Governments risk worsening the energy crisis by seeking to suppress price rises—there are better options

As Europe approaches the cold winter months, governments face difficult policy choices as they seek to protect consumers from soaring energy bills in an environment of generally high inflation. Wholesale prices for natural gas were on average seven-and-a-half times higher in the summer of 2022 than they were in early 2021. Even though they have since fallen from their highs at the end of the summer, they remain well above their early 2021 levels and could rise again ahead of the 2023–24 winter. There have been steep rises in the cost of coal and crude oil, too.

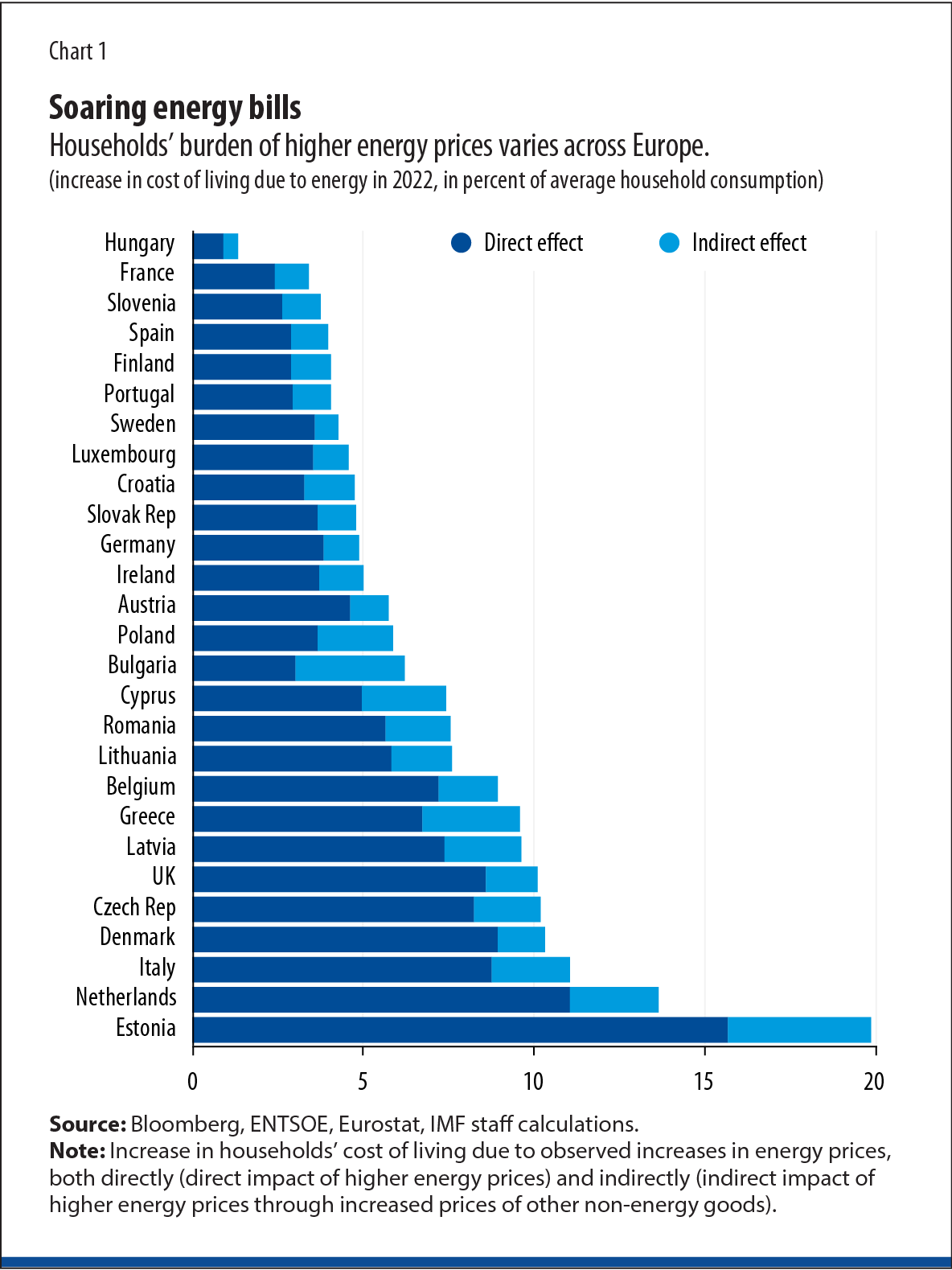

In recent work, we estimate that high energy prices have raised the cost of living for the average European household by about 7 percent this year relative to early 2021—adding to inflationary pressures from disruptions to food shipments and supply chains (see Chart 1). The energy price shock—and the implied loss of national income for energy importers—is persistent: futures contracts suggest prices will stay above pre-invasion levels for the foreseeable future. Governments should focus on softening the impact of the price surge on the more vulnerable households—some of which face a choice between heating or eating this winter—while allowing the rest of the economy to learn to live with higher prices, including by becoming more energy efficient.

Efforts to suppress energy price increases and to provide broad-based support could actually make matters worse. Imagine that all countries in Europe have sufficient fiscal space to allow only a small portion of the current increase in wholesale gas prices to pass through to retail prices. What would happen then? European consumers would reduce their consumption only marginally, and since the supply of gas is limited, global gas prices would rise further, increasing fiscal costs and reducing the effectiveness of government efforts to protect consumers at home. Moreover, non-European countries would then have to contend with even higher prices. In short, Europe’s price suppression would result in even higher gas prices and hardship internationally, while domestic consumers would not be significantly better-off.

Europe’s response so far

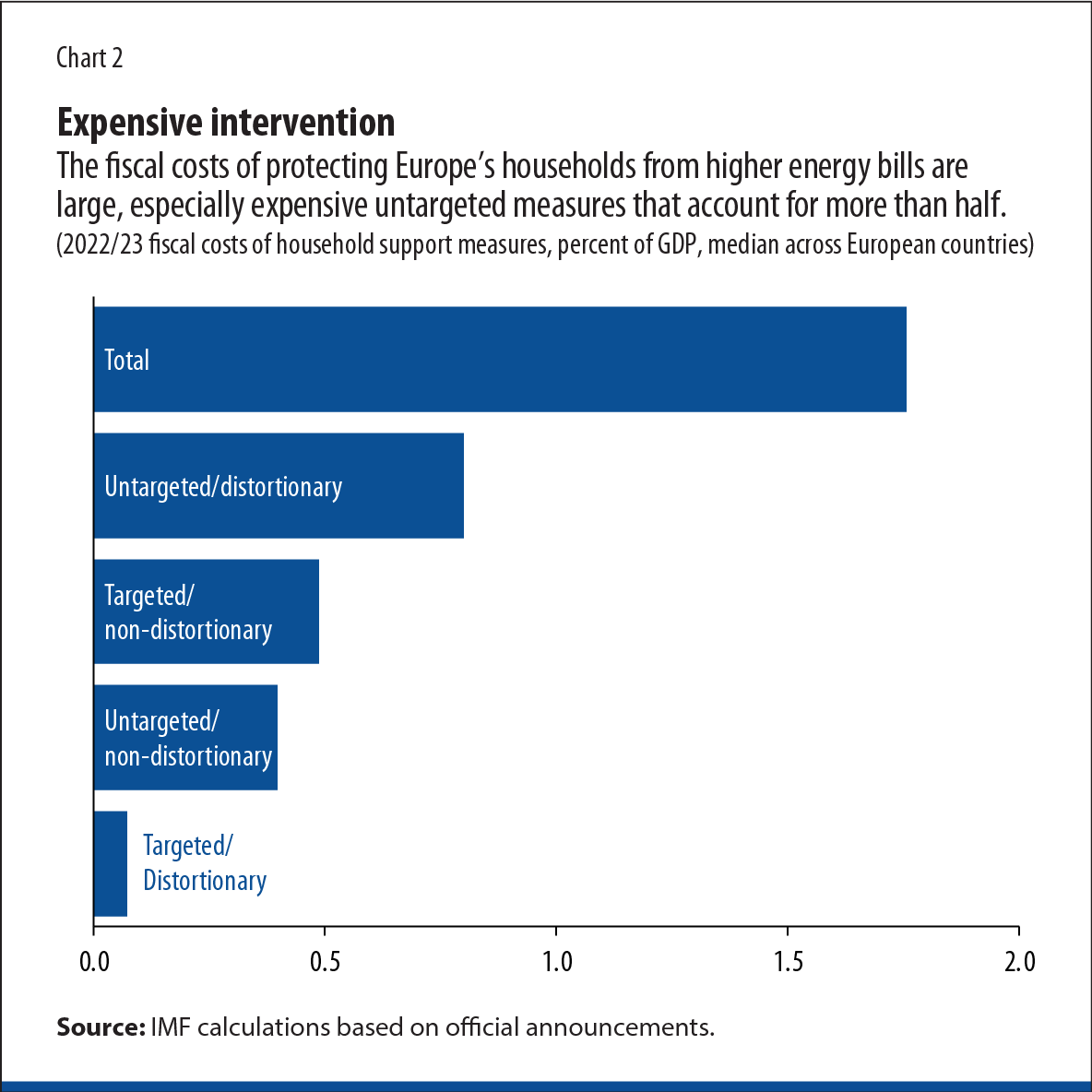

European governments have up to now used a wide range of policies to lessen the effects of high energy prices, including various forms of price suppression. In some countries the fiscal cost of the energy crisis response is set to exceed 1.5 percent of GDP in the first year alone—with more than half of that in costly non-targeted measures (see Chart 2).

Measures that mute price signals, such as capping retail energy prices or reducing fees, charges, and taxes have been adopted in nearly all countries (including Austria, Italy, France, Germany, Portugal, Spain, and the United Kingdom). Most measures were meant to be temporary, but they have already been extended, expanded, or both in many places.

Some countries have also adopted blanket measures that benefit both low- and high-income households, including fuel subsidies and energy vouchers for all. Countries with a history of highly regulated retail tariffs, such as Hungary and Malta, have continued to allow very little or no pass-through to consumers. This keeps demand for energy higher than it should be at a time of scarcity and when energy is also becoming increasingly costly.

Last but not least, relief to households to cover surging energy costs adds to overall demand for goods and services, complicating the fight against inflation. Broad-based price-suppressing schemes and other forms of untargeted support provided to all households tend to add more to aggregate demand than measures that are more targeted.

Rather than seeking to suppress the pass-through from wholesale to retail prices through price caps, rebates, tax reductions, and the like, governments should ideally let price signals operate and provide lump-sum transfers to vulnerable households. The IMF staff estimates that it would cost 0.9 percent of GDP in 2022 and 1.2 percent in 2023 to fully compensate the bottom 40 percent of Europe’s households for the surge in the price of energy since early 2021—that’s about half the average cost of Europe’s current policies. Support to households should ideally be designed so that benefits taper off gradually at higher income levels.

Second-best options

This first-best policy response may be hard to implement rapidly in practice. In many countries, income transfers can be extended quickly only to households already receiving social benefits. But given the extent of the recent price surge, some low- and lower-middle-income households that are outside safety nets may also need support.

To help them, governments could send bank transfers or checks based on income tax information or encourage households to sign up for support and provide the required income information. Data privacy laws and capacity constraints mean that these approaches aren’t feasible in many countries. An alternative, requiring minimal paperwork, is to give all households a lump-sum rebate on their energy bill (or a lump-sum check unrelated to the energy bill since the former may be perceived as a consumption subsidy). Additional transfers would go to the poorest through the welfare system, while support to higher-income households would be reclaimed through the tax system.

Another option that still preserves some price signals is “block pricing”: charging consumers a discounted price for energy up to a subsistence level and the market price for energy they consume above that level. Subsistence consumption could be set at the same level for all households, or it could differ across households and be set at a fraction of each household’s recent consumption (as a proxy for household size). These approaches don’t differentiate support by household income level. They should therefore be complemented with actions to raise additional tax revenues in a progressive manner so as to claw back support to higher-income households.

Some countries have implemented specific measures (among a mix of relief programs) that do not interfere with price signals. Examples include progressive or uniform lump-sum transfers (Cyprus and Germany, respectively); lump-sum transfers to lower-income households that are neither covered by a “minimum vital income” benefit nor receiving a pension (Spain); lump-sum rebates on energy bills with a clawback through the tax system for those with higher incomes (Belgium, Germany); and expansion of existing lump-sum social assistance programs to more households (Belgium, Germany, Luxembourg). Block pricing has been implemented or announced in several countries.

Governments could also pay users to reduce energy consumption or shift it to times of the day when there is a greater supply of renewable energy and less reliance on gas. This could be done through auctions to reduce total consumption or consumption during peak hours. If auctions are held on a large scale at the European level (where electricity markets tend to be interconnected, albeit imperfectly), they could result in substantial benefits by reducing overall demand and thus lowering global energy prices. Germany is considering auctions for energy savings by firms, for example.

In sum, with energy prices projected to remain higher than prewar levels for some time, Europe’s policy emphasis must shift rapidly from price-suppressing measures to income relief targeted to the vulnerable. Measures must provide strong incentives to save energy and switch out of fossil fuels while also containing the fiscal costs. Given the scale of the shock, some households that do not currently receive welfare benefits may also need support.

While some countries may struggle to implement the first-best policy of letting price signals operate and providing targeted transfers to vulnerable households, there are reasonable practical second-best options, including uniform lump-sum transfers or subsidies for subsistence-level consumption through block pricing, which can be clawed back from the better-off through taxes. Given the high-inflation environment, relief should be provided within a non-expansionary fiscal stance so as not to add to aggregate demand. In the longer run, increasing the supply of non-fossil-fuel energy sources is the most reliable way to bring energy prices down and ensure energy security. Maintaining clear price signals will help with that transition.

This article draws on an update of IMF Working Paper 2022/152 (“Surging Energy Prices in Europe in the Aftermath of the War: How to Support the Vulnerable and Speed up the Transition away from Fossil Fuels”).

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.