The first women to work in New York’s banks and brokerages broke up a boys’ club

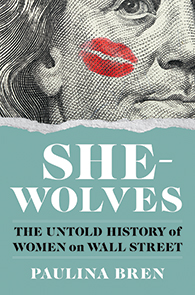

SHE-WOLVES

The Untold History of Women on Wall Street

Paulina Bren

W. W. Norton & Company

New York, NY, 2024, 384 pp., $29.99

Writer and historian Paulina Bren tells the stories of the first women to work in New York’s banks and brokerages in She-Wolves: The Untold History of Women on Wall Street. She shows that women faced a hostile environment, rife with daily harassment, gender and racial discrimination, and invisible barriers. Readers are left with a vivid picture of the breadth and depth of entrenched social norms and systemic inequities from the 1960s onward. Yet Bren’s compelling storytelling also captures the perseverance, resilience, and ingenuity of Wall Street’s early female pioneers and their profound impact in reshaping the world of finance.

Bren introduces readers to Muriel Siebert, who became the first woman to hold a seat on the New York Stock Exchange, in 1967, and successfully navigated an environment where the attitude was, “It’s not that women are prohibited. It’s just that they’re not allowed.” Bren also introduces a cohort of women who began their Wall Street careers as secretaries and parlayed their roles into positions of influence through determination and resourcefulness. She-Wolves spotlights Harvard Business School alumnae who, despite having equal credentials as their male counterparts, were told that they would never be hired on Wall Street. Over and over, the stories show how Wall Street underestimated and undervalued women while simultaneously benefiting from their insightful and innovative work.

A hallmark of the book is how Bren, a professor at Vassar College, in Poughkeepsie, New York, skillfully connects powerful individual stories to broader social and cultural trends, charting the progress of women’s representation and agency in finance. She traces pivotal moments—the rise of the women’s movement, the sway of the National Organization for Women, the establishment of the Equal Employment Opportunity Commission, even the placement of the “Fearless Girl” statue on Wall Street—to acquaint readers with the realities of the broader environment. Bren’s focus on her subjects’ personal and professional histories adds depth and humanity to their struggles and triumphs.

Beyond chronicling historical challenges, She-Wolves underscores how the systemic issues faced by Wall Street’s early women—unequal pay, glass ceilings, and workplace harassment—continue to hinder women’s progress today, albeit in more subtle forms. Seemingly positive signs of progress, such as the increasing number of women occupying top executive roles and the rise of female-led investment firms, are balanced with sobering realism. Marianne Spraggins, Wall Street’s first Black female managing director, was routinely “mocked for her race and her aggressiveness.” Bren’s analysis serves as both a celebration of how far women have come and a reminder of how far society will have to go to achieve equality.

She-Wolves is an inspiring and necessary contribution to the history of women in finance. The blend of historical insight and relatable storytelling makes the book accessible and impactful. It shines a light on the indelible contributions of women who dared to lead in places where they were often unwelcome and inspires us to envision a future where such courage is no longer necessary.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.