Proponents aim to create societies that are free, equal, and wealthy

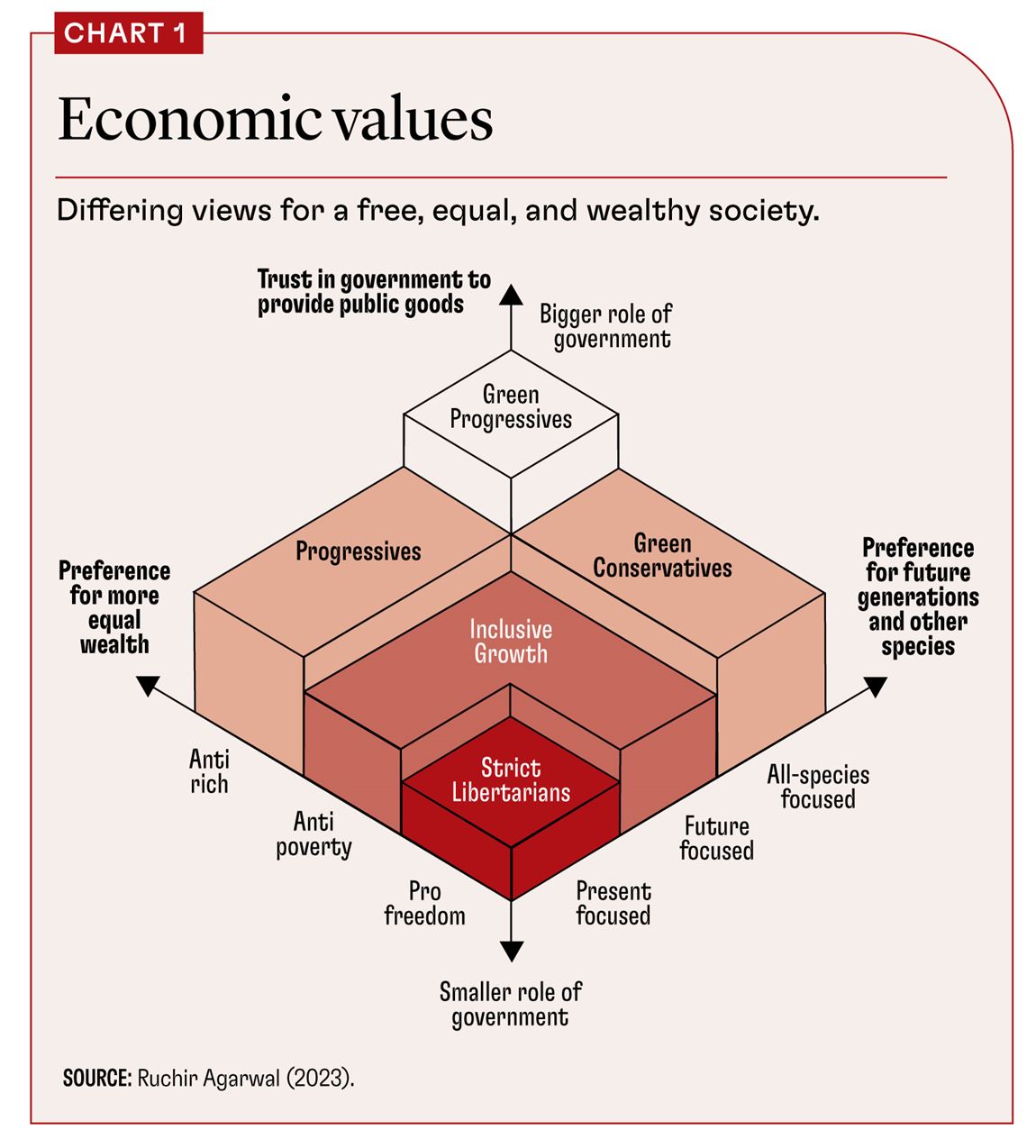

What is the role of government in modern economies? Is it possible to create a more equal society without sacrificing economic freedom or wealth? Should we emphasize equal opportunities or equal outcomes? The idea of “inclusive growth” seeks to strike this balance.

Since the term can be open to interpretation, let me offer a definition: Inclusive growth seeks to boost national wealth and well-being while reducing poverty, ensuring equity across generations, and preserving economic freedoms.

Different interpretations of freedom exist. Libertarians advocate minimal state intervention in private lives and free markets. By contrast, the capabilities approach, championed by Nobel laureate Amartya Sen, focuses not just on the absence of restrictions but also on the presence of opportunities to be healthy, educated, and secure. Each interpretation sets a different standard for what it means to be a “good society” and envisions a distinct role for the government in achieving this.

Even renowned advocates of freedom, from John Locke to Adam Smith and John Stuart Mill, recognized the necessity of some government intervention. Their different views bring us to the heart of the debate on what it means to be a free and equal society. Imagine that you’re at the helm of designing a society. How would you strike a balance between these principles? Every policy choice involves a trade-off.

Wealth redistribution

First, let’s evaluate your preferences for wealth redistribution. How would you ensure better living standards while preserving economic freedom and growth? Imagine a scenario with a flat income tax of 30 percent on all. Now consider a proposal to increase the tax rate for the richest to 50 percent. Do you support it?

If you oppose the tax increase because you believe the richest are already contributing their fair share and that higher taxes might slow economic growth, your view represents a more conservative approach to inclusive growth. This stance prioritizes economic freedom and economic growth, favoring a uniform tax on all.

If you agree with the tax hike on the wealthy, provided the extra revenue targets poverty reduction, you take a broader perspective on inclusive growth. This viewpoint is willing to trade some economic freedom to support targeted anti-poverty initiatives.

If you support the tax increase to reduce wealth inequality, regardless of whether the revenue aids anti-poverty programs, aligns with a progressive stance. It pushes beyond traditional inclusive growth boundaries.

This scenario sheds light on the role of social safety nets. Not only progressives but also classical liberals such as Adam Smith, Friedrich Hayek and Milton Friedman acknowledge their importance. While they would be against using taxes for redistributing wealth, they recognize the need for safety mechanisms that prevent extreme poverty, aiming to provide a basic standard of living that allows everyone the opportunity to succeed.

The first choice relates to the idea of universal basic income (UBI) with a flat income tax, similar to what economists Friedman and Gregory Mankiw have proposed. However, for conservative economists, the attractiveness of UBI may diminish if it’s funded by progressive tax systems, as indicated in the second option. They believe this could hinder economic growth.

The third choice is in line with the ideas of progressive economists such as Thomas Piketty and measures like the Green New Deal. These approaches endorse high marginal tax rates, often of 70 percent or more, partly to reduce the wealthy’s political influence.

Some progressive economists, such as Dani Rodrik, focus on the concentration of wealth and innovation in selected firms and cities, not just individuals. They observe that this leads to economic exclusion for many. Their solutions include more labor rights, antitrust laws, higher minimum wages, subsidies, and other industrial policies to counter corporate dominance, along with government investments targeting job creation in neglected areas. Others, including me, worry about the growth effects of such industrial policies, and the ability of governments to implement them, and fear that they might lead to a global shift toward protectionist trade.

Future generations

Next, let’s consider how our actions today affect future generations, including those not yet born, and other species.

How far should government intervention go to ensure a prosperous future for our children, grandchildren, and beyond? Should we extend this intervention to conservation of the environment and wildlife, even if it doesn’t yield direct benefits for humans? These questions are vital in shaping the world we leave behind and defining the government’s role in our planet’s ecosystem.

Let’s examine this through the lens of climate change. Consider a carbon tax proposal of $35 a metric ton, designed to significantly cut future carbon emissions. This would raise costs on electricity, gasoline, and heating by about 20 percent for everyone. What’s your stance?

If you oppose the tax, you likely prioritize current economic growth and freedoms, skeptical of sacrificing present resources for uncertain future gains. This perspective emphasizes the immediate economic impact, particularly on poorer households, mirroring the stance of some developing economies hesitant to implement higher carbon taxes now.

Supporting the tax, meanwhile, can reflect a belief in prioritizing the well-being of future generations. This stance aligns with existing policies for carbon pricing considered by several advanced economies, focusing on safeguarding the freedoms and choices of those yet to come over today’s economic comfort.

Endorsing the tax might stem from a commitment to the broader health of the planet, valuing the intrinsic worth of nature and biodiversity. This view, often associated with green advocacy, goes beyond human-centric benefits.

These options also highlight the complexity of inclusive growth, which aims to balance the needs of both current and future generations. Even for those typically against higher taxes, concern for existential threats and long-term sustainability can shift perspectives. It’s not about ecological impact but about preserving critical resources and a healthy environment for those yet to come.

Public goods

Next, let’s consider the role of government in providing public goods such as education, health care, and nonmarket well-being, which includes elements vital for a good life, such as clean air, not measured in GDP. Classical economists understood market failures—when individual choices alone don’t always lead to the best outcomes. This can happen as a result of externalities—for example, when polluters don’t pay for the environmental damage they cause—or when there’s not enough investment in education and health care for everyone’s benefit. In developing economies, the need for government intervention may be even more pronounced, as a result of poor infrastructure and more people without access to quality education and health care.

Some people trust the government to provide these public goods, believing it to be more capable than markets of handling certain problems. However, others are skeptical of too much government involvement and worry about government failure and corruption. They argue that good fiscal policy needs rational, unbiased policymakers, which isn’t always the case. Critics also fear that government efforts might backfire, making problems worse instead of better. Some go further to suggest market-based solutions, like Nobel laureate Ronald Coase’s idea that clear property rights and minimal transaction costs can lead to efficient outcomes without government help.

Where do you stand? If you’re for more government intervention, you trust the government to fix market imbalances and achieve social goals. But if you’re wary of government failure, you prefer to let the market work with minimal interference from the government, questioning its effectiveness and fearing the risks of too much control. This choice reflects your level of trust in government versus your faith in market-based solutions.

Understanding inclusive growth

Unlike policies aimed at directly reducing wealth inequality across individuals or regions, often associated with progressive ideologies, inclusive growth focuses on creating a level playing field. It emphasizes the idea that people’s futures should be determined by their talent and effort, not predestined by their background. This approach envisions a society where success is based on merit and ability rather than the circumstances of birth.

Overall, inclusive growth embodies the principle that wealth creation, economic freedom, and equal opportunity can coexist. It promotes the notion that a society can be free and equal while also pursuing long-term economic growth and well-being. And the government’s role in this balance will depend on individual values, trust in political actors, and local realities.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.