(Versions in 中文, Français, 日本語, Русский, عربي and Español)

Plunging oil prices have taken the public finances on an exciting ride the past six months. Oil prices have fallen about 45 percent since September (see April 2015 World Economic Outlook), putting a big dent in the revenues of oil exporters, while providing oil importers an unexpected windfall. How has the decline in oil prices affected the public finances, and how should oil importers and exporters adjust to this new state of affairs?

In the April 2015 Fiscal Monitor, we argue that the oil price decline provides a golden opportunity to initiate serious energy subsidy and taxation reforms that would lock in savings, improve the public finances and boost long-term economic growth.

A sword that cuts both ways

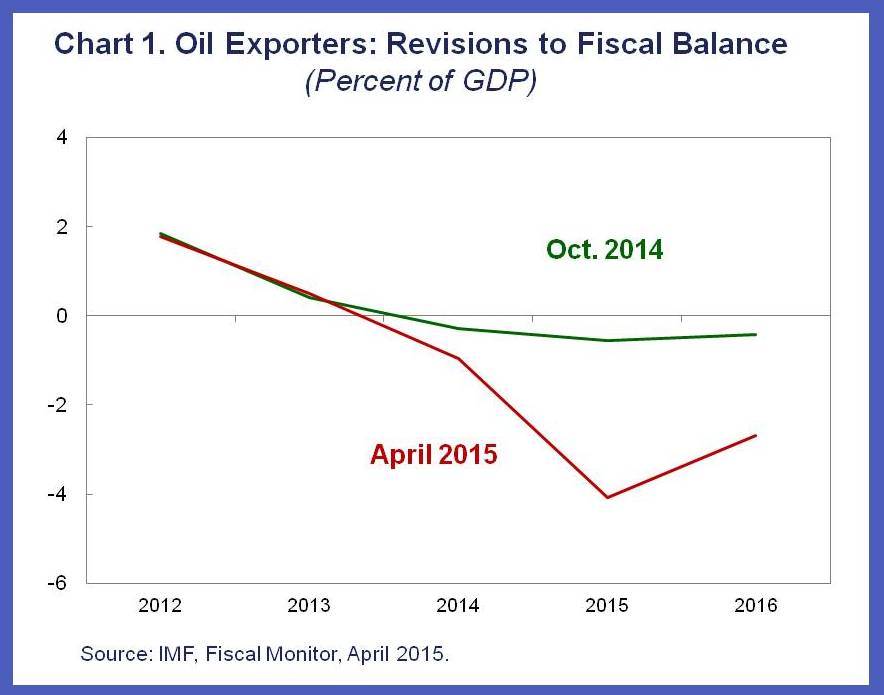

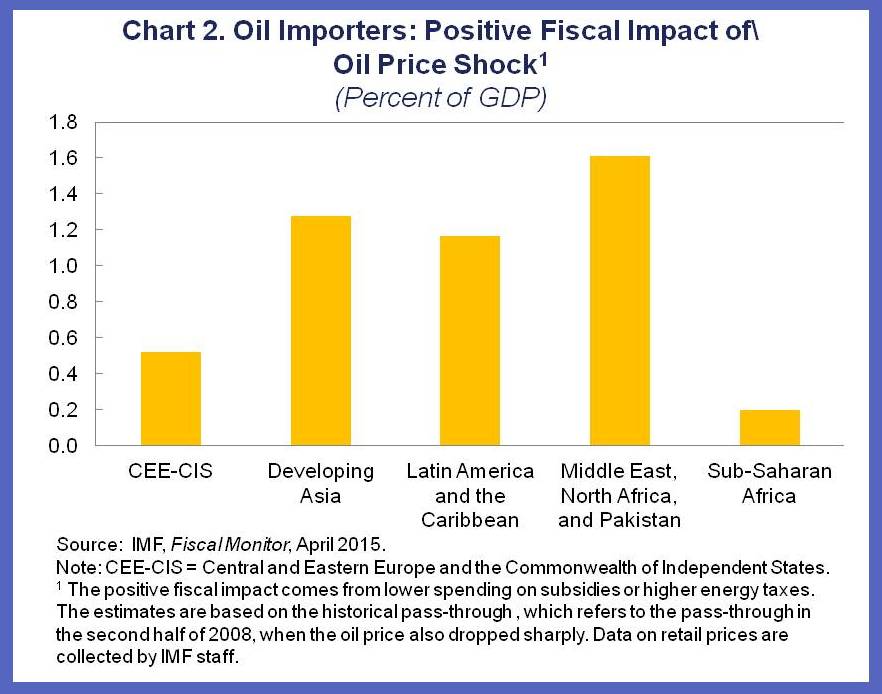

For oil exporters, the decline in prices is expected to cut their revenues by an average of 4 percent of GDP in 2015. This is reflected in the large deterioration in the fiscal balances of exporters we now predict for 2015 (see chart 1). At the same time, oil importers are benefiting, but with significant variation across regions (see chart 2).

The fiscal effects for importers depend on whether they regulate domestic energy prices. If they do and leave domestic prices unchanged, for example, the amount governments need to pay for energy subsidies goes down, as governments get to keep the windfall. For a typical oil importing country, we expect that about one-third of the decline in oil prices will be passed on to consumers, and two-thirds will go to governments. The fiscal savings under this scenario are expected to be about 1 percent of GDP in 2015.

Oil exporters: dulling the edge of the sword

Oil exporters whose governments have amassed significant financial assets (net of public debt), including the Gulf Cooperation Council countries and Norway, can use them to mitigate the short term impact of the shock. Others are allowing their currencies to weaken and will be able to partially offset lower oil revenues in foreign currency terms. Given the size of the shock, most will have to cut government spending to achieve a sustainable fiscal position.

Given the possibility of a prolonged period of lower oil prices, a shift in focus to long-term reforms is advisable. This will require efforts to boost the non-oil revenue base; improve natural resource management; and improve the efficiency of government spending. In addition, stronger fiscal frameworks are needed to help countries cope with the ups and downs of commodity prices and revenues. This is an important challenge, and the October 2015 Fiscal Monitor will be exploring this theme in more detail.

Seize the moment

Both oil importers and exporters have an historic opportunity to take advantage of the decline in oil prices to start the process of reforming energy subsidies and taxation. Getting energy prices right would help rationalize energy consumption and reduce its adverse effects on the environment. In emerging market and developing economies, further reform of energy subsidies and taxation could provide space for growth-enhancing spending in education, health, and infrastructure, as well as programs for the poor. In advanced economies, taxes on labor could be cut, and paid for with higher energy taxes.

Many countries are already taking bold steps in this direction. More than 20 countries have recently taken steps to decrease or eliminate energy subsidies, including Angola, Egypt, India, Indonesia, and Malaysia. Many of these countries have followed the best practices discussed in Energy Subsidy Reform: Lessons and Implications—to communicate the reform plan to the public, explain its benefits, and set up mitigating measures for the poor.

These are examples to follow. Low inflation and low oil prices create a favorable environment for the success of ambitious energy subsidy and energy taxation reform. Now is the time!