Amman, Jordan (photo: Leonid Andronov / Alamy Stock Photo)

How the Middle East and Central Asian Countries Can Reduce Debt and Preserve Growth

November 13, 2018

“Well-designed public finance reforms can help policymakers reduce debt while preserving growth and protecting the most vulnerable,” said Jihad Azour, Director of the Middle East and Central Asia Department at the IMF.

Related Links

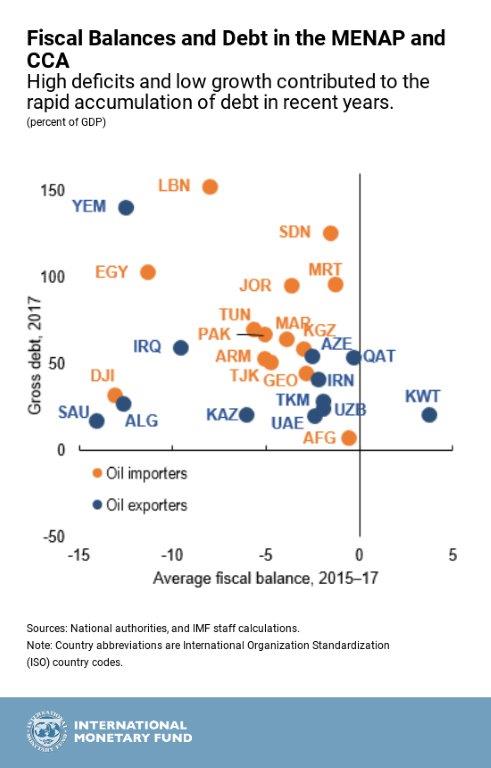

Tightening global financial conditions have increased the urgency of reducing budget deficits and debt in countries of the Middle East and Central Asia. The buildup of debt in recent years—which now exceeds 50 percent of GDP in almost half of the countries in the region—requires urgent action. If governments do not heed the call, they will be forced to spend increasing portions of their budgets on interest payments and paying down debt rather than on critical investments in physical and human capital that promote growth.

At the same time, faced with a rapidly expanding labor force and high unemployment rates, especially among youth and women, the region needs higher and more inclusive growth. The prospect of absorbing 5 million workers each year seems particularly daunting for the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region, given that one in five young people are already unemployed.

Measures that reduce budget deficits would often be expected to hold back growth. However, there are policy approaches countries can use to effectively tackle both challenges, which is the focus of a chapter in the latest Regional Economic Outlook for the Middle East and Central Asia.

Lessons from country experiences in reducing deficits

When governments cut expenditures or increase taxes, there is a fear that the most vulnerable in society will be hurt. To ensure that fiscal policy guides an economy toward a virtuous circle of improving both growth and equity, budget reforms need to be carefully designed to protect the poor. Indeed, lifting people out of poverty boosts their productivity, increases their spending power, reduces crime and conflict, and, increases the long-term economic potential of a country. So, the two concepts—growth and equity—are very much interrelated.

Experience shows that, while the amount needed to achieve debt sustainability will differ, the way in which expenditures are cut or revenue increased matters for growth and equity. Countries that reduced deficits while managing to preserve public investment had higher growth and a more equal distribution of income. Governments that have undertaken subsidy and public wage reforms and that prioritized social spending (education, health care, safety nets) achieved higher long-term growth and greater income equality. Studies of the MENAP region have shown that each dollar of government resources diverted from energy subsidies toward productive investment translated into two dollars of additional growth over the long term. Further, governments that pursued a combination of expenditure cuts and broader fiscal reforms to increase tax collection experienced longer-lasting benefits than those that used one-sided measures.

Have MENAP and CCA countries been reducing deficits in a growth-friendly way?

Over the past three years, most countries in the MENAP and the Caucasus and Central Asia (CCA) regions adopted a mix of spending cuts and revenue-boosting measures that reduced deficits— but these reforms were not always growth friendly.

For example, oil exporters in the MENAP region—like Bahrain and Iran—mostly managed to protect capital spending and reform subsidies. However, these countries were not able to sufficiently increase tax collection, which threatens the durability of gains.

Meanwhile, oil importers in the MENAP region, such as Tunisia, managed to mobilize tax revenues, but those gains were partly offset by higher subsidies due to rising oil prices as subsidy reforms were not completed. Furthermore, despite major gaps, spending on infrastructure took a big hit in MENAP oil importers like Djibouti and Mauritania.

Where should countries head from here?

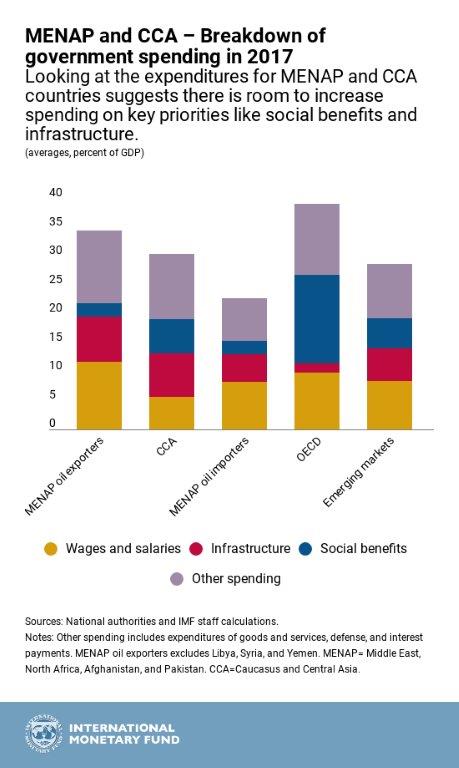

In the MENAP region, especially in oil-exporting countries, there is a need to increase tax revenues, where the region lags emerging market peers. MENAP oil exporters collect less than 10 percent of GDP in non-oil tax revenues, less than half the emerging market average of close to 20 percent of GDP. There is scope for countries to reduce the generous corporate tax exemptions, such as in Jordan, that favor large businesses over small and medium enterprises; make tax systems more progressive (for example, in Jordan and Iran); and broaden the tax base, including in Bahrain and Egypt. Governments could also focus on achieving a more equitable allocation of the tax burden, including by increasing taxes on wealth—such as property, inheritance, capital gains, dividends, and interest—and gradually replacing more regressive and costly stamp duties and fees with a personal income tax.

On the spending side, policymakers need to budget for the likely increase in debt servicing costs and improve the quality of spending. At the same time, measures are needed to increase, or at the very least preserve, investments in physical and human capital. That means further efforts are needed to reduce the public wage bill in countries such as Algeria, Kuwait, and Tunisia. Completing the reform of wasteful subsidies and transfers that disproportionately benefit the rich would allow governments to boost social spending, which in the MENAP region is only a third of the emerging market average.

For countries in the CCA, there is scope to improve public procurement processes and oversight of state-owned enterprises to preserve budget resources and minimize fiscal risk. On the revenue side, there is scope to raise the contribution of corporate taxes to revenues to be more in line with those raised from personal income taxes.

Finally, for all countries, to ensure that infrastructure spending translates into inclusive growth, close attention should be paid to the public investment management framework, including project appraisal, selection, and evaluation. More government transparency and accountability would reduce the scope for corruption, misappropriation of public resources, and help increase tax revenues. Better perceptions of government accountability would lower the cost of borrowing for both the sovereign and the private sector, further boosting investment and growth.