Market in São Paulo, Brazil. Locals are feeling the pinch of surging prices. (Photo: iStock/Fernando Podolski)

Latin America Hit By One Inflationary Shock On Top of Another

April 15, 2022

Related Links

After years of fluctuating around targets, inflation in Latin America’s largest economies is the highest it’s been in 15 years, having suffered two major shocks: the impact of the pandemic, and of the Russia-Ukraine war.

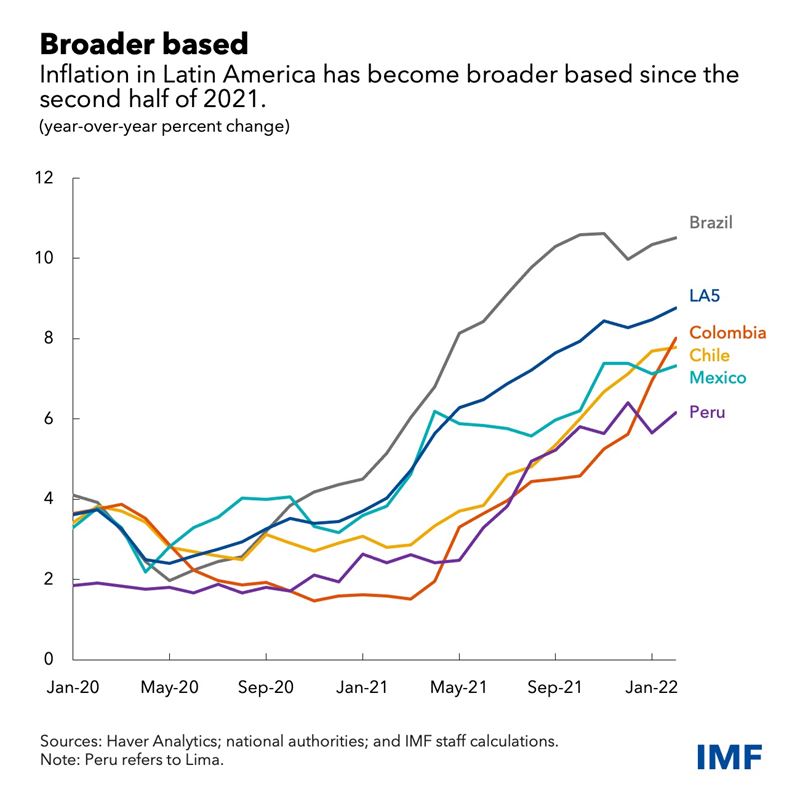

As in other emerging markets and advanced economies, inflation accelerated in Brazil, Chile, Colombia, Mexico, and Peru—the LA5—in 2021. The increase in inflation was initially driven by surging food and energy prices but became broader, reflecting monetary policy inertia and wage indexation practices (contracts that adjust their terms automatically with inflation), as well as a strong recovery in demand, initially for goods but later for services too.

The war in Ukraine is yet another inflationary shock to the region. Our estimates suggest that a 10 percentage points increase in global oil prices would lead to a 0.2 percentage point increase in inflation in LA5, while a 10 percentage points increase in global food prices would result in a 0.9 percentage point increase in inflation. A combined 10 percentage points shock to both oil and food prices would push up inflation by 1.1 percentage points.

Inflationary pressures exacerbated by the war may persist due to existing indexation and early indications of labor market tightness in some countries.

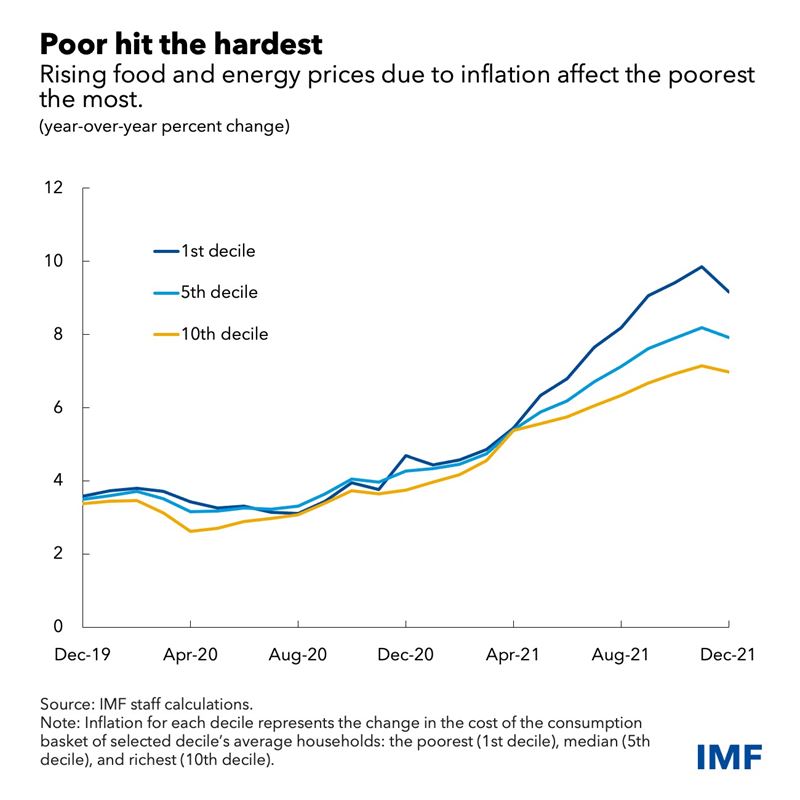

In addition to the macroeconomic impact, current higher inflation is regressive, with low-income households suffering a steeper cost-of-living increase. For a region with historically high levels of inequality, the erosion of real incomes due to the soaring cost of food and energy will only add to the economic strains faced by vulnerable households in the region. And as we showed in our October 2021 Outlook, low-income households were already the most affected by the economic consequences of the pandemic.

Inflation drivers

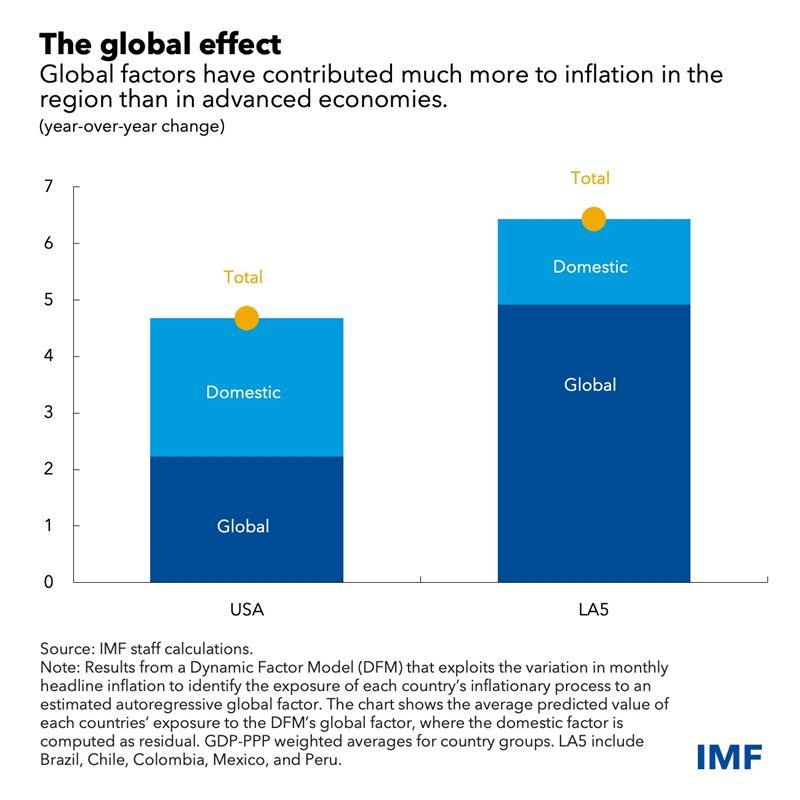

Global factors, specifically commodity and import prices, were key drivers of inflation in 2021. Our analysis suggests that these play a larger role in the region than in advanced economies.

Domestic factors also contributed. Although they’re often country-specific, there are some associated with the pandemic that are common to countries in the region. As in some advanced economies like the United States, in LA5 they appear to be related to the recovery in private consumption in 2021.

Fiscal stimulus and other support measures boosted demand for goods in most LA5 countries in the early months of the pandemic and core goods inflation moved in tandem. Growing demand for services, supported by the lifting of mobility restrictions, made inflation broader based as reflected in the recent rise in core services inflation. For instance, private demand for goods recovered rapidly and strongly in Chile on the back of fiscal support and pension withdrawals, and a sustained but milder recovery in private demand for services followed, which contributed to the rise in core inflation of 6.6 percent year-over-year in February 2022.

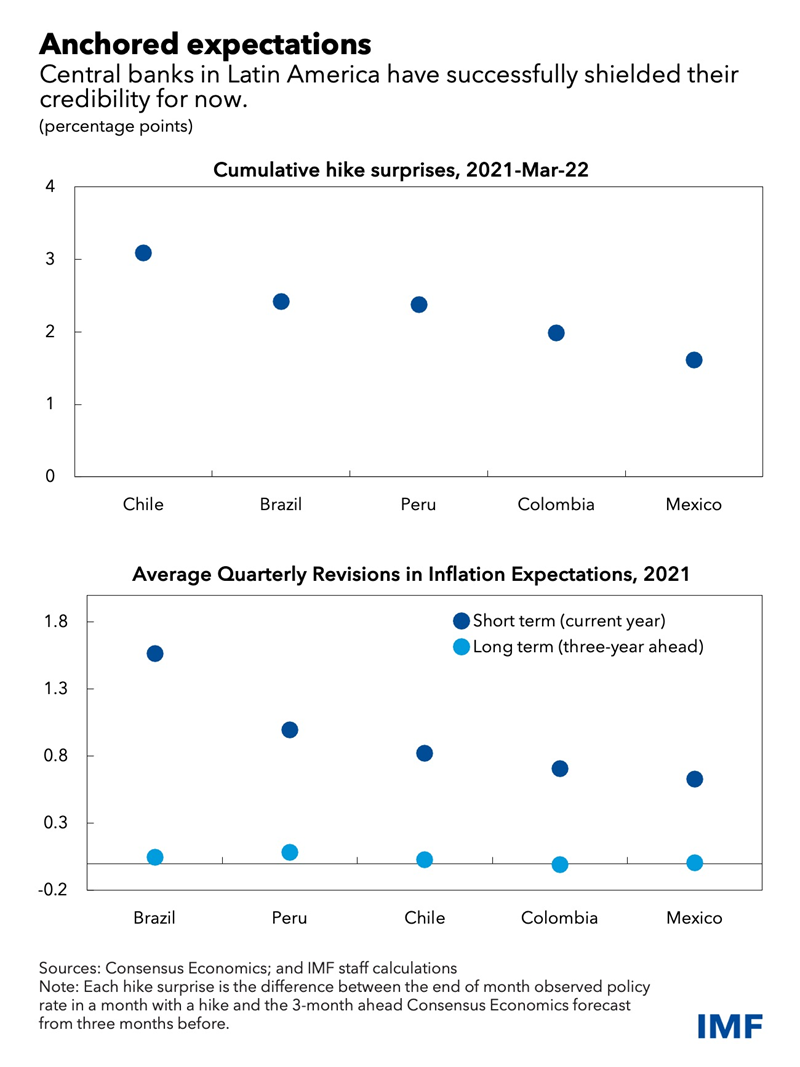

Long-term expectations remain well-anchored

Following unprecedented monetary policy easing to support the economy during the early months of the pandemic, central banks in LA5 swiftly reversed their stance when inflation began rising, often tightening rates by more than anticipated by market participants.

The Central Bank of Brazil was the first one to change course in March 2021, and others followed suit, leading to cumulative rate hikes that ranged from 1.75 to 9.75 percentage points from their end-2020 levels.

These actions, together with LA5 central banks’ hard-won credibility in fighting inflation, have kept long-term inflation expectations anchored despite the increase in inflation. As shown in the October 2021 Outlook, LA5 central banks seem to have achieved higher credibility than the average emerging market central bank.

Central banks need to be vigilant and continue to take decisive actions if needed.

***

Ilan Goldfajn is director of the IMF’s Western Hemisphere Department.

Maximiliano Appendino and Samuel Pienknagura are economists in the IMF’s Western Hemisphere Department.