Global public debt could increase to 100 percent of global gross domestic product by the end of the decade if current trends continue, according to projections in our latest Fiscal Monitor. The rising ratio of public debt to GDP reflects renewed economic pressures as well as the consequences of pandemic-related fiscal support, according to our report. This trend raises fresh concerns about long-term fiscal sustainability as many countries face rising budget challenges.

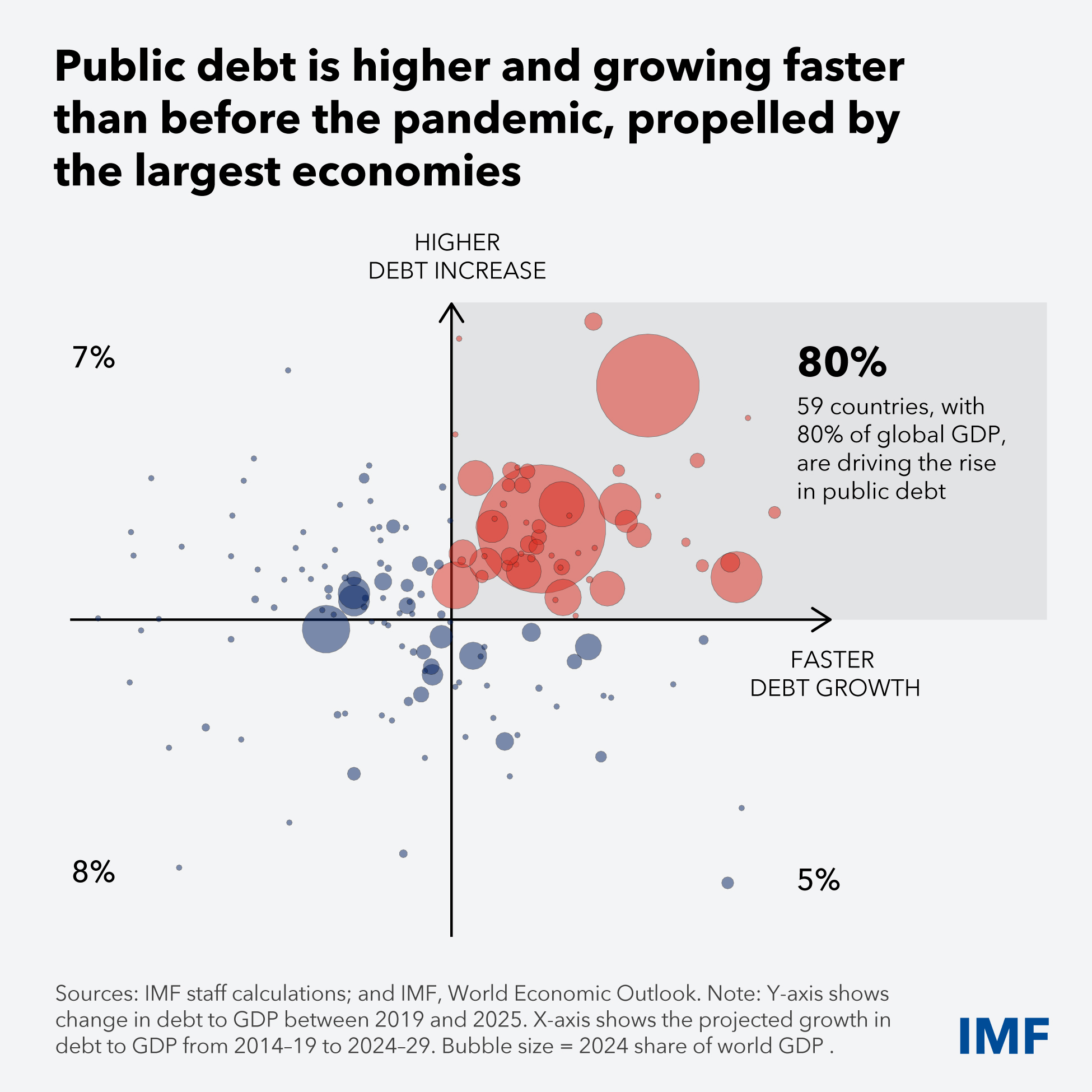

The Chart of the Week shows that about a third of countries, accounting for 80 percent of global GDP, have public debt that’s both higher than it was before the pandemic and rising at a faster pace. More than two-thirds of the 175 economies in our study now have heavier public debt burdens than before COVID spread in 2020.

Public debt’s evolution over the past five years diverges widely across countries, which means fiscal policy must vary in line with country‑specific factors and circumstances. However, given the uncertain times that may lie ahead amid high trade policy tensions, countries everywhere will need much greater resilience.

Specifically, fiscal policy should:

- Be part of overall stability‑oriented macroeconomic policies.

- Aim, in most countries, at reducing public debt and rebuilding capacity to spend and respond to new pressures and other economic shocks with a credible medium‑term framework.

- Lift potential growth to ease policy tradeoffs. Amid uncertainty, fiscal policy must anchor confidence and stability for economies to deliver growth and prosperity.

It’s increasingly vital for governments to build trust, tax fairly, and spend wisely. Policymakers should devote their political capital to fostering confidence and trust. Doing so starts with redoubling their efforts to keep their own fiscal houses in order.

—For more, see the Fiscal Affairs Department’s April 23 blog post and press briefing.