Middle East and Central Asia

Regional Economic Outlook: Middle East and Central Asia

October 2020

Countries in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region and those in the Caucasus and Central Asia (CCA) responded to the COVID-19 pandemic with swift and stringent measures to mitigate its spread and impact but continue to face an uncertain and difficult environment. Oil exporters were particularly hard hit by a “double-whammy” of the economic impact of lockdowns and the resulting sharp decline in oil demand and prices. Containing the health crisis, cushioning income losses, and expanding social spending remain immediate priorities. However, governments must also begin to lay the groundwork for recovery and rebuilding stronger, including by addressing legacies from the crisis and strengthening inclusion.

Regional Developments and Outlook

The coronavirus disease (COVID-19) pandemic continues to sweep across the region, though countries are cautiously proceeding with reopening. The necessary public health response to the pandemic has greatly decreased mobility and has come at a steep economic cost. As a result, real GDP in the region is projected to fall by 4.1 percent in 2020. This contraction is 1.3 percentage points larger than projected in April 2020. With global recovery subdued, downside risks continue to dominate the outlook as the pandemic continues to test countries. Ensuring adequate resources for health systems and correctly targeting support programs are still immediate priorities. In the near future, governments and policymakers need to continue to act decisively to secure jobs, provide liquidity to businesses and households, protect the poor, and put in place a carefully designed economic road map to recovery. Further actions will be necessary to address pressing vulnerabilities in countries with limited fiscal space to ensure a smooth recovery while maintaining macroeconomic sustainability.Addressing Economic Scarring from the Crisis

The coronavirus disease (COVID-19) pandemic may inflict a deeper and more persistent economic impact than previous recessions in the Middle East and Central Asia (MCD) region did, as the unique characteristics of a global pandemic shock collided with long-standing vulnerabilities in the region. In particular, the region’s large exposure in the hard-hit services sector (including tourism), strained corporate balance sheets, low ability to work from home, and dependence on remittances will weigh heavily on recovery prospects. Real GDP in the region could remain below precrisis trends for a decade. As the pandemic continues, policymakers must carefully balance preserving livelihoods, minimizing scarring, and promoting recovery, without hampering necessary reallocation. In the medium term, it will be key to rebuild buffers to guard against future shocks.

Fiscal Challenges from the Pandemic

The coronavirus disease (COVID-19) pandemic has required a substantial fiscal response from all countries, resulting in the largest synchronous fiscal easing in oil importers and a significant one in oil exporters. Nonetheless, the size of fiscal measures is slightly below that of other emerging market and developing economies, reflecting already-strong health and welfare systems in some economies and limited fiscal space in others. While the emergency measures have been critically important, these, along with significant declines in revenues, will increase financing needs for the region. Higher debt and deficits will erode fiscal space, leaving the region vulnerable to a resurgence of the virus and, for some countries, resulting in unsustainable debt dynamics. These adverse impacts are somewhat mitigated by lower borrowing costs, reflecting the large monetary easing in major advanced economies and increased official financing. Nevertheless, even with ambitious baseline fiscal adjustments, albeit not unprecedented, countries are not expected to revert to their pre-pandemic debt levels. In response to the increased fiscal vulnerabilities, governments should mitigate fiscal risks by developing medium-term fiscal frameworks, adopting fiscal rules, and strengthening debt management. At the same time, they must seek to expand fiscal space by, for example, enhancing tax compliance, increasing the progressivity of tax systems, and raising expenditure efficiency, including through improving governance and gradually eliminating fuel subsidies. Meanwhile, policymakers must also seek to support an inclusive recovery by enhancing social safety nets and prioritizing spending on health, education, and job retraining.Financial Stability Considerations amid the Pandemic

Banks in the Middle East and Central Asia (MCD) region began the year in a generally strong position, but the unprecedented crisis caused by the coronavirus disease (COVID-19) pandemic could trigger significant increases in defaults and nonperforming loans (NPLs). The results from a streamlined stress-testing exercise show that the potential costs from asset impairment for countries in the region could reach $190 billion. In this exercise, the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region is hit particularly hard—oil exporters face the largest losses while bank capital in several oil importers falls below regulatory minimum requirements. Banking systems in the Caucasus and Central Asia (CCA) are more resilient due to higher starting capital and low private sector credit. So far, supportive financial sector policies have helped prevent some short-term financial risks from materializing, including some of the worst-case outcomes highlighted by the stress test, and helped ease the provision of credit. Going forward, authorities should carefully balance the sustained provision of credit and the preservation of financial stability. As the pandemic subsides, efforts should focus on removing regulatory easing, strengthening supervision, and continuing to improve financial inclusion—including for small and medium-sized enterprises (SMEs)—to boost inclusive growth.Statistical Appendix

Statistical Appendix | Excel data

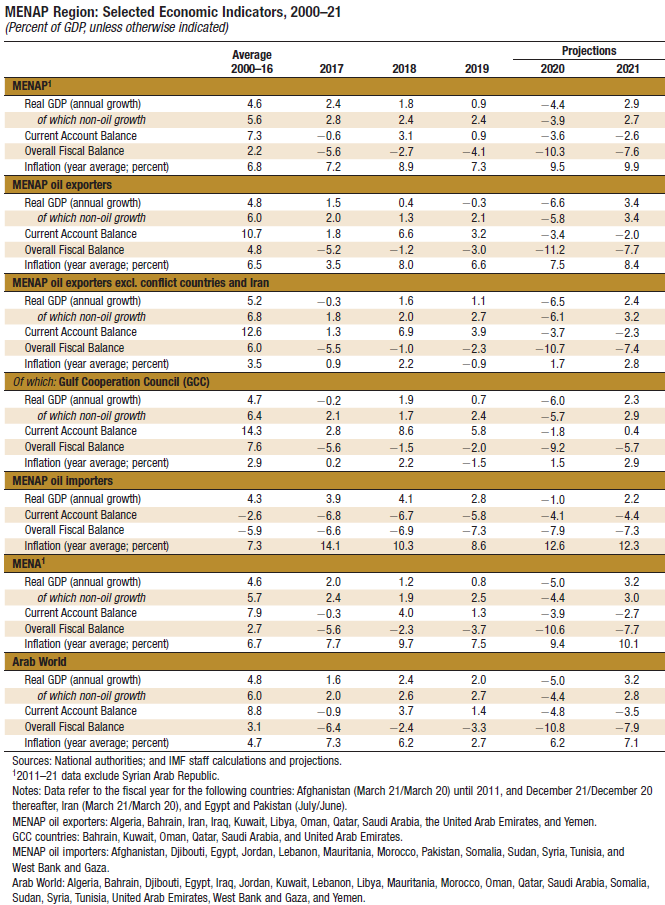

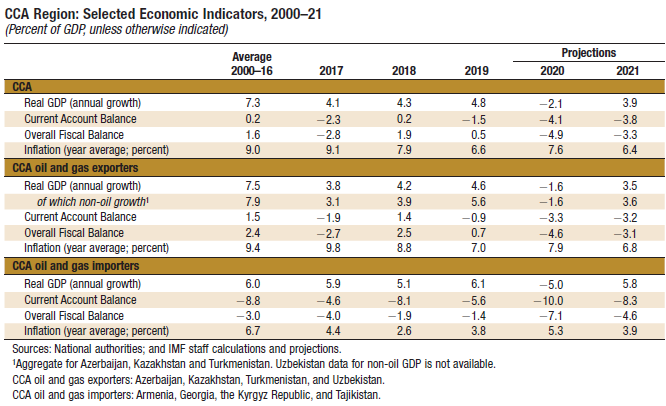

The following statistical appendix tables contain data for 31 MCD countries. Data revisions reflect changes in methodology and/or revisions provided by country authorities. A number of assumptions have been adopted for the projections presented in the Regional Economic Outlook Update: Middle East and Central Asia. It has been assumed that established policies of national authorities will be maintained, that the price of oil1 will average US$41.69 a barrel in 2020 and US$46.70 a barrel in 2021, and that the six-month London interbank offered rate (LIBOR) on U.S.-dollar deposits will average 0.74 percent in 2020 and 0.41 percent in 2021. These are, of course, working hypotheses rather than forecasts, and the uncertainties surrounding them add to the margin of error that would in any event be involved in the projections. The 2020 and 2021 data in the tables are projections. These projections are based on statistical information available through late September 2020.