The world has gone from plentiful cheap energy to scarcity, amid low investment and war

The last decade seemed to herald an era of energy abundance, with fast growing hydrocarbon and renewable energy production. Now this seems a distant memory, especially in Europe.

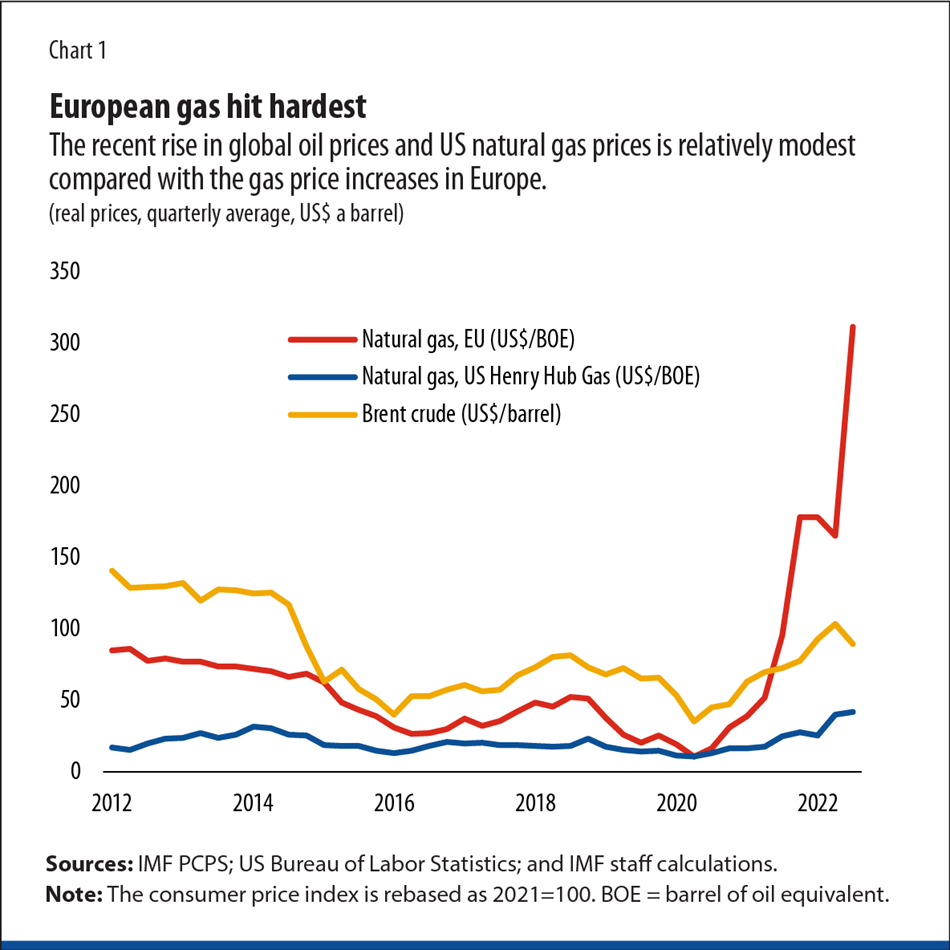

European gas prices have reached unprecedented levels in the third quarter of 2022, increasing roughly 14-fold from the third quarter of 2019 (see Chart 1). At the same time, US gas prices have tripled and global oil prices have increased by about 40 percent.

Even though prices have moderated a bit since the third quarter of 2022, high energy prices are one of the major drivers of high inflation and a major drag on economic growth around the world.

How did the world go so swiftly from a period of cheap energy to today’s unfolding energy crisis? How vulnerable were energy markets before the war in Ukraine shook them up? And why was natural gas hit so much harder than oil?

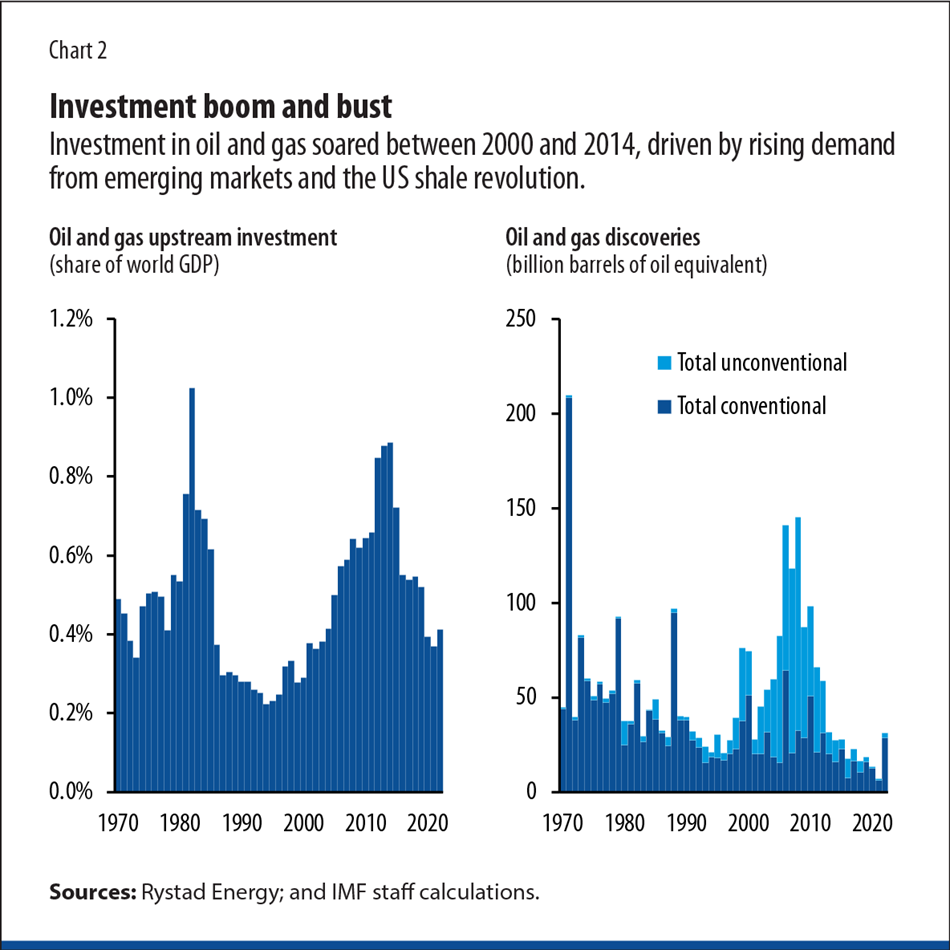

Beginning around the turn of the century, the world saw a surge in oil and gas investment, peaking in 2014 (see Chart 2). The investment boom was driven by high prices (following buoyant demand from emerging markets) and the U.S. shale oil and gas revolution following technological innovation in fracking unconventional deposits. It was transformative. The United States became a net exporter of hydrocarbons, roughly doubling its oil and gas production within a decade. But booms sow the seeds of their busts. In this case, the boom in US oil production and OPEC’s decision to defend its market share by increasing production led to a collapse in energy prices in 2014. As a result, global oil and gas investment was cut drastically.

What could have been a typical boom-bust cycle interacted with the clean energy transition, with two implications. First, producers slashed investment and started to divest from fossil fuels at a fast pace. At the same time, however, investment in renewable energy lagged the United Nations’ target of net zero emissions by 2050 by about $1 trillion a year, according to the International Energy Agency (IEA). Together, these trends led to a shortfall in total global energy investment.

Second, as electrification rates rose, many economies increased their dependence on natural gas as a buffer against interruptions in renewable (wind, hydro, solar) energy production and to replace coal-fired power plants. The global share of gas in total primary energy production rose, from 16 percent in 2010 to 22 percent in 2021. In OECD countries, the share of gas in power generation increased from 23 percent to 30 percent during the same period, according to the IEA.

War in Ukraine

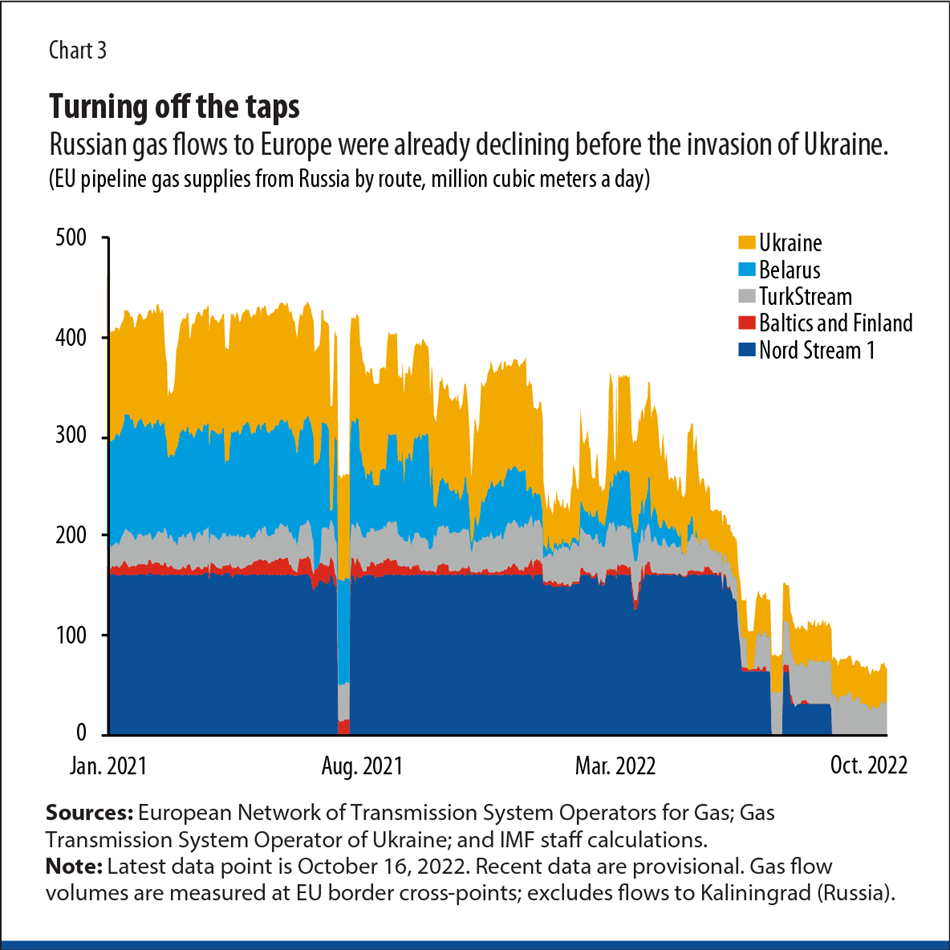

In 2021, before Russia’s invasion of Ukraine, these trends coincided with a cold winter and weather-driven low power generation from renewables in Europe and Brazil. Gas markets were already imbalanced since global gas consumption had rebounded faster than expected after the pandemic. What’s more, Russia, which usually supplied one-third of European gas consumption, reduced its gas flows to Europe starting in mid-2021 before the start of the war (Chart 3, next page). Gazprom, the Russian energy corporation, decided not to fill up its central European storage facilities. European gas prices and Asian gas prices, which generally move together because of the global liquefied natural gas (LNG) market, increased almost sevenfold to $33 per million British thermal units in the fourth quarter of 2021 from $4.90 in the fourth quarter of 2019. In contrast, oil prices stood at $78 per barrel in the fourth quarter of 2021, only $18 higher than eight quarters earlier. Coal more than doubled to $182 a ton from $73 over the same period.

When the reverberations of the war in Ukraine hit, natural gas markets were already under severe stress, whereas oil markets were relatively balanced. Since the start of the war, the divergence between gas and oil prices has grown further. After six months of war, European gas prices in the third quarter of 2022 had climbed another 75 percent; oil prices were up only 15 percent since the invasion.

Why have gas and oil prices reacted so differently to the shocks from Russia? The answer lies in the differing structures of the two markets and the underlying shocks.

Fragmented gas markets

Natural gas markets are globally fragmented because they rely mostly on pipeline infrastructure that prevents arbitrage across regions. Currently, only a quarter of global gas markets are integrated. European pipeline gas markets are connected to the market for LNG through gas liquefaction and re-gasification terminals. These terminals allow the transportation of gas across continents using tankers, connecting European gas consumers to consumers in other LNG-importing countries around the world, mostly in east Asia.

Russia does not have sufficient pipelines or gas liquefaction terminals to reroute a large fraction of its European gas pipeline exports to elsewhere. That’s why the decline in Russian gas flows is a true supply shock. It is equivalent to about 17 percent of European gas consumption and non-European LNG imports combined evaporating off the market.

Rerouting LNG from Asia and Europe has helped to buffer the supply shock, gas consumption in the EU has declined, and supply from Algeria, Azerbaijan, and Norway has increased somewhat as well. To incentivize such market adjustments, gas prices need to increase by several times as demand and supply elasticities are low. Government policies that shield consumers by distorting price signals, e.g., price subsidies, are therefore not helpful. If market forces are not allowed to induce adjustment, rationing becomes the only option, which is far more damaging to the economy. Governments can still protect vulnerable households through lump sum payments and other mechanisms but should keep price signals working.

Integrated oil markets

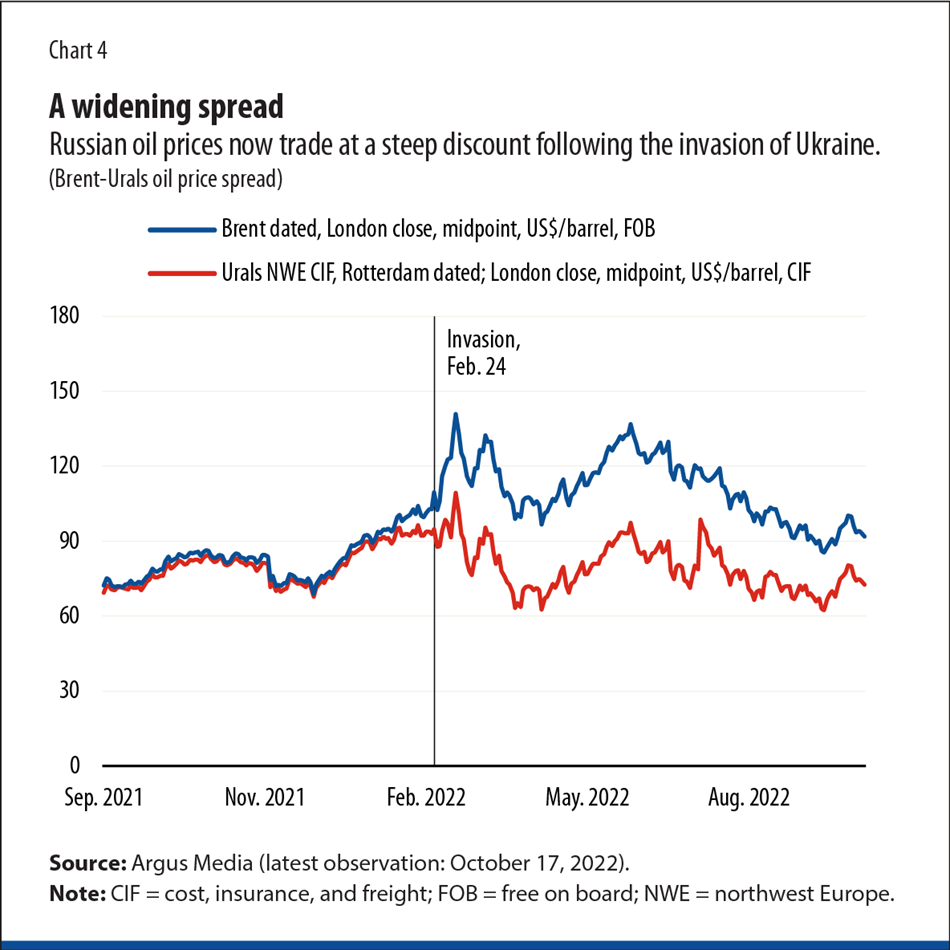

In contrast to gas markets, global integration provides a buffer against shocks to the oil market. Transportation and processing infrastructure allow for arbitrage across borders. As a result, even though shocks to the oil market still have a strong impact on prices, the impact is more temporary than for natural gas prices. Supply and demand price elasticities are higher since they can adjust at a larger scale.

Moreover, unlike gas markets the oil market has not experienced a physical shock to supply due to the war. Russian oil exports have been steady in 2022. Sanctions and Western companies reducing business with Russia caused dislocations in oil markets. These were in part absorbed by a widening spread between Brent oil and Russian oil prices. Brent prices rose while Russian oil sold at a discount (Chart 4). This creates an incentive to reroute Russian oil to India, China, and elsewhere. Unlike for gas, there are strategic oil reserves that were released to tame higher prices. In addition, the slowdown of economic activity in China and around the world exerts downward pressure on oil prices.

Fallout for electricity markets

As the war in Ukraine hits natural gas markets harder than oil markets, the fallout for European electricity markets is substantial. Wholesale electricity prices move in tandem with gas prices in Europe because electricity prices are determined by the highest marginal cost of production (as in any competitive market) and gas-powered plants are currently the highest-cost producers. As a result, electricity prices have been extremely volatile and recently peaked at seven times what they were in early 2021, even in countries such as Spain and Portugal, where the share of natural gas in power generation is relatively small compared with renewables.

The shock to electricity prices is being felt across Europe, but not in the same way in every country. Though Europe has integrated gas and electricity markets with considerable cross-border trade, there are infrastructure bottlenecks, differences in the mix of sources of power generation and diverging policies regarding subsidies or price caps. These factors have caused a large divergence in wholesale energy prices.

It is hard to know what events will hit the energy markets in the coming months amid the war and a weakening global economy. At the same time, a comparison between natural gas and electricity markets on one side and oil markets on the other shows the risks of fragmentation and the benefits that more integrated markets offer to buffer supply and demand shocks. Governments should foster the integration of global natural gas as well as regional electricity markets. In addition to support for renewables, they should assist in the building of gas liquefaction and trade infrastructure as well as denser electricity transmission networks. Doing so in an expedited way will help replace Russian energy supplies and deal with the intermittence of renewable energy.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.