A bigger role for women in digital finance can enhance company performance and economic growth

The advent of digital financial services—such as those that use mobile phones or the internet to conduct financial transactions—is transforming people’s lives, helping the underserved gain greater access to financial services. But not all segments of the population are benefiting equally.

Women continue to be significantly underrepresented in both finance and technology. Take traditional financial services. Previous research has documented an association between a higher share of women on commercial bank boards and greater resilience and stability in the banking system. Yet women hold fewer than 25 percent of board seats in traditional banks and bank supervision agencies (Sahay and Čihák 2018). Increasing the access of both men and women to traditional financial services reduces income inequality within countries, but the benefits are larger when more women have access (Čihák and Sahay 2020). Despite these substantial gains for countries, gender gaps in financial inclusion persist. Globally, 65 percent of women have an account with a financial institution, compared with 72 percent of men, as women continue to face socioeconomic, cultural, and technological barriers to financial services (Demirgüç-Kunt and others 2018).

Our new study on digital financial services confirms the findings related to traditional financial services—greater inclusion of women as users and leaders of digital financial services has benefits beyond addressing gender inequality. We find that narrowing the gender gap in leadership would foster better performance of firms in the digital financial services industry, which is critical to economic growth.

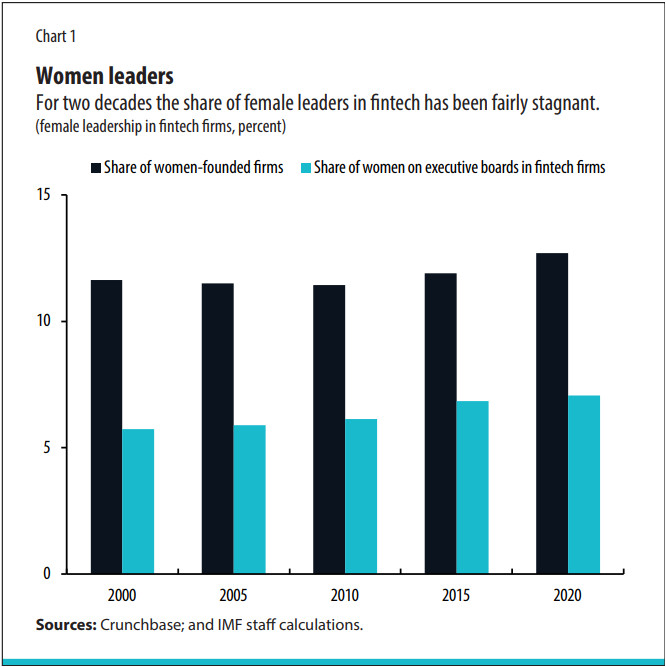

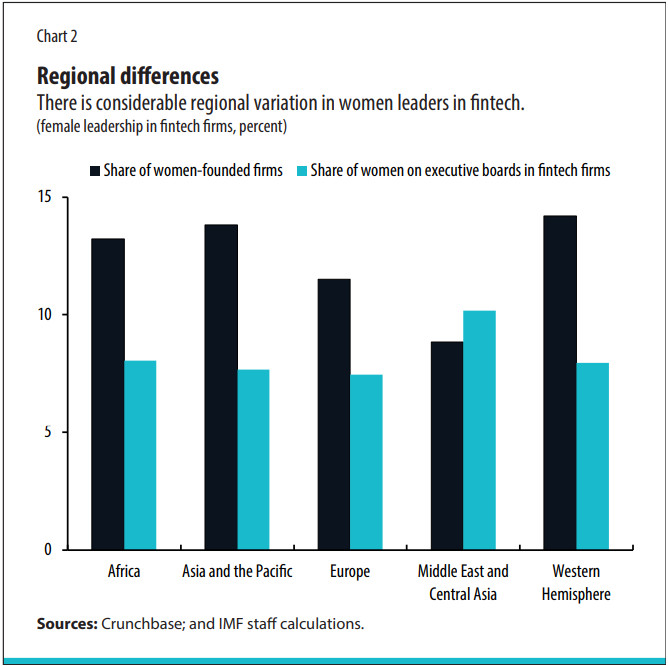

Using a novel fintech firm-level data set across 97 countries, we find that women represent less than 13 percent of leadership—both as founders and as members of executive boards of fintech firms—even less than their representation in traditional banking and technology companies. As Chart 1 shows, these numbers have hardly moved in the past 20 years. Chart 2 shows the considerable regional variation, with the highest shares of fintech companies founded by women in the Western Hemisphere and Asia and Pacific regions and the lowest in the Middle East and Central Asia.

But does it really matter whether women are fintech industry leaders? We find a positive relationship between more women on executive boards and the revenue earned by the respective fintech firm as well as the funding they receive for future investments. A 10 percent higher share of women on executive boards is associated with roughly 13 percent higher revenue and funding earned by a firm. There is a documented positive relationship between gender diversity in a firm and the firm’s performance (Christiansen and others 2016). Firms with a higher share of women executives earn higher revenue and receive more funding.

In contrast, we find that firms founded by women tend to make less revenue and receive less funding than those founded by men. This may reflect women’s greater risk aversion when making investment decisions or it may result from gender bias among investors (mostly men) funding the firms.

What about women’s participation as users of digital finance? Growing evidence suggests that increasing digital financial inclusion, including women’s access to and use of financial services, is positively associated with economic growth, which in turn benefits society (Khera and others 2021). When more women access financial services they participate more in the labor force and contribute to business activity, thereby directly increasing GDP. And when more diverse talent enters the labor force, it is likely to help productivity grow and reinforce economies’ output growth (Ostry and others 2018).

Sahay and others (2020) find that fintech is indeed helping narrow financial inclusion gender gaps in several countries by removing some obstacles that particularly affect women—such as mobility and time constraints—for example, by giving women access to financial accounts from home. Moreover, digital services circumvent interactions with bank branch agents: this makes a difference where social norms constrain interactions between men and women. Still, in some countries, although women’s digital financial inclusion is increasing, men’s is increasing faster and the gender gap is widening further. For instance, in 31 of the 52 countries in the authors’ sample gender gaps were narrowing in digital financial inclusion between 2014 and 2017; in the other 21, they widened.

Women’s financial inclusion is one of the many powerful levers that can boost gender equality and, at the same time, raise economic growth, financial stability, and income equality. But we can’t make progress if we don’t truly understand the realities of women’s lives. So what fuels gender disparity in the use of digital finance? We find three key drivers:

Women often lack the basic means to access digital services—such as mobile phones and the internet.

Cultural norms in some countries limit women’s financial literacy, as measured by the share of women who have completed upper secondary education.

Women’s digital and technology-related literacy, measured by the share of women in STEM (science, technology, engineering, and mathematics) fields, remains low at about 15 percent globally.

Our findings strengthen the case for higher inclusion of women—both as users and leaders in the digital finance industry—to enhance economic growth. As the adoption of digital financial services further accelerates in the post-COVID era, there is an emerging risk of new sources of financial exclusion due to the digital gender divide. Investing in digital and financial literacy should be high on the agenda of governments. Consumer protection agencies and regulators can play an active role in the prevention of explicit or implicit biases.

At the same time, we need more research and better data to identify the conditions that facilitate the entry of women into leadership roles in the digital financial industry, which could in turn have implications for narrowing gender gaps in financial inclusion. Interestingly, in our study we find preliminary evidence of a positive correlation between women leaders in fintech firms and the use of digital financial services by women. This likely indicates that women’s greater representation in leadership positions in the fintech sector is spurring development of financial services and products more targeted and tailored to women. More rigorous and in-depth work on this topic could help efforts to further improve financial inclusion.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.