The economies of Latin America and the Caribbean have continued their strong post-pandemic rebound, but the winds are shifting as global financial conditions are tightening and commodity prices are reversing their upward trend, while inflationary pressures persist.

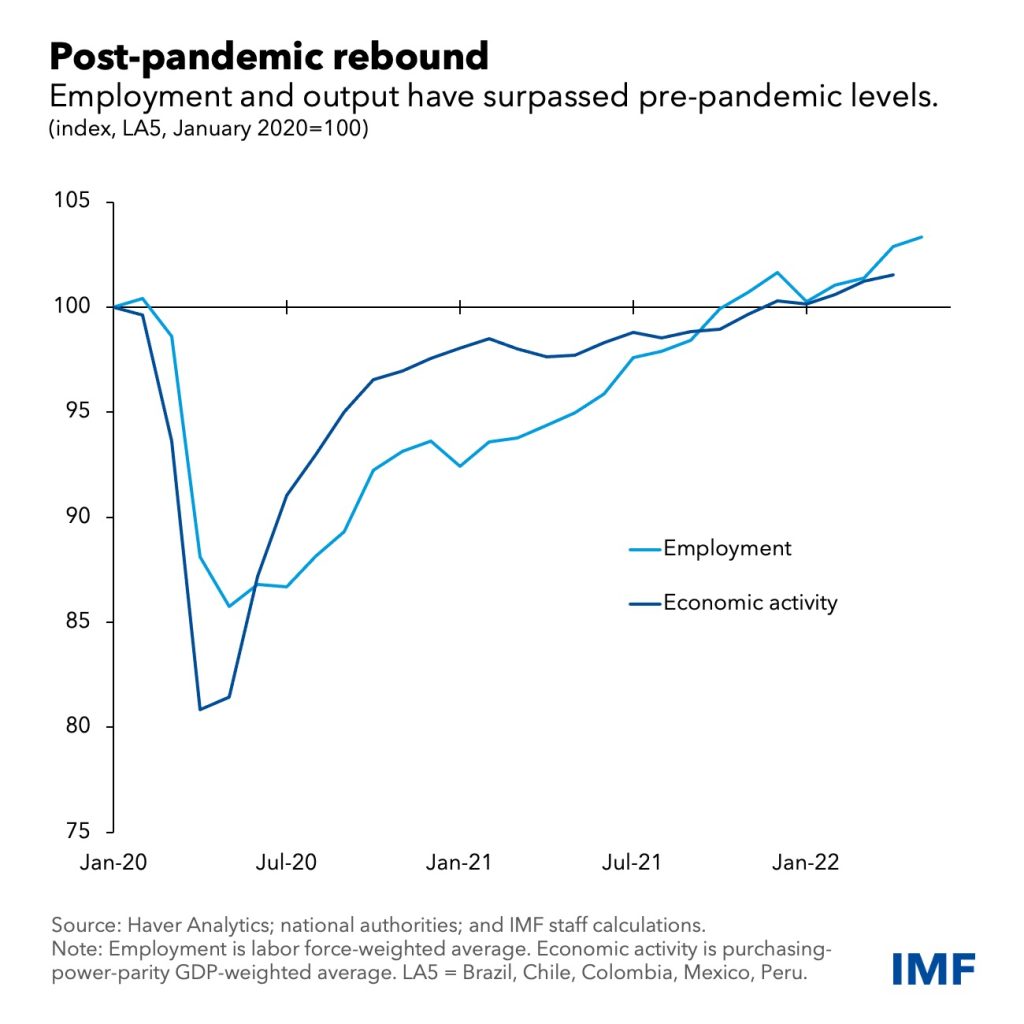

The reopening of contact-intensive sectors, especially hospitality and travel, the unwinding of pandemic pent-up demand, and still favorable external financial conditions supported a solid expansion in the first half of the year, allowing services to catch up with manufacturing, and employment to reach pre-pandemic levels. Year-on-year growth reached 2.8 percent in the first quarter, compared to an average of 1.7 percent in the years preceding the pandemic, and high-frequency indicators point to continued momentum in the second quarter.

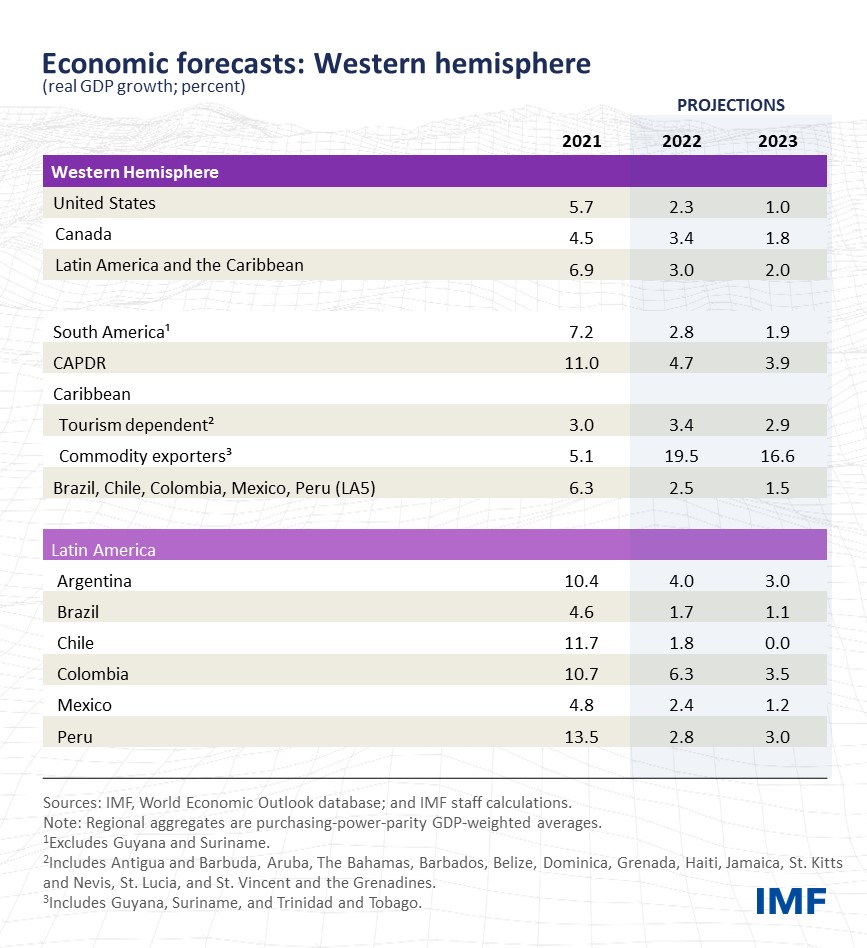

On the back of this solid first half of the year, and despite an expected slowdown in the second half, we forecast the region to grow by 3.0 percent this year, an upgrade from our April forecast of 2.5 percent.

However, the region faces significant challenges, including tightening global financial conditions, lower global growth, persistent inflation, and increasing social tensions amid growing food and energy insecurity. These factors contribute to our downgrade in growth to 2.0 percent in 2023, 0.5 percentage point lower than anticipated in April.

Uneven recoveries, common inflationary pressures

The strength of the post-pandemic recoveries has varied across the region. The global rebound of commodity prices from the pandemic lows, further boosted by the war in Ukraine, has generally supported the recovery of commodity exporters (some South American economies), while constraining those that depend more on commodity imports (Central America and tourism-dependent Caribbean economies). The upward trend of commodity prices seems to be reversing, as the global financial conditions tighten.

Among the largest economies, Chile and Colombia have seen a particularly dynamic rebound, propelled by strong growth in services, in part due to the fiscal stimulus in late 2021, while Mexico’s economic output is yet to regain its pre-pandemic level as services and construction continue lagging.

Caribbean economies are also behind in their recovery as tourism is yet to return to pre-pandemic levels, despite the recent rebound. Meanwhile, Central America, Panama, and the Dominican Republic have already surpassed their pre-pandemic output levels, driven by the rapid recovery in the United States, through strong exports and remittances inflows as well as supportive policies.

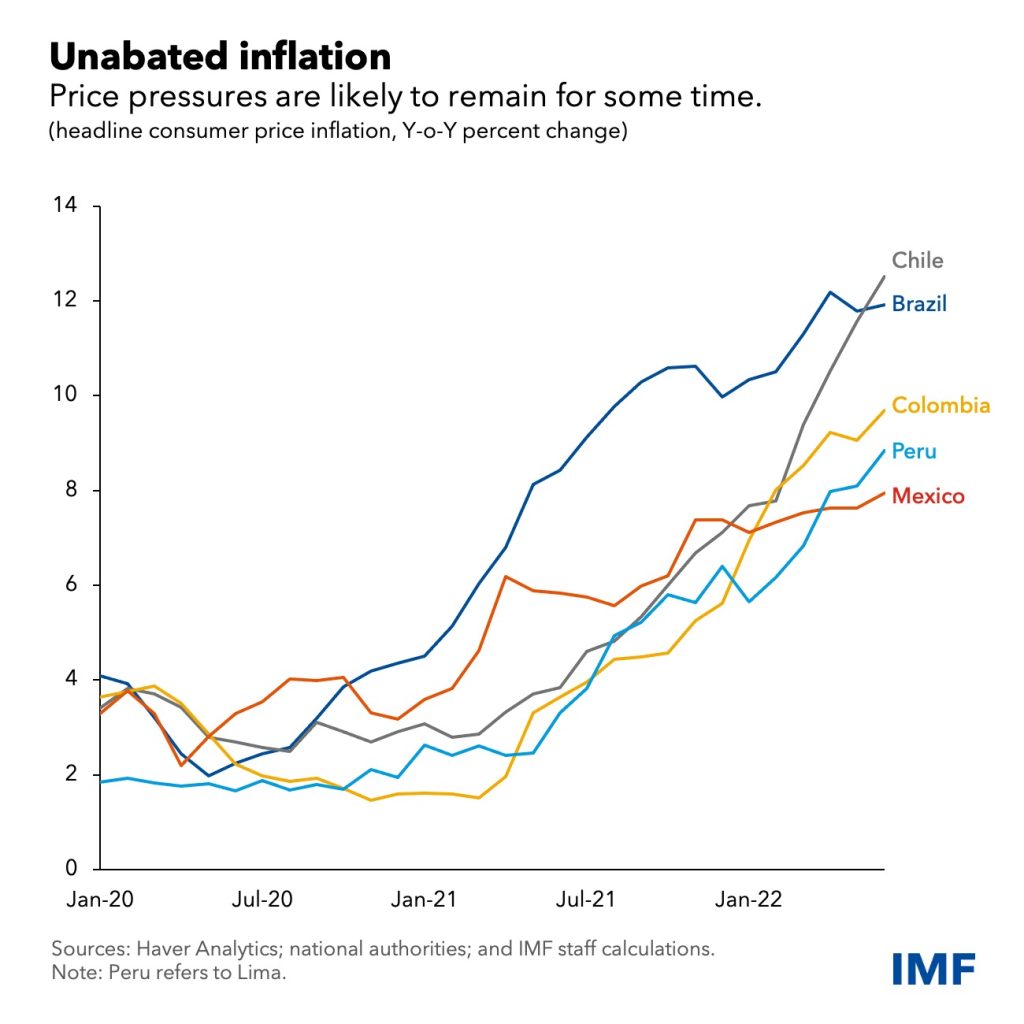

Inflation, on the other hand, has accelerated throughout the region, amid rebounding domestic demand, lingering supply chain disruptions, and rising commodity prices. Central banks have appropriately tightened monetary policy to contain second-round effects and anchor longer-term inflation expectations. But inflation could prove persistent in the wake of compounding shocks and broadening price pressures.

Meanwhile, after last year’s withdrawal of pandemic stimulus, fiscal policy in most countries has largely shifted into a neutral stance in 2022. This should help put fiscal balances on a more sustainable footing and support monetary policy in containing inflationary pressures.

Challenging global conditions

With inflation on the rise around the world and central banks in advanced economies tightening financial conditions, global demand is weakening. Growth forecasts for 2023 have been revised down considerably from 2.3 to 1.0 percent in the US and 2.8 to 1.8 percent in Canada. Even before the full impact of financial tightening, growth in these economies was decelerating, leading to a downward revision of our 2022 growth forecasts from 3.7 to 2.3 percent for the United States, and from 3.9 to 3.4 percent for Canada.

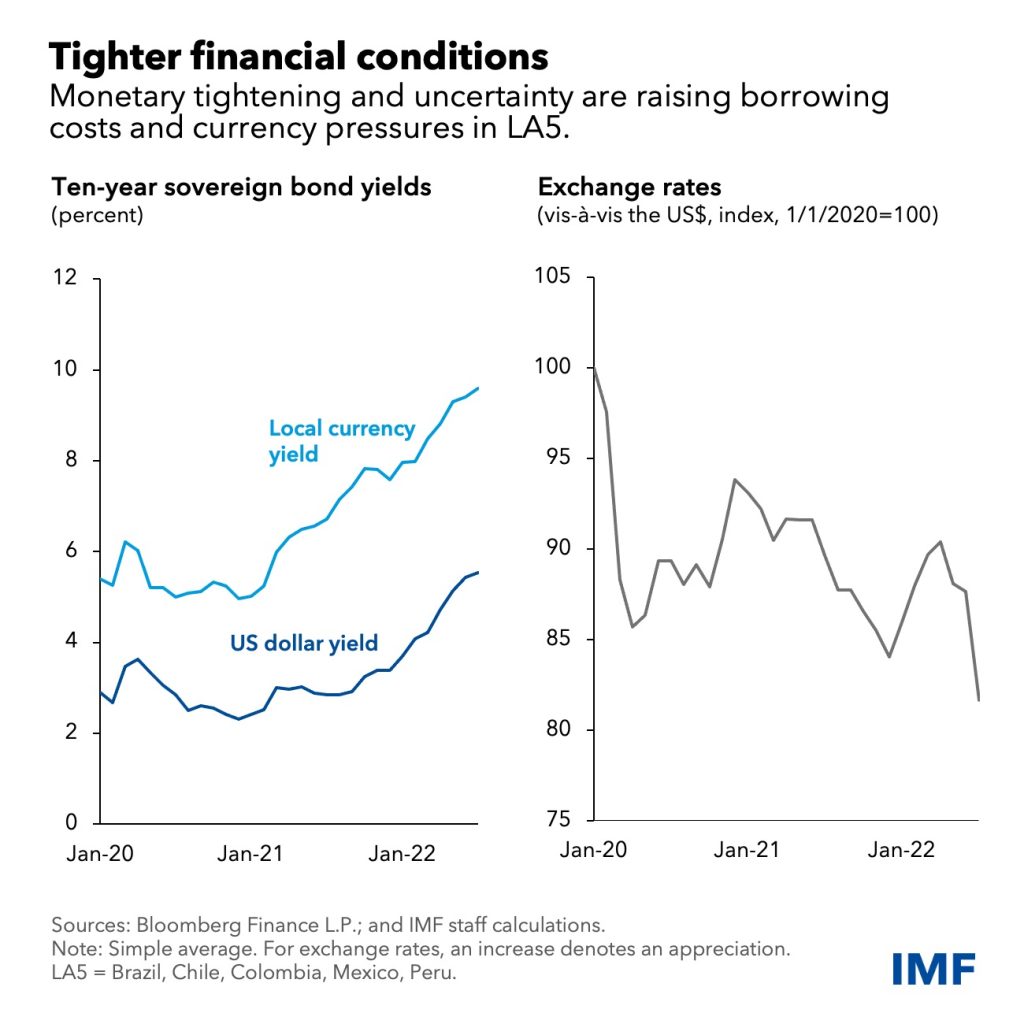

Amid global monetary tightening and greater economic uncertainty, external financial conditions for Latin America and the Caribbean are worsening, leading to rising borrowing costs and currency pressures. Adding to this, and partly reflecting the global slowdown, some commodity prices have fallen and are expected to soften further. This could bring some welcome relief to global inflationary pressures with time, but at a cost of further challenges to the region.

Inflation outlook

As elsewhere, price pressures in the region are likely to remain high for some time, as indicated by our inflation forecasts of 12.1 and 8.7 percent for 2022 and 2023, respectively, the highest rates in the past 25 years. This means we expect inflation to exceed the upper bound of central banks’ target ranges by about 400 basis points, on average, in the five largest Latin American economies (Brazil, Chile, Colombia, Mexico, and Peru) by the end of this year, and to remain outside the target range for part of next year.

Further currency weakening—especially if global financial conditions tighten further—and growing wage pressures, together with existing indexation mechanisms in some countries, could lead to additional inflationary pressures.

Navigating shifting winds

Persistent inflation amid decelerating economic activity in the context of falling commodity prices will make policymaking more challenging.

Policymakers should remain focused on preserving macro-economic stability and social cohesion. Amid high post-pandemic public debt levels and rising real interest rates, fiscal policy will need to focus on strengthening fiscal balances and ensuring debt sustainability while continuing to support the most vulnerable people with targeted and if needed temporary measures through a period of slower growth and high inflation.

Meanwhile, monetary policy must continue focusing on taming inflation and anchoring inflation expectations. This, together with clear communication, will remain key to preserve the hard-won credibility of central banks.