Middle East and Central Asia

Confronting the COVID-19 Pandemic in the Middle East and Central Asia

April 2020

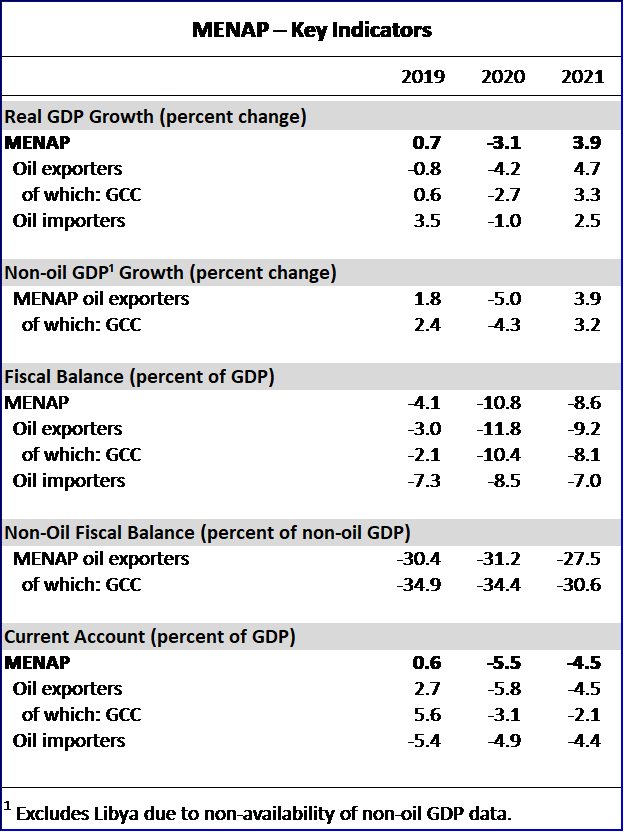

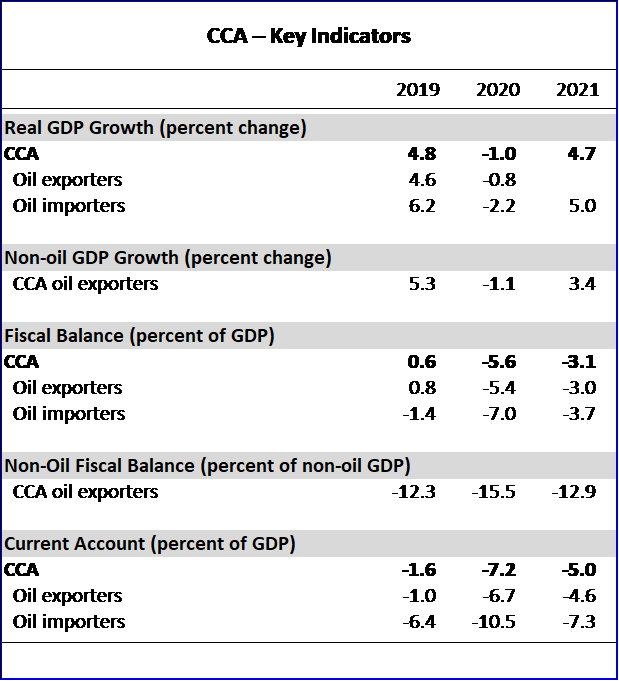

Countries of the Middle East and Central Asia region have been hit by two large and reinforcing shocks, resulting in significantly weaker growth projections in 2020. In addition to the devastating toll on human health, the COVID-19 pandemic and the plunge in oil prices are causing economic turmoil in the region, with fragile and conflict affected states particularly hard-hit given already large humanitarian and refugee challenges and weak health infrastructures. The immediate priority for policies is to save lives with needed health spending, regardless of fiscal space, while preserving engines of growth with targeted support to households and hard-hit sectors. In this context, the IMF has been providing emergency assistance to help countries in the region during these challenging times. Further ahead, economic recoveries should be supported with broad fiscal and monetary measures where policy space is available, and by seeking external assistance where space is limited.

Summary and Full Report

1. The Shocks

2. Country Responses

3. Outlook and Vulnerabilities

4. Policy Priorities

5. The Role of the IMF

Statistical Appendix

The IMF’s Middle East and Central Asia Department (MCD) countries and territories comprise Afghanistan, Algeria, Armenia, Azerbaijan, Bahrain, Djibouti, Egypt, Georgia, Iran, Iraq, Jordan, Kazakhstan, Kuwait, the Kyrgyz Republic, Lebanon, Libya, Mauritania, Morocco, Oman, Pakistan, Qatar, Saudi Arabia, Somalia, Sudan, Syria, Tajikistan, Tunisia, Turkmenistan, the United Arab Emirates, Uzbekistan, the West Bank and Gaza, and Yemen. The following statistical appendix tables contain data for 31 MCD countries. Data revisions reflect changes in methodology and/or revisions provided by country authorities. A number of assumptions have been adopted for the projections presented in the Regional Economic Outlook Update: Middle East and Central Asia. It has been assumed that established policies of national authorities will be maintained, that the price of oil1 will average US$35.61 a barrel in 2020 and US$37.87 a barrel in 2021, and that the six-month London interbank offered rate (LIBOR) on U.S.-dollar deposits will average 0.7 percent in 2020 and 0.6 percent in 2021. These are, of course, working hypotheses rather than forecasts, and the uncertainties surrounding them add to the margin of error that would in any event be involved in the projections. The 2020 and 2021 data in the figures and tables are projections. These projections are based on statistical information available through April 7 2020.