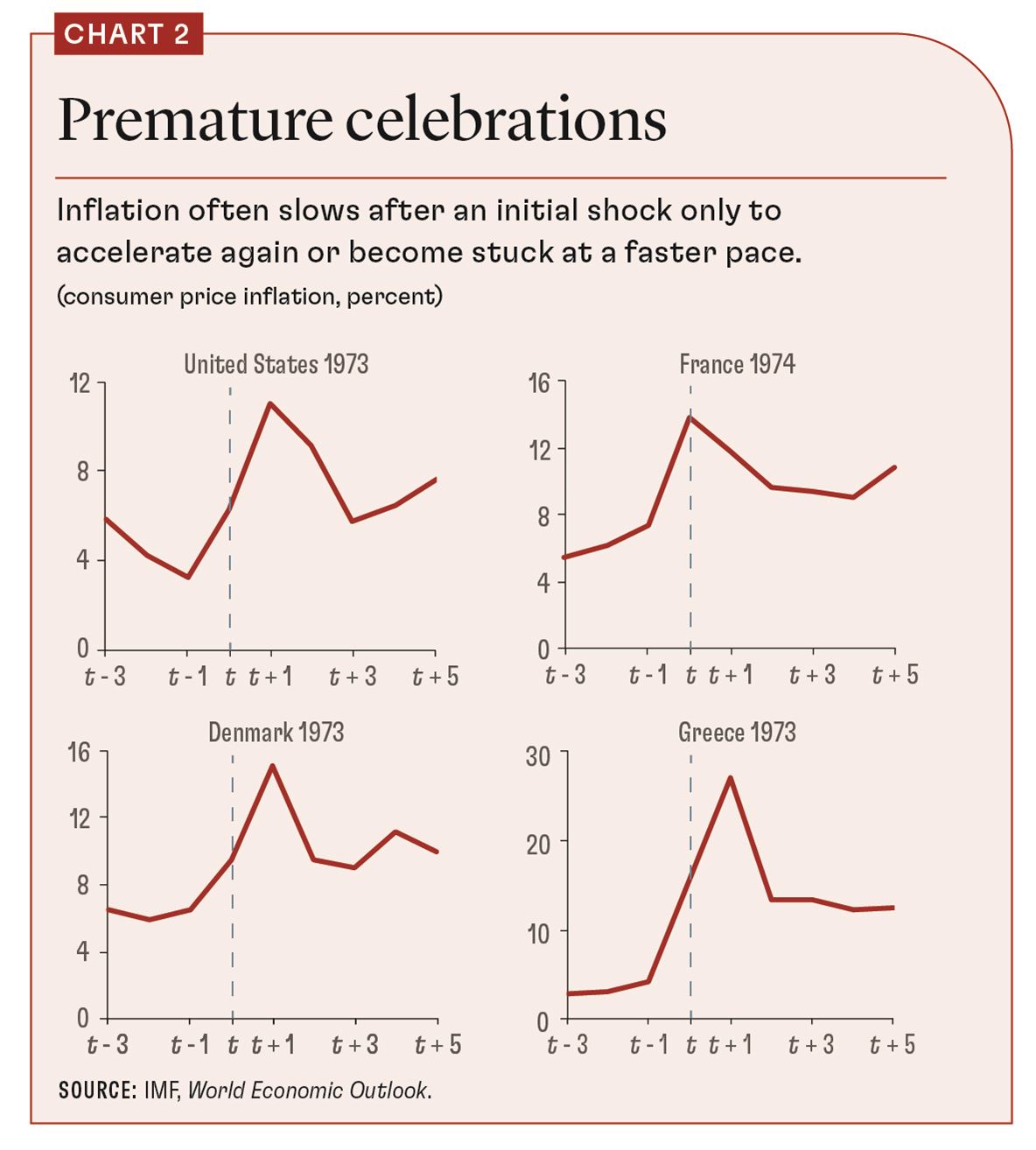

In the early 1970s, conflict in the Middle East set off a spike in oil prices that left central banks around the world scrambling to control inflation. After a year or so, oil prices stabilized and inflation started to retreat. Many countries believed they had restored price stability and loosened policy to revive their recession-hit economies only to see inflation return. Could history repeat?

World inflation reached historic highs in 2022 after Russia’s invasion of Ukraine triggered a terms-of-trade shock akin to that of the 1970s. Disruptions to Russian oil and gas supplies added to COVID supply-chain problems to drive prices higher. In advanced economies, prices rose at the fastest pace since 1984. In emerging market and developing economies, the price increase was the largest since the 1990s.

Aided by the sharpest rise in interest rates in a generation, inflation has started to subside at last. Headline inflation in the United States and across much of Europe has halved from about 10 percent last year to less than 5 percent today. The latest conflict in the Middle East has, for now at least, not had a large impact on oil prices. But it is still too soon for policymakers to celebrate victory over inflation.

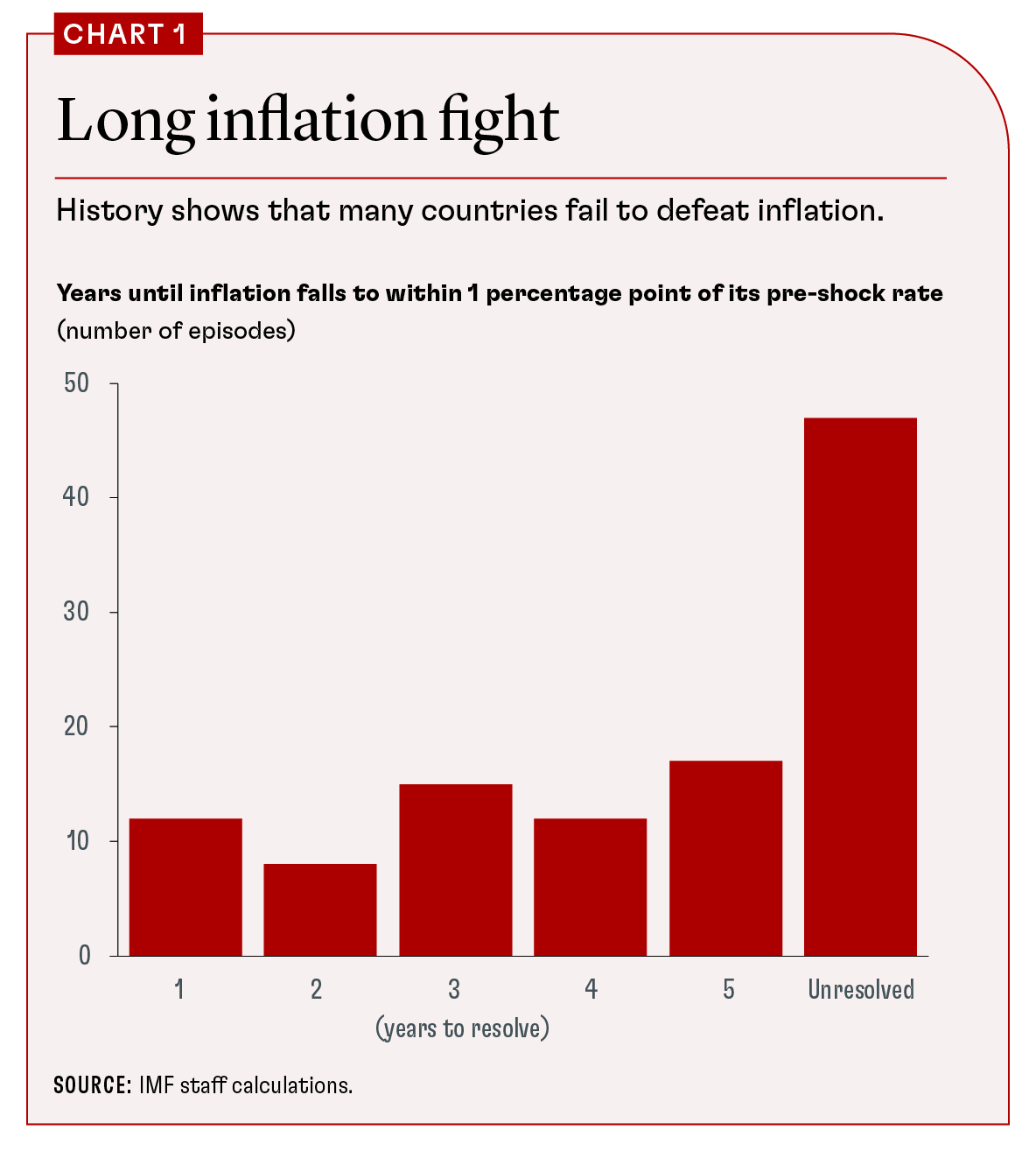

Our recent study of over 100 inflation shocks since the 1970s offers two reasons for caution. First, history teaches us that inflation is persistent. It takes years to “resolve” inflation by reducing it to the rate that prevailed before the initial shock. Forty percent of countries in our study failed to resolve inflation shocks even after five years. It took the remaining 60 percent an average of three years to return inflation to pre-shock rates (Chart 1).

Second, countries have historically celebrated victory over inflation and loosened policy prematurely in response to an initial decline in price pressures. This was a mistake because inflation soon returned. Denmark, France, Greece, and the United States were among nearly 30 countries in our sample to loosen policy prematurely after the 1973 oil-price shock (Chart 2). In fact, almost all countries in our analysis (90 percent) that failed to resolve inflation saw price growth slow sharply in the first few years after an initial shock, only to accelerate again or become stuck at a faster pace.

Today’s policymakers must not repeat their predecessors’ mistakes. Central bankers are right to warn that the inflation fight is far from over, even as recent readings show a welcome moderation in price pressures.

Consistency and credibility

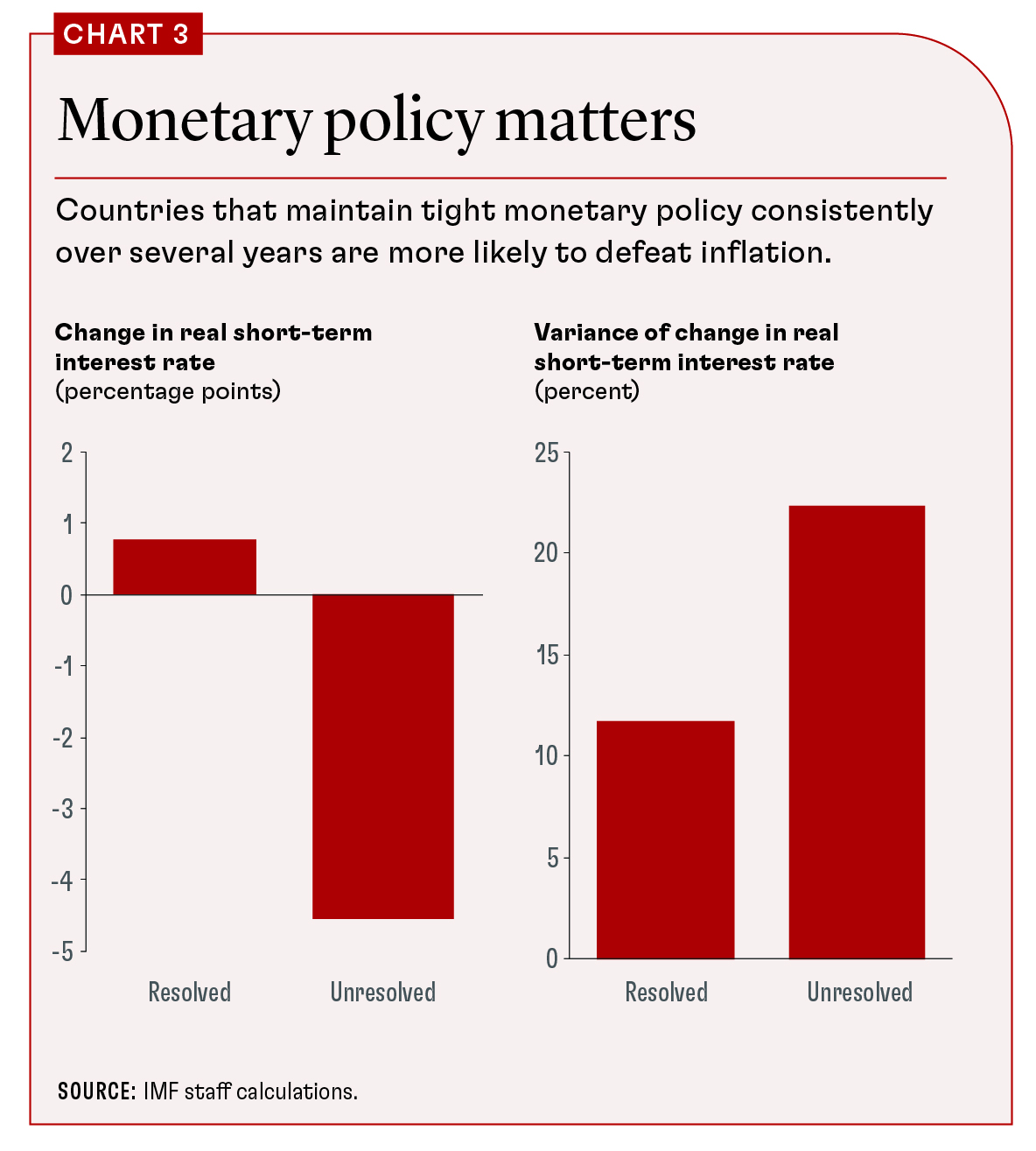

How should policymakers respond to persistent inflation? Again, history provides some lessons. The countries in our study that successfully resolved inflation tightened macroeconomic policies more in response to the inflation shock and, crucially, maintained a tight policy stance consistently over a period of several years. Examples here include Italy and Japan, which adopted tighter-for-longer policies after the 1979 oil-price shock. By contrast, countries that did not resolve inflation had looser policy stances and were more likely to change between tightening and loosening cycle (Chart 3).

Policy credibility matters, too. Countries where inflation expectations were more firmly anchored, or where central banks had more success maintaining low and stable inflation in the past, were more likely to defeat inflation.

Today’s policymakers can take some solace from this finding. Central bankers in many countries may find it easier to defeat inflation this time because of the policy credibility they have built up over several decades of successful macroeconomic management. With the right policies in place, countries could resolve inflationary pressures sooner than in the past.

But it won’t be easy. Conditions in the labor market in particular require close attention. In many countries, workers’ wages have fallen in real inflation-adjusted terms and may need to rise again to catch up with higher prices. Yet wage growth could fuel inflation if it is too high and could lead to pernicious wage-price spirals.

Historically, countries that resolved inflation successfully tended to have lower nominal wage growth. Importantly, this did not translate into lower real wages and a loss of purchasing power, because lower nominal wage growth was accompanied by lower price growth. The implication for policymakers here is to remain focused on real wages, not nominal wages, when responding to developments in the labor market.

Countries that resolved inflation successfully were also better at maintaining external stability. Free-floating currencies were less likely to depreciate sharply, and currency pegs were more likely to survive. This is not a call for currency intervention. Instead, it appears that countries’ success in fighting inflation—through tighter monetary policy and greater policy credibility—was instrumental in shoring up exchange rates.

The ultimate prize

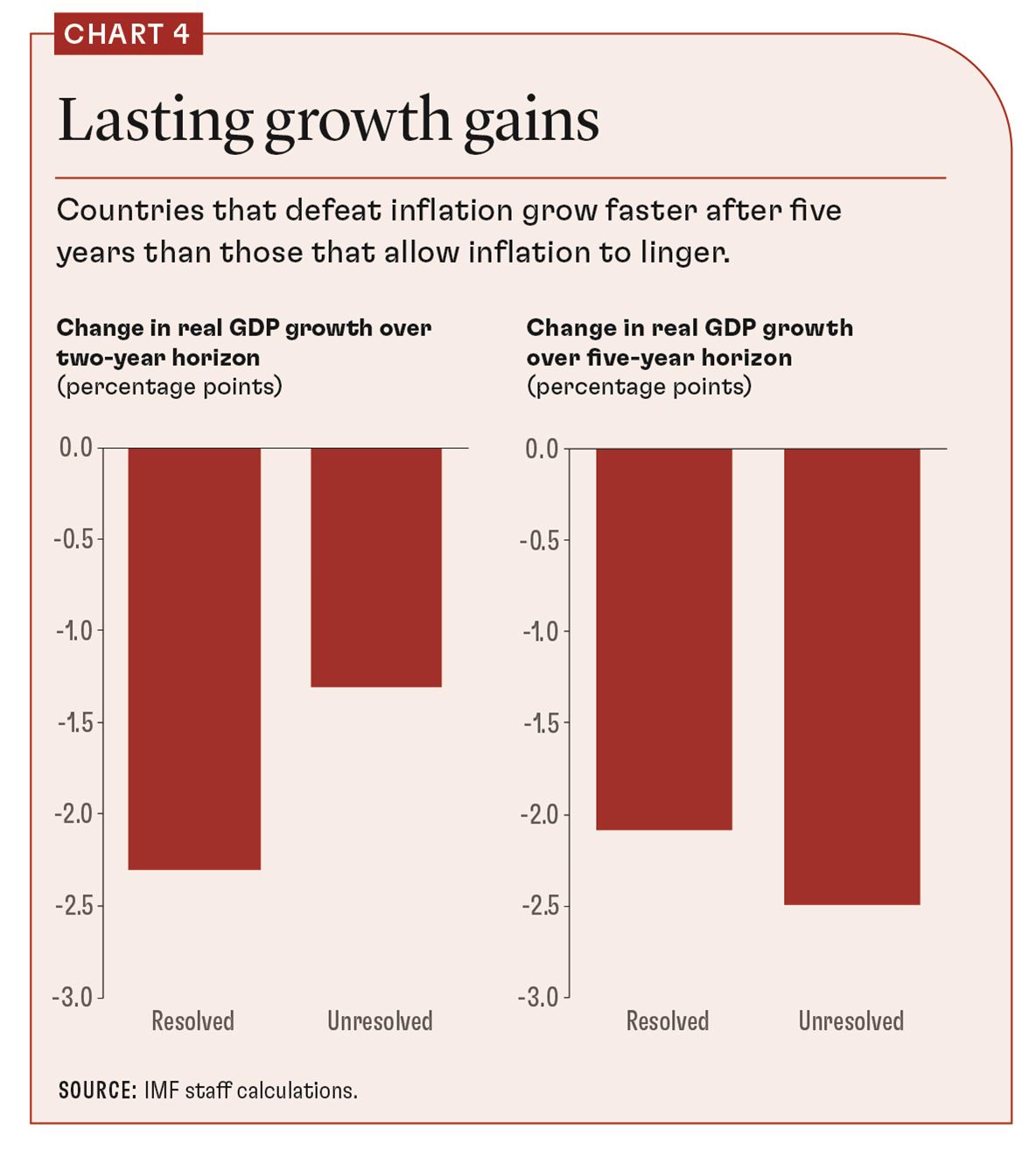

Fighting inflation is difficult. But it is important to recognize the benefits of price stability. Historically, countries that resolved inflation had lower economic growth in the short term than those that did not. But this relationship reversed over the medium and long term. Five years after the inflation shock, countries that resolved inflation had higher growth and lower unemployment than economies that allowed inflation to linger.

The economics behind this finding are intuitive. There is a trade-off between bringing inflation down on one hand and achieving higher growth and lower unemployment on the other. But this trade-off is temporary: growth recovers and jobs are created once inflation is brought under control.

By contrast, leaving inflation unresolved comes with its own costs of macroeconomic instability and inefficiency. These costs accumulate for as long as inflation remains high. Consequently, cumulative welfare losses from unresolved or permanently high inflation dominate over the medium to long term (Chart 4). Countries that allow inflation to linger ultimately pay a higher price.

Central bankers are on the front line of the fight against inflation and should pay the most attention to these lessons. But governments must not make the task of monetary authorities harder by adding to price pressures with loose fiscal policy. To make fiscal support during a cost-of-living crisis less inflationary, governments should target relief to the most vulnerable, where it will alleviate suffering most.

The past is never a perfect guide to the present, because no two crises are precisely alike. All the same, history offers clear lessons to policymakers today. Fighting inflation is a marathon, not a sprint. Policymakers must persevere, demonstrate policy credibility and consistency, and keep their eyes on the prize: macroeconomic stability and stronger growth brought about by returning inflation firmly to target. If history is a guide, inflation’s recent decline could be transitory. Policymakers would be wise not to celebrate too soon.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.

This article draws on IMF Working Paper 2023/190, “One Hundred Inflation Shocks: Seven Stylized Facts,” by Anil Ari, Carlos Mulas-Granados, Victor Mylonas, Lev Ratnovski, and Wei Zhao.