Stablecoins are far from the revolutionary ideals of crypto’s creators and are not without risk

When it was launched in 2009, the crypto revolution was about much more than just finance. The financial crisis shook people’s trust in banks and the governments that bailed them out. For those wanting to shun traditional institutions and find alternative means to make payments, Bitcoin and the innovative blockchain technology that underpins it promised to decentralize and democratize financial services. Power would be placed in the hands of the people—this remains a compelling vision.

The problem was that speculators soon piled into the market. Instead of spending bitcoins and other crypto assets, speculators simply hoarded them in the hope that prices would rise ever higher. Crypto assets struggled to prove their potential as a payment instrument and instead became a speculative punt. The creation of thousands of other volatile “altcoins”—many of them nothing more than schemes to get rich quick—made it even more problematic to use crypto assets for transactions. After all, how do you pay for something with an asset that is not a stable store of value or a trusted unit of account?

A stablecoin is a crypto asset that aims to maintain a stable value relative to a specified asset, or a pool of assets. These assets could be a monetary unit of account such as the dollar or euro, a currency basket, a commodity such as gold, or unbacked crypto assets. This stability can be achieved only if a centralized institution is in charge of issuing (minting) and redeeming (burning) these crypto assets. Another centralized institution (a custodian) must hold corresponding reserves (typically fiat currency issued by governments) that back each unit of stablecoin that is issued.

Centralizing finance

This evolution is at odds with the original vision. Rather than decentralizing finance, many stablecoins have centralizing features. Instead of moving away from fiat currencies, most types of stablecoins are fundamentally reliant on those currencies to stabilize their value. Rather than disintermediating markets, they lead to new centralized intermediaries, such as stablecoin issuers (who hold data on their users), reserve managers (usually commercial banks), network administrators (who can change the rules of the network), and exchanges and wallets (that can block transactions). In fact, given the transparency of blockchains and the need to comply with anti-money-laundering rules, stablecoins may offer less privacy than existing payment rails.

If stablecoins oppose elements of the initial vision of Bitcoin, why do they exist and what purpose do they serve? Stablecoins are used primarily to permit users to remain in the crypto universe without having to cash out into fiat currency. They’re used to purchase unbacked crypto assets as well as access and operate in decentralized finance (DeFi). They were a key element in the growth of the crypto asset and DeFi markets.

In some emerging market and developing economies, dollar-denominated stablecoins could become popular as a store of value and a hedge against inflation and currency depreciation. From the users’ perspective, this so-called cryptoization provides an avenue to protect financial interests in the face of macroeconomic pressures and weak financial institutions. Where they are not regulated, stablecoins can circumvent controls on free capital movement while complicating macroeconomic management by the central bank.

For some, stablecoins represent the future of payments. After all, in many economies most money in circulation is not central bank money but privately issued commercial bank money. Furthermore, blockchains have the potential to increase the speed and reduce costs for services traditionally offered by banks, in particular cross-border remittances. An argument can be made that stablecoins will be the privately issued money of the future.

Unstable coins

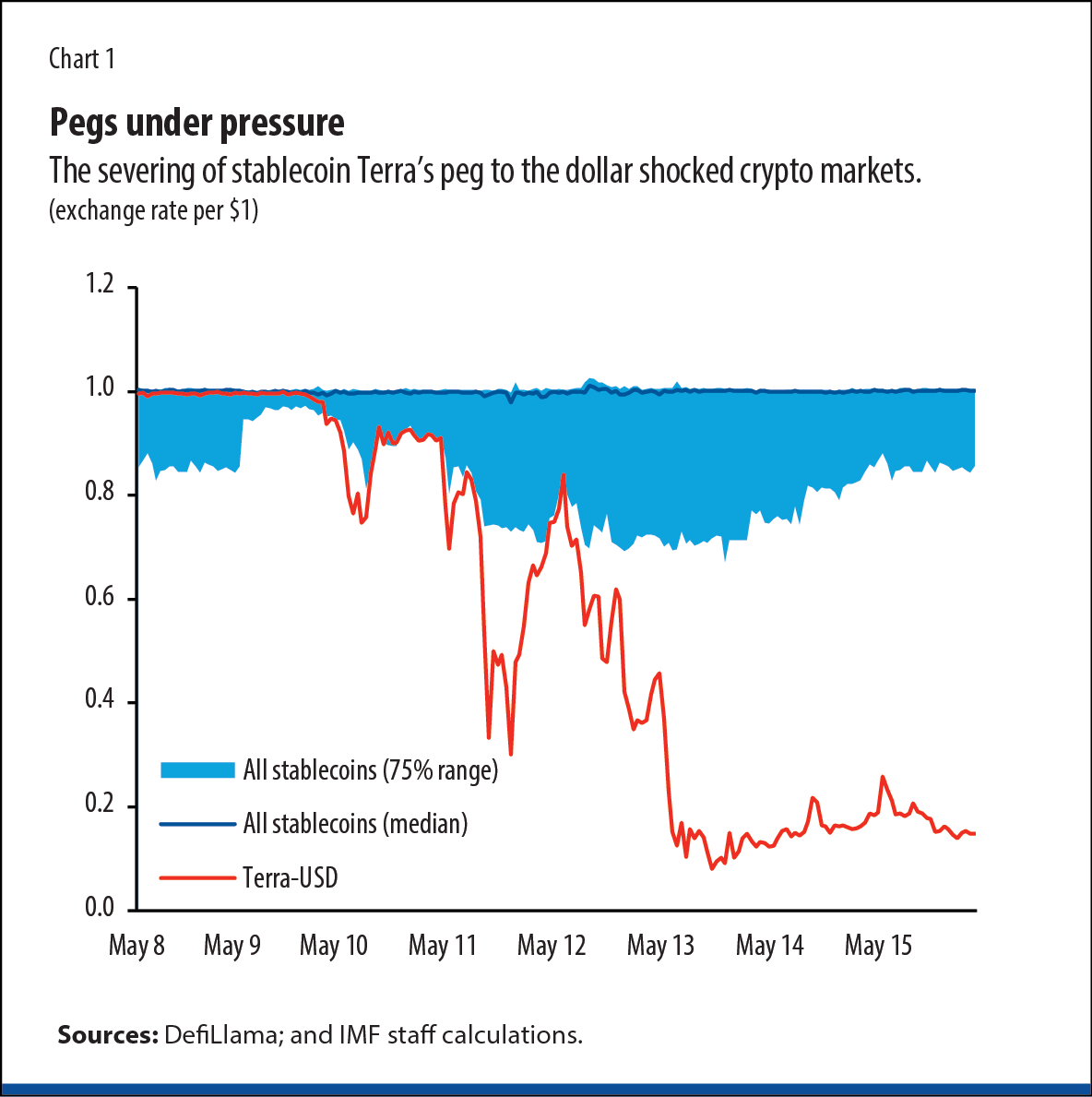

This vision comes with some challenges. First, stablecoins are not all stable. In fact, most stablecoins fluctuate around their desired value rather than sticking rigidly to it. Some stablecoins can deviate significantly from their desired value. This is particularly true of algorithmic stablecoins. These tokens aim to stabilize their value through an algorithm that adjusts issuance in response to demand and supply, sometimes combined with backing through unbacked crypto assets. However, these tokens are extremely risky. They are susceptible to de-pegging in the event of a large shock that becomes self-perpetuating once it starts, as the TerraUSD experience shows.

This stablecoin suffered a peg failure in mid-2022 after bank-like runs by users. The collapse of TerraUSD, then the third-largest stablecoin, triggered significant ripple effects across the entire crypto market. Similar contagion in the future could go well beyond crypto markets: many stablecoins hold reserves in traditional financial instruments, and exposure to crypto assets among traditional financial market participants has increased.

Second, the distributed ledger technology that underpins stablecoins has not been tested at scale from a payment perspective. These technologies could make cross-border remittances and wholesale payments somewhat more efficient, but they may not offer sizable advantages over domestic payment systems, especially in advanced economies.

While financial inclusion is often touted as a benefit of stablecoins, most users are educated, relatively young, and already have bank accounts. Unless transactions are conducted outside the blockchain—taking stablecoins further away from the traditional crypto ideals of transparency and decentralization—they can at times be more expensive than alternatives such as mobile or electronic money. These non-crypto alternatives raised financial inclusion in Kenya from 14 percent to 83 percent between 2006 and 2019.

Regulation challenges

Finally, regulatory barriers may arise. Regulators of domestic payment systems may not allow stablecoins to serve as a payment instrument for purchases of goods and services and integrate with domestic payment systems. In addition, stablecoins (and the wider crypto universe) are not yet regulated for conduct and prudential purposes in many jurisdictions. Although some anti-money-laundering rules might apply, users aren’t protected if something goes wrong. Users could face large losses without recourse to compensation if, for example, fraudulent stablecoins were issued, issuers claimed their stablecoins were backed but were not, stablecoins were stolen, or users couldn’t access their stablecoins or redeem them at par.

Given the risks they pose, some authorities have looked to regulate stablecoins in a manner similar to traditional financial institutions, with different rules according to their business models, economic risks, and economic functions. For example, where stablecoins are not issued by banks and are used for payments on a small scale, issuers might be subject to adjusted payment regulations. Where stablecoins have less liquid reserve assets and are used for investment purposes, issuers might be subject to requirements similar to those applied to securities.

One of the proposals floated by many authorities is to apply bank-like regulations to stablecoins, particularly if they become more widely used for payments. Should this happen, stablecoins will themselves become the banks that crypto assets were meant to replace.

Any innovation that provides people with more choice, reduces the power of institutions that are too big to fail, and increases access to financial services should be explored. With the right regulation in place, stablecoins could grow to play a valuable role in delivering these benefits, but they won’t be able to do so alone. And they are far from the revolutionary vision of crypto’s creators.

Opinions expressed in articles and other materials are those of the authors; they do not necessarily reflect IMF policy.