Introductory Remarks at the IMF’s European Department Press Briefing

October 17, 2025

Welcome to today’s press conference on the economic outlook for Europe

Six months since our previous briefing, Europe’s continues to face a difficult macroeconomic context: trade tensions and uncertainty are holding back investment and short-term growth, and the continent’s medium-term prospects remain subdued.

While Europe has capably managed significant shocks, their lingering impact is beginning to weigh on the economic and fiscal outlook. The vigorous debate in Europe about how to raise productivity and growth underscores a shared understanding of the need for reform; however, decisive action has yet to materialize. Delaying or shortcutting reforms could result in substantial economic and social costs.

Forecast

Let’s take a closer look at the near term…

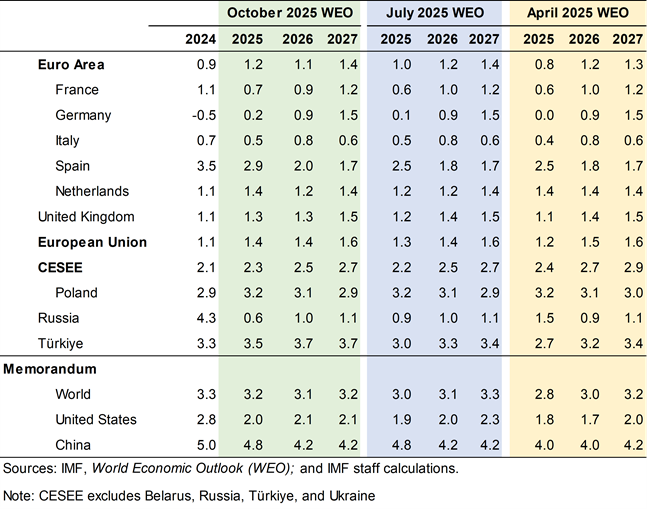

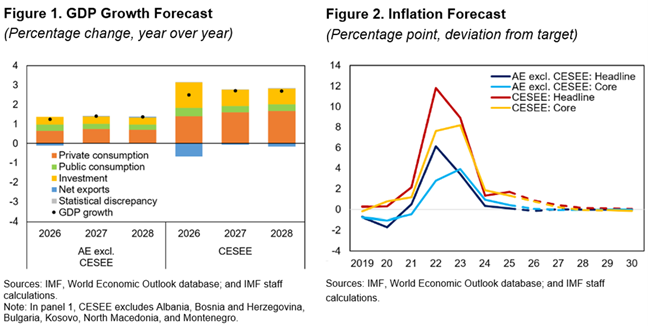

- For the euro area, we forecast growth rates of 1.2 and 1.1 percent for 2025 and 2026. Compared to July 2025 (Table 1) we upgraded growth in 2025 by 0.2 percentage points, mostly due to tariff-induced frontloading in the first half of the year. The flip side is the downgrade of 2026 growth by 0.1 percentage points to 1.1 percentage points.

- The increase in US tariffs and elevated uncertainty weigh on the expected pick up in domestic demand in 2026 and 2027. As a result, Europe’s speed of growth remains close to its weak potential rate. Europe lacks the much-needed reform momentum to sustainably lift its underlying growth momentum given still-low productivity and increasing headwinds from demographics.

- Growth in the Central, Eastern, and Southeastern European (CESEE) region[1] remained broadly unchanged at 2.3 percent in 2025 (+0.1 ppt compared to July). They trade less directly with the U.S. but are exposed indirectly through supply chains. We still expect 2.5 and 2.7 percent growth in 2026 and 2027 (Figure 1), respectively.

- Risks to growth across Europe are to the downside. Uncertainty around trade policy remains very high. Add to this the security risks in Europe itself, it is easy to imagine that sentiment could weaken further and weigh on investment and job creation despite looser monetary policy.

- Trade diversion to Europe from China or other countries has been modest so far and could well end up supporting incomes and consumption through lower prices—but trade diversion could intensify and weaken selected sectors.

- For the euro area, an additional strengthening of the euro poses downward risk for exports and growth.

On the inflation front, we see faster convergence to targets driven by lower energy prices and—in the euro area and some other cases—stronger currencies (Figure 2).

- Euro area inflation has reached the target and is forecast to remain around this level in the medium term. UK inflation, revised up slightly to 3.4 percent in 2025 and 2.5 percent in 2026, is expected to decrease to 2 percent in 2027.

- In CESEE countries, disinflation continues at a gradual pace with headline inflation at 3.5 percent in 2026 and 2.9 in 2027. Most CESEE countries will likely meet their inflation targets only in the course of 2027. This delay relative to the euro area reflects still relatively high rates of wage growth.

Medium-Term Outlook

As I mentioned earlier, Europe has essentially decelerated back to its low rate of potential growth. There are a number of factors that are holding Europe back:

- High remaining intra-EU trade barriers, insufficiently integrated and deep capital markets to fund innovation, and barriers to incentivize labor to move to areas of growth opportunities weaken productivity and firm level dynamics. A unified energy market would enhance resilience, lower costs and help build energy security.

- Europe’s population is aging. By 2050 the working-age population will have shrunk in more than two-thirds of EU countries.

- Most CESEE countries suffer from low capital stock because of still-depressed private investment rates.

There are some upside risks. For example, the arrival of AI has the potential to boost productivity globally and in Europe. But even in this case the remaining obstacles that fragment the EU’s single market for goods and services and frictions in capital and labor mobility could mean slower growth benefits from the new technologies than what might otherwise be possible.

Europe’s twin deficit: growth and fiscal sustainability

So—where does Europe stand when it comes to reforms?

- The EU’s single market has come a long way since Europe’s economies decided to join forces after World War 2. And a number of new efforts are in train to further deepen integration. But—one year after the Draghi and Letta reports—the gap between what needs to be done and what has been achieved remains large. The necessity for action is widely recognized. What we need now is more ambition and more implementation to make a difference.

- At the national level, too, well-known structural reform needs remain unaddressed.

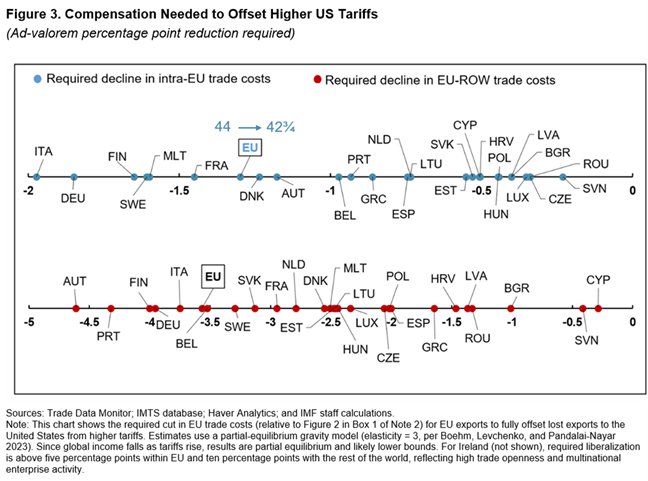

- The reform gap is costly. For this October Regional Economic Outlook, we have taken a granular look at productivity in Europe. Much of growth worldwide is driven by regional production centers—think of Silicon Valley in the US, the BeNeLux corridor, Bavaria’s high-tech manufacturing area, or the Ile-de-France region in Europe. But we find that, relative to their US counterparts, European production hubs are around one-third less effective in turning density into higher productivity. Internal barriers to trade—estimated as ad-valorem costs of 44 percent for goods and 110 percent for services—limited mobility of workers and capital, and domestic policy gaps in areas such as labor market and business regulations suppress the ability of these hubs to turn scale into productivity.

Continued policy drift would not only weaken Europe’s chances of raising medium-term growth but also greatly amplify the fiscal challenges ahead. Our research shows that successful implementation of growth-enhancing reforms would alleviate fiscal burdens, improve debt dynamics and reduce the need for fiscal consolidation.

Policies

What needs to be done? What policies does Europe need to navigate global uncertainty and secure its future?

First, European policy makers should ensure stability through balanced macroeconomic policies.

- Inflation rates in advanced economies[2] are now at or close to targets. Following the success of the ECB’s disinflation effort, the current macroeconomic configuration in the euro area supports the ECB maintaining its policy rate at 2 percent unless inflation outlook or risks shift materially. Policy decisions can become more guided by forward-looking analysis.

- In CESEE, a prudent and data-driven approach remains essential. Where inflation remains stubbornly above the target, monetary policy must continue to account for the lingering asymmetry of risks, especially in economies with high wage growth well above current levels of productivity growth.

- Financial policy also has a role to play. European banks are resilient, but elevated uncertainty and slower growth increase credit risks and reinforce the need for macroprudential buffers. And we need robust prudential policies and system-wide stress tests to address risks in the nonbank financial sector. And increasingly, crypto assets require enhanced monitoring and attention.

- Trade policy remains very much on the forefront. Higher tariffs on European exports are a new obstacle to growth. But Europe has options.

- First, by upholding its open trade policy and strengthening regional and global agreements, Europe can expand trade with other partners.

- Second, by deepening the EU’s single market further, Europe can intensify trade within the region and help its firms try scale up and become more productive.

- This is more than just an idea—we have run the numbers (October 2025 REO Chapter 1, Section: Trade Policy: Judicious Use of Safeguard Measures and Expanding Internal and External Trade [Hyperlink to October 2025 REO Chapter 1 here]): just lowering intra-EU barriers to trade by around 1.25 percentage points or lowering external trade barriers to the rest of the world by about 3.5 percentage points could offset the effects of higher tariffs on EU exports to the U.S.

- Should trade diversion into Europe become more prominent, safeguard measures should be used judiciously, be clear and transparent with time-consistent trade-policy road maps to reduce uncertainty and support investment.

Secondly, Europe urgently needs to act upon the opportunity to lift its growth through transformational reforms.

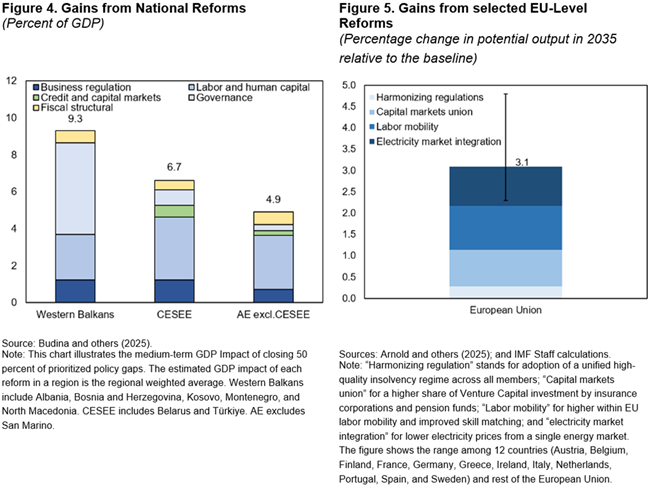

- Advancing national reforms and deepening the EU single market could deliver substantial output dividends—of about 9 percent in 10 years.

- At the national level, our analysis shows that more efficient labor and capital allocation can help lift total factor productivity, the main reason for Europe’s substantive GDP per capita gap with the United States. National reforms account for about 6 percent of the total 9 percent output increase in the EU.

- And our numbers show that a limited set of selected reforms toward a more integrated EU single market can increase investment and innovation, reinforce resilience, and boost the EU GDP by at least another 3 percent over the next 10 years.

- Synergies and complementarities between national- and EU-level reforms would allow for higher and longer-lasting growth gains, lifting GDP per capita across most regions.

Thirdly, at current growth rates, existing fiscal plans are insufficient to manage Europe’s enormous fiscal pressures.

- Fiscal consolidation has slowed down in both advanced and emerging Europe, not least due to new infrastructure and defense spending plans. At the same time, longer-term spending pressures from pension, health, and clean energy needs are expected to rise. But fiscal space is limited for many countries that already have high debt. In many countries, this puts the sustainability of the public finances at risk (See October 2025 REO Chapter 1, Section: Securing Long-Term Fiscal Sustainability: Reforms and Adjustment, [Hyperlink to October 2025 REO Chapter 1 here]). Absent change, the simple average of Europe's debt would double to 130 percent of GDP in 15 years, putting in question how Europe can finance its priorities.

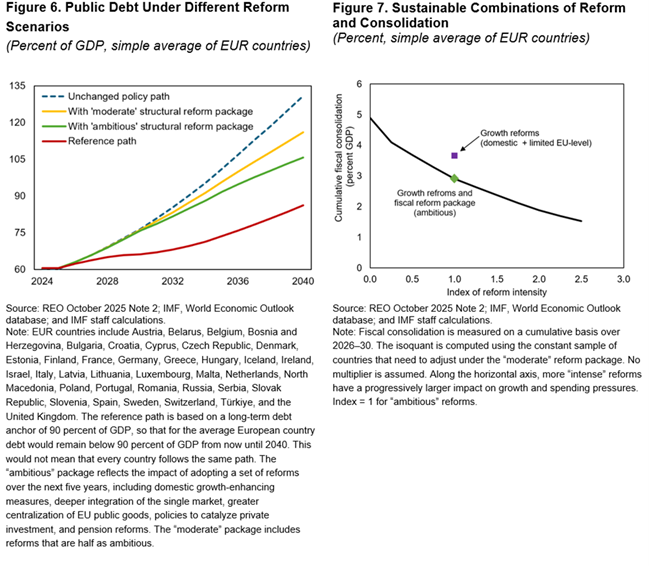

- The solution is a comprehensive policy package combining structural reforms, medium-term consolidation, and, depending on the circumstances, a more substantive realignment of the scope of government activities. For example, an “ambitious” combination of the national and limited EU level reforms that I outlined before (Figures 4 and 5), together with selected additional fiscal structural reforms, would reduce the average country’s debt-to-GDP ratio by 25 percentage points by 2040, relative to the unchanged policy path. The cumulative fiscal consolidation effort would be below 3 percent of GDP over five years to bring debt levels sustainably to 90 percent of GDP for the average European country. Under an “moderate” set of reforms, that implements only about half of these reforms, the required additional consolidation effort would increase to about 3½ percent of GDP. Some high-debt countries might need to do more, which might involve difficult trade-offs and require a deeper rethink of the scope of public services to fill the gap.

- Reforms are difficult, but delays imply higher adjustment costs. For instance, if reforms are implemented with a five-year delay, the fiscal adjustment need increases by 1½ percentage points, under the “moderate” reform package discussed above, from just above 3 ½ to over 5 percent of GDP.

Finally, Europe needs to overcome policy drift. Reforms are difficult, but delayed or incomplete reforms are even more costly. And experience shows that Europe can act when needed. What it takes is for policymakers to go out and make the case for reforms and engage in social dialogue. Bundling, sequencing, and timing reforms just right also help. And we might need more agile EU processes to get reforms on the road and implemented across the EU.

Europe stands at a pivotal juncture. Growth is too low, and there is no shortage of challenges that could make things even worse. But Europe has a choice. Our analysis shows that bold and comprehensive reforms can do away with many of the obstacles that are holding the economy back. Policymakers know what there is to do—it’s time to do it.

Thank you.

References

Adilbish, O. Cerdeiro, D., Duval, R., Hong, G.H., Mazzone, L., Rotunno, L., Toprak, H., and Vaziri, M., 2025, “Europe's Productivity Weakness”, IMF Working Paper No. 2025/040.

Arnold, N., Dizioli, A., Fotiou, A., Frie, J., Hacibedel, B., Iyer, T., Lin, H., Nabar, M., Tong, H., and Toscani, F. 2025. “Lifting Binding Constraints on Growth in Europe.” IMF Working Paper No. 2025/113.

Budina, N., Adilbish, O., Cerdeiro, D., Duval, R., Égert, B., Kovtun, D., Nguyen, A.T.N., Panton, A. and Tejada, C.M., 2025. 2025. “Europe’s National Level Structural Reform Priorities.” IMF Working Paper No. 2025/104.

Eble. S., Pitt. A., Bunda, I., Adilbish, O.E., Budina, N., Hong, G.H., Malak, M.T., Mohona, S., Myrvoda, A. and Primus, K.,2025, "Long-Term Spending Pressures in Europe", IMF Departmental Papers 2025

IMF October 2024 Regional Economic Outlook: Europe, 2024, Europe’s Declining Productivity Growth: Diagnoses and Remedies Note 1

[1] CESEE includes Albania, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Kosovo, Latvia, Lithuania, North Macedonia, Moldova, Montenegro, Poland, Romania, Serbia, Slovak Republic, and Slovenia, but excludes Belarus, Russia, Türkiye, and Ukraine

[2] Advanced economies include Austria, Belgium, Cyprus, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Israel, Italy, Luxembourg, Malta, Netherlands, Norway, Portugal, San Marino, Spain, Sweden, Switzerland, and the United Kingdom, but exclude CESEE.

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER:

Phone: +1 202 623-7100Email: MEDIA@IMF.org