عربي, 中文, Español, Français, 日本語, Português, Русский

Leaders are often called upon to “rise to the challenge” in times of crisis. As firms and their leaders rise as best they can amid the ongoing health and economic crises, yet another crisis lies on the horizon. A looming environmental crisis, obscured by the exigency of the pandemic, requires action be taken by firms (and others). So how will business leaders and companies respond?

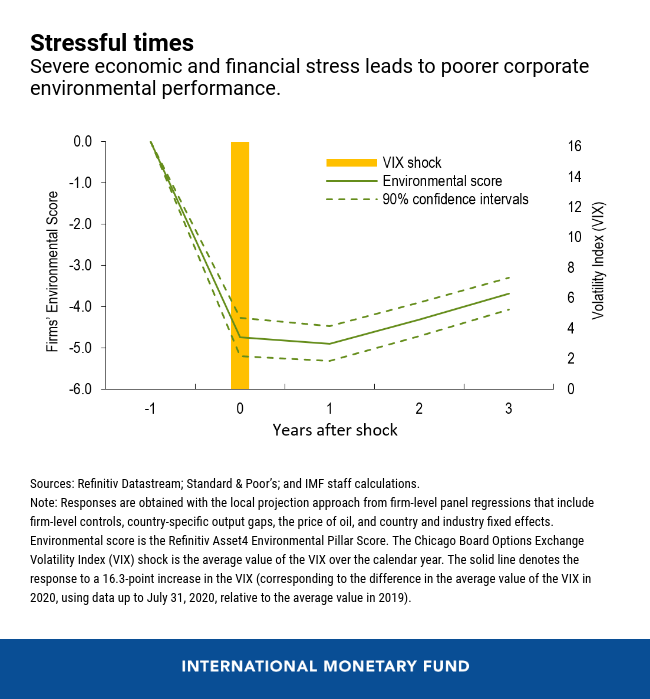

Our latest analysis looks at past episodes of financial and economic stress to gauge the likely impact of the current crisis on firms’ environmental performance.

On the one hand, the COVID-19 pandemic could increase awareness of environmental risks and bring about a shift in consumer preferences, corporate actions, and investor behavior that could accelerate the transition to a low-carbon economy. On the other hand, there is a risk that financially weakened firms, amidst heightened economic uncertainty, will reduce their investments in long-horizon, capital-intensive green projects, slowing down the transition.

Past as predictor

Looking at a large international sample of listed firms over the period 2002 to 2019, our analysis shows that the environmental performance of financially constrained firms is significantly weaker than for unconstrained firms.

Our analysis incorporates various factors that commonly serve as proxies for financial constraints—smaller, unrated firms are more likely to be financial constrained than are larger firms with ratings. Similarly, firms that are financially constrained may be less willing to pay out dividends. Our main measure of environmental performance is a score based on various key performance indicators, such as resource usage, emissions reductions, and product innovation.

For firms that do not pay dividends, are not rated, or are smaller, the environmental performance score is, on average, 10 to 30 percent lower than the score of large, dividend-paying, or rated firms.

A shock with large macroeconomic and financial implications, such as the COVID-19 pandemic crisis, increases uncertainty and disrupts economic activity, a development that tends to amplify firms’ financial constraints. This, in turn, is likely to adversely affect firms’ green investments.

As shown in our chart of the week, a sudden jump in global financial stress and uncertainty—comparable to the average level that prevailed in the first half of 2020—would lead to a drop in firms’ environmental performance, reversing gains made over the last decade. Critically, the pre-shock environmental performance level is not regained even three years after the shock. Similarly, our analysis found that when economic output declined, so too did firms’ environmental performance.

Present insight

These results have important implications in the context of the COVID-19 crisis and the urgent need to reduce global greenhouse gas emissions:

First, absent climate policy actions, such as a green investment push as called for in the recent World Economic Outlook, tighter financial constraints and adverse economic conditions can be detrimental to firms’ environmental performance, reducing green investments, and potentially slowing down the transition to a low-carbon economy. Therefore, to offset any potential deterioration in firms’ environmental performance, it will be crucial to put in place climate policies that alleviate firms’ financial constraints and aid green investment.

Second, in addition to green recovery packages, policies aimed at fostering sustainable finance will be key:

-

Comparable, consistent corporate reporting on sustainability would enable a more effective assessment of firms’ environmental performance. Only accurate and adequately standardized reporting and disclosure will allow investors to determine actual exposures of companies to climate-related financial risks.

-

It is important to instill confidence in investors that sustainability be not just an attractive label, but that it reflect underlying sustainable investment decisions. To achieve that, further standardization and clarification of what constitutes a sustainable investment fund is needed.

-

International cooperation and a collaborative approach to the initiatives taking place globally are crucial to leverage efforts and to avoid fragmentation of sustainable asset markets. The IMF will be contributing to this endeavor.